Summary

OANDA Global Markets Ltd operates under the brand name of OANDA Corporation, founded in 1996. The group comprises several entities regulated in multiple jurisdictions around the world. With easy-to-use trading platforms, numerous account types, and a quality research department, the company claims to be one of the most competitive brokers in the industry. However, the broker is criticized for its slow withdrawal process, poor trading conditions, and high trading costs.

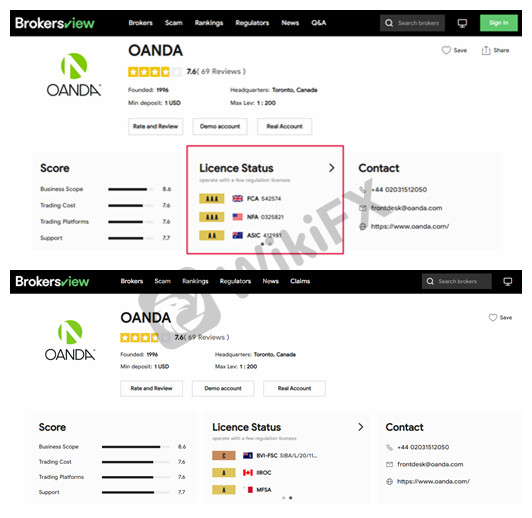

Is OANDA Regulated?

OANDA holds multiple regulations worldwide. Major regulators of the company include but are not limited to USA National Future Association (NFA), UK Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC), Investment Industry Regulatory Organization of Canada (IIROC), British Virgin Islands Financial Services Commission (BVI-FSC) and Malta Financial Services Authority (MFSA) .

Clients Feedback

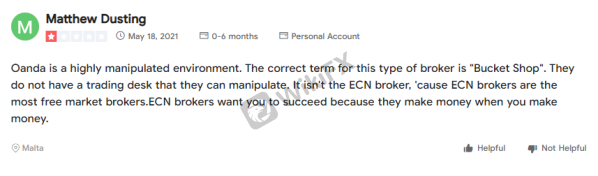

OANDA is mostly reported for withdrawal problems. However, clients have also denounced the company for worsened trading conditions and slow customer support. Some clients even perceive the company to be a dealing desk broker.

According to OANDA clients, the brokerage manipulates their orders before passing them to the market. Investors also accuse the company of not providing flexible charting time frames and advanced technical indicators. Other complaints include widened spreads, no negative balance protection, guaranteed stop-loss, etc.

Has OANDA Ever Been Red Listed by Regulators?

Malaysian Regulators once warned OANDA for providing trading activities without its approval. The company sometimes faces non-compliance issues as well. For instance, OANDA was penalized for $200,000 after NFA found the company in breach of conduct. According to the authority's press release dated April 01, 2021, the company failed to report accurate forex daily activities to the NFA.

Further, OANDA personnel did not adhere to the process and failed to notify OANDA's AML Compliance Officer after one of its customer's accounts got hacked.

Leave a Reply