Top Takeaways for 2021

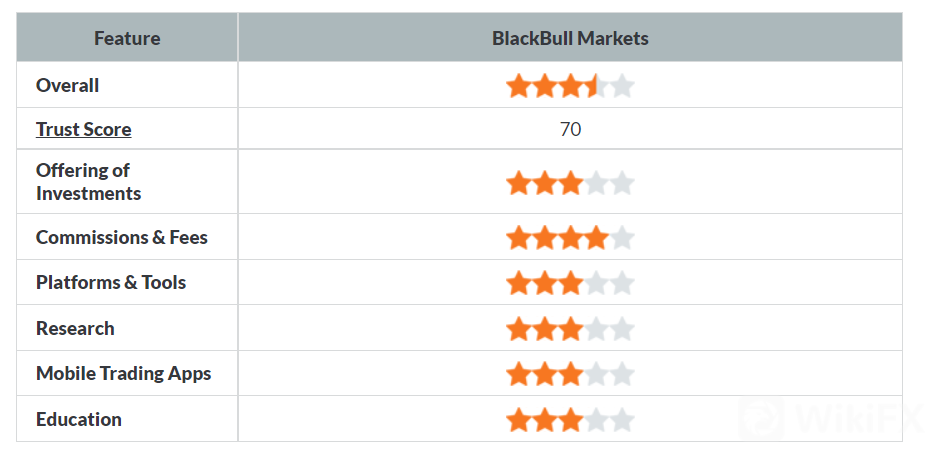

Here are our top findings on BlackBull Markets:

-

BlackBull Markets maintains regulatory status in one tier-2 jurisdiction, making it a safe broker (average-risk) for forex and CFD trading.

-

As a MetaTrader-only broker, BlackBull Markets offers several social copy-trading platforms. However, MT5 is not available, and the range of research and education tools trails the best MetaTrader brokers.

-

Based on average spreads we obtained, commissions and fees at BlackBull Markets appear to be in-line with the industry average. That said, the brokers narrow range of 44 tradeable symbols trails the best forex brokers by many thousands of products across global markets.

Overall Summary

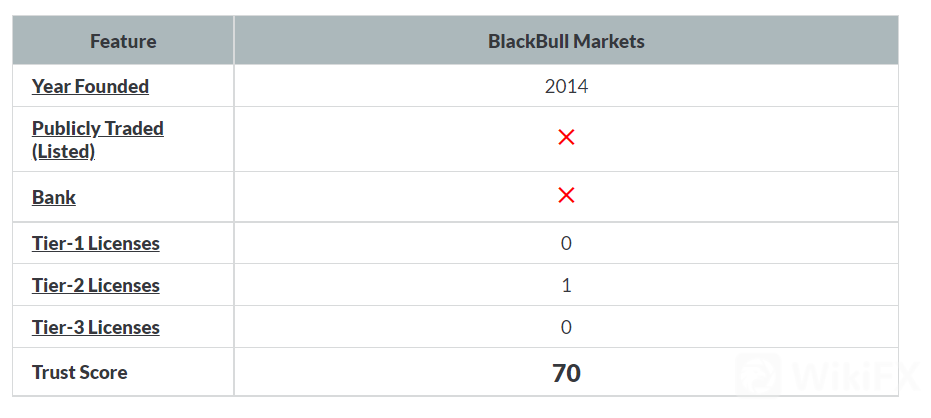

Is BlackBull Markets Safe?

BlackBull Markets is considered average-risk, with an overall Trust Score of 70 out of 99. BlackBull Markets is not publicly traded and does not operate a bank. BlackBull Markets is authorised by zero tier-1 regulators (high trust), one tier-2 regulator (average trust), and zero tier-3 regulators (low trust). BlackBull Markets is authorised by the following tier-2 regulators: New Zealand Financial Markets Authority (FMA). Learn more about Trust Score.

Regulations Comparison

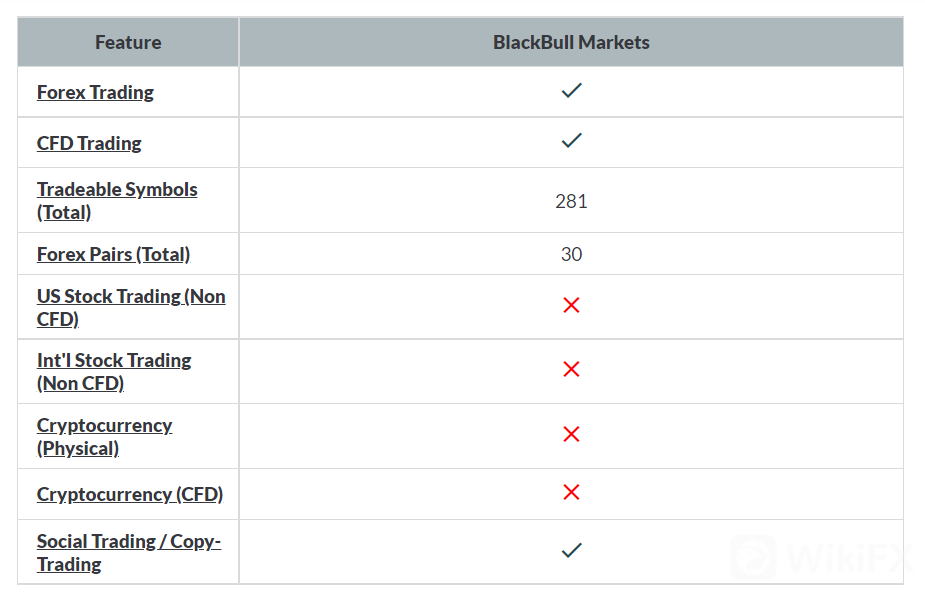

Offering of Investments

BlackBull Markets offers a total of just 44 tradeable symbols, which is a small selection and below the industry average. The following table summarizes the different investment products available to BlackBull Markets clients.

BlackBull Markets offering of investments:

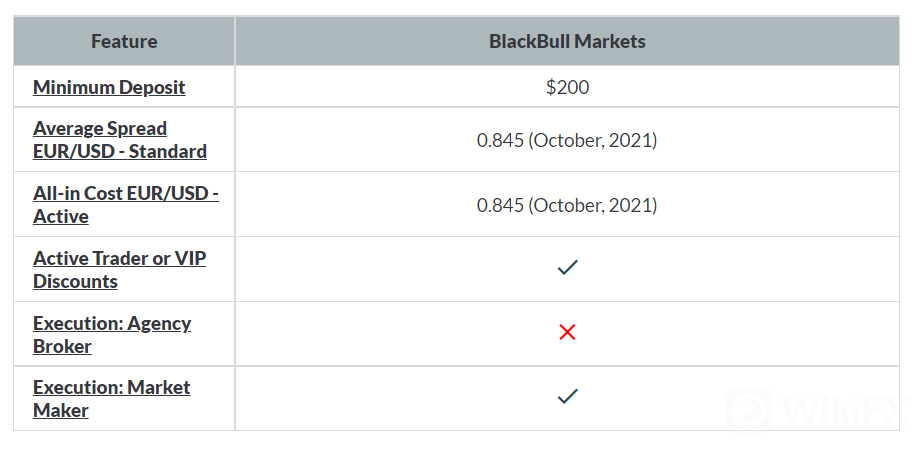

Commissions and Fees

The cost to trade at BlackBull Markets depends on the account type chosen, with three options available.

Spreads: After including the round-trip commission equivalent of 0.6 pips per trade on the ECN Prime account, the effective average spreads are 0.76 for the six months ending August 31st, 2020. This pricing makes the ECN Prime account the ideal option compared to the Standard account.

Accounts comparison: The Standard account is commission-free and only requires a $200 deposit. The ECN Prime account requires at least $2,000, and although spreads are lower, there is a $3 commission per side or $6 round turn per lot. Lastly, for active traders that deposit at least $20,000, BlackBull Markets offers its ECN Institutional account where you must negotiate commission rates with the broker on a case-by-case basis.

BlackBull Markets pricing summary:

Platforms and Tools

As a MetaTrader 4 (MT4) broker, BlackBull Markets offers the desktop and web version of the popular trading platform.

With a limited range of markets and no platform add-ons, there is not much to say about the brokers MT4 offering beyond the Virtual Private Servers (VPS) hosting available from third-party providers.

VPS hosting: For Free VPS, clients must deposit at least $2,000 in the ECN Prime account and complete at least 20 standard lots or 2,000,000 units worth of trading volume each month.

Social copy trading: BlackBull Markets offers several third-party apps for social copy trading, in addition to the native Signals market available in MT4. Supported copy trading platforms include ZuluTrade, MyFxbook, SwipeStox (a mobile app from Naga), and PsyQuation. From among these options, SwipeStox is mobile-based, while PsyQuation has barely over 30 traders to copy. While both entrants are newer and have potential, ZuluTrade and MyFxbook are more established and mature options to consider.

Aside from a robust range of copy trading platforms, BlackBull Markets is a laggard in the Platform and Tools category when it comes to its primary trading platform, with just MT4 on offer. That said, the broker plans to launch MetaTrader 5 (MT5), which will be a welcomed addition.

Education

Like research, BlackBull Markets has a long way to go to catch up in its offering of education materials, especially when compared to the best forex brokers for beginners. There is a section on the BlackBull Markets website dedicated to education with various categories such as “Learn To Trade.” Yet, these are mostly devoid of any comprehensive materials.

Educational videos: The Trading Videos section has barely half a dozen videos, and they are focused on platform tutorials instead of forex trading concepts. That said, it is worth mentioning that BlackBull Markets has created a series of various educational videos on its YouTube channel, which I found to be of decent quality.

Mobile Trading

BlackBull Markets offers two mobile apps: its proprietary BlackBull Markets App, and the MetaTrader platform suite.

As a MetaTrader-only broker, BlackBull Markets customers are limited to the MetaTrader 4 (MT4) app. While some of the third-party social copy-trading platforms offered have mobile versions, they connect to the brokers MT4 platform.

Overall, mobile trading is not a category where BlackBull Markets stands out when compared to the best MetaTrader Brokers.

Final Thoughts

With a limited product range on MT4, the social copy trading tools alone do not give BlackBull Markets an edge, because its Trust Score is low compared to the most trusted forex brokers. Research and education are also sub-par compared to industry leaders.

Besides enhancing its product offering, BlackBull Markets should work towards obtaining Tier-1 licenses in jurisdictions such as the UK or Australia, among other major financial centers. I do not consider New Zealand or Seychelles to be a Tier-1 regulatory hub.

BlackBull Markets is also relatively new to the brokerage scene and has yet to mature compared to firms that have been around for decades. Overall, there are better forex brokers available for traders to use.

Leave a Reply