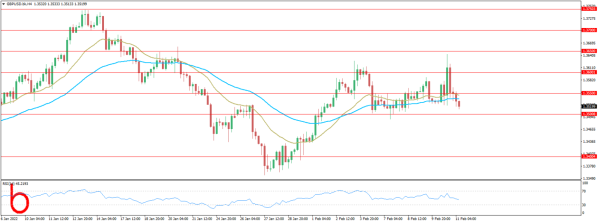

The Cable pair intraday losses went to around 1.3550 but keeps the previous day‘s pullback from a multi-day high during Friday’s Asian session.

The cable pair praised US dollar weakness to rise to the highest levels since January 20 but strong US Treasury yields and cautious sentiment ahead of the key data/events seems to have weighed on the quote of late. Also on the negative side were recently upbeat comments from the Fed speakers and political drama in the UK.

Former Tory Prime Minister (PM) Sir John Major recently criticized the current PM Boris Johnson‘s ’Partygate‘ scandal while condemning him as “a lawbreaker whose disregard for honesty and ministerial standards risks undermining the UK’s long-term democratic future,” per The Guardian. Following that, UK PM Johnson terms these claims as ‘demonstrably untrue’.

Looking forward for Friday, first readings of the UK‘s fourth quarter (Q4) GDP will be crucial for GBP/USD prices as a firmer print will justify the Bank of England’s (BOE) recent rate hikes, defending them from allegations of late performance. Market expectations suggest headline numbers to remain unchanged at 1.1% QoQ while easing to 6.4% YoY versus 6.8% prior. Following that, the preliminary readings of the US Michigan Consumer Sentiment Index for February, expected 67.5 versus 67.2 prior, may entertain the pair traders.

Leave a Reply