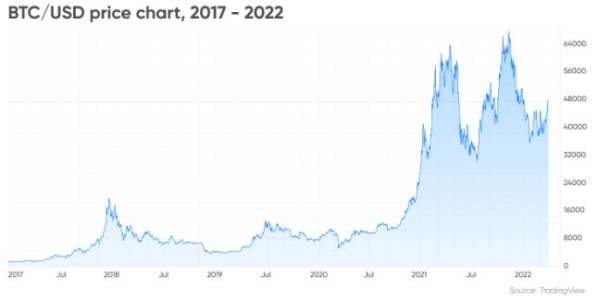

Over a decade ago, anonymous creator Satoshi Nakamoto mined the first-ever bitcoin (BTC) block known as the genesis block, kickstarting the cryptocurrency boom that still dominates financial markets today.

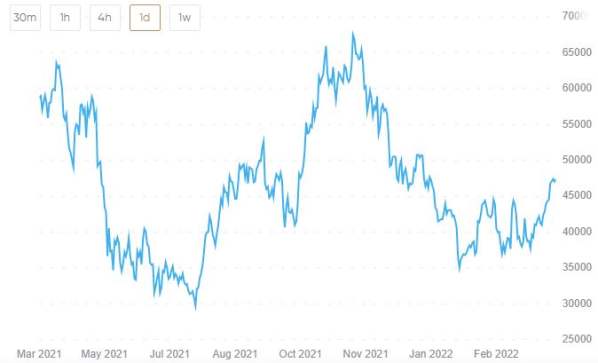

As the first cryptocurrency to ever be created, Bitcoin is almost synonymous with digital currencies and is the biggest by market capitalisation (as of 31 March 2022). In 2021 alone, BTCs value surged by 54.64% from $29,374.15 on 1 January to $46,306.45 on 31 December, managing to surpass the $60,000 mark twice.

Its narrative managed to move far beyond being “a purely peer-to-peer version of electronic cash” to becoming a store of value and being compared to gold as a hedge against inflation.

Although bitcoin‘s success is undisputed, questions surrounding the cryptocurrency’s future continue to arise: Will bitcoin go up long-term and what are the bitcoin price projections for the decades ahead?

Halving events are likely to boost the price

Bitcoin mining relies on a blockchain that connects all public transactions together. Using a Proof-of-Work (PoW) consensus, BTC miners compete against one another to solve mathematical equations and confirm the legitimacy of transactions. They are rewarded with BTC tokens, thus further encouraging participation in this crypto-mining ‘game’.

Bitcoin has a maximum supply of 21 million tokens. As of 31 March 2022, 18.9 million BTC are in circulation.

In order to reduce the rate at which new BTCs are given out to users, the cryptocurrency was designed to undergo halving events roughly every four years that would reduce the number of bitcoin tokens released into circulation by half limiting their supply and making the token scarcer, thus raising its value.

Research conducted by Capital.com showed that the value of BTC enjoyed a bull market lasting between 12 and 15 months after a halving event occurred. The past three halving events that took place in 2012, 2016 and 2020 saw the BTC price surge by 9,915%, 2,949% and 665% respectively.

While halving events tend to create buzz and excitement in crypto circles, they do not necessarily mean that bitcoins future price will rally.

“From a historical perspective, every next halving pushes the BTC price surge a little lower, meaning that the effect of bitcoin halving may be winding down. That doesn‘t mean that the halving won’t drive the price up, however, its impact is notably decreasing every four years,” Capital.coms research team stated.

Bitcoins fifth and sixth halving events, which are set to take place in 2028 and 2032 respectively, and the halving cycle around them, could be another factor shaping the bitcoin forecast for 2030.

Joe Burnett, mining analyst at Blockware Solutions, believes bitcoins halving sessions will do good for its future price projections.

“Over the long run, bitcoin gets programmatically more scarce… The final 1,000,000 BTC [tokens] wont all be mined until around 2140 – over 100 years away. This ever-increasing scarcity will be a large driver for the future price of bitcoin as market participants search for tools to preserve their wealth,” Burnett told Capital.com.

CoinLoan founder and CEO Alex Faliushin pointed out that the coins scarcity enabled but the halving events is what will drive the price higher in the future.

“We all know that there will be only a maximum of 21,000,000 BTC ever available, which makes it scarce – hence the price should go up in the long run, given that investors will believe in the technology,” Faliushin added.

Other factors shaping a BTC price prediction

In 2020 the global cryptocurrency market amounted to $1.49bn. According to Allied Market Research, by 2030 its value could grow to $4.94bn by 2030 – representing a 12.8% surge.

Meanwhile, research conducted by ResearchAndMarkets.com in December 2021 noted that the overall cryptocurrency market could rise to $2.73bn in 2025 from $1.63bn in 2021.

Allied Market Research stressed that bitcoin would remain as the highest gainer throughout the forecast period, noting that BTC was an “untapped potential on emerging economies” as it has already allowed many people, as well as firms, to develop and flourish. In addition, the token has been a great help to developing nations.

Positive developments in the 2021 BTC cryptocurrency market space included the adoption of BTC as a legal tender by El Salvador in early September and the launch of the Bitcoin futures exchange-traded fund (ETF) in October on the New York Stock Exchange (NYSE) that started to offer retail investors diversification, protection and liquidity, and a new way to get involved in the rapidly growing world of cryptocurrencies.

In November 2021, the Bitcoin blockchain underwent a much-anticipated upgrade known as Taproot, which made the token cheaper, more efficient and private. This enabled Bitcoin to run smart contracts (similarly to its number-one rival Ethereum). Ethereums smart contracts allowed the platform to become the most-used blockchain, however, the Bitcoin update could lead to it having an increase of daily users, which is a bullish development.

Increasing adoption rates means bitcoin‘s future price could enjoy a boost. BTC is already accepted as a form of payment by 7,855 merchants as of 31 March 2022, and as this number grows, the heightened demand would see the token’s price surging.

Last year, BTCs value increased by 12.52% after Tesla CEO Elon Musk tweeted that his electric vehicles could now be purchased using the digital currency, boosting its value from $52,774.26 on 24 March 2021 to $59,384.31 on 2 April 2021.

“One or two major players start a bull run whereby they announce the replacement of one asset with bitcoin. It might be a pension announcing that millions of their members will now have their retirement money in bitcoin,” said Mark Basa, global brand and business manager at HOKK Finance.

“This news would drive the bitcoin price sky high. I think many bitcoin investors are waiting for that to happen,” Basa told Capital.com exclusively.

DailyFX analyst Tammy Da Costa stressed that while BTC remains the “father” of cryptocurrencies, it could face much larger competition from the second-highest digital asset by market capitalisation – ethereum (ETH).

“Due to the nature of the blockchains, the Ethereum blockchain is a more environmentally friendly option, and the unlimited supply of coins makes it a more feasible option for governments that are embracing the concept of digital assets as a potential medium of exchange, provided that there is regulatory oversight,” she told Capital.com.

“While this can support the crypto sphere, it is possible the creation of digital currency could hinder progressive growth for bitcoin and ether in the future. However, for now, as prices remain above the $40,000 handle, the uptrend pertaining to bitcoin may continue to hold, at least for now,” the analyst added.

Is bitcoin a good inflation hedge?

A number of analysts have been underlining that the similarities between gold and BTC are uncanny.

“The similarities between bitcoin and gold are difficult to ignore. Both are viewed, rightly or wrongly, as a natural hedge against inflation; there is a finite amount of both; they usually have relatively low correlations to equities and fixed income; and they act as a store of value outside of traditional systems such as governments or central banks,”

In May 2021, this was also noted by Goldman Sachs, and in October 2021, JPMorgan analysts echoed this sentiment: “Institutional investors appear to be returning to bitcoin, perhaps seeing it as a better inflation hedge than gold.”

CoinLoans Faliushin agreed, noting that due to high inflation, the bitcoin projected value is gaining more momentum to the upside.

Yet according to Da Costa, while comparisons of bitcoin and gold were appropriate throughout 2021, the more recent market dynamics shows cryptocurrencies also behave in line with technology stocks.

“Given that inflation remains a key concern for both consumers and policymakers, low interest rates have supported stocks and bitcoin despite rising geopolitical risks,” Da Costa told Capital.com.

“Meanwhile, throughout last year, bitcoin was seen as a potential hedge against inflation, a characteristic akin to gold. However, this narrative has shifted in the first quarter of the year as the direct correlation between cryptocurrency and tech stocks becomes more apparent,” she added.

Blockware Solutions Burnett said BTC can be treated as a highly volatile long-term savings account, but not an investment as it offers no potential future cash flows.

“It simply is another form of cash or money. In comparison to other tools that have historically been used as money, bitcoin is the most scarce,” Burnett told Capital.com.

He added: “It is the only asset in the world that has no dilution risk. There can only be 21,000,000 BTC. Governments and central banks can create more dollars, yen and euros. Gold miners can find more gold. Bitcoins unique monetary properties make it more like a new savings technology, rather than a traditional investment.”

What price will bitcoin reach in 2030?

Algorithm-based forecasting service WalletInvestor gave a bullish view on the price of bitcoin in 10 years, noting that it is an “outstanding long-term investment”.

Based on its analysis of the cryptocurrency‘s past performance, the forecasting service suggested the price could reach $70,068.80 by next year and $161,343 in five years’ time.

On the other hand, DigitalCoinPrice gave a more modest outlook for the price of bitcoin in 2030, suggesting the token could reach $67,869.30 by December 2022.

By the end of 2025, bitcoins expected price was forecast at $94,527.99, rising further to $146,341.60 by the end of 2028. In 2030, the website suggested the token could reach $223,939.05.

While DigitalCoin did not provide a forecast for 2035, 2040, or 2050, it noted that the token could be worth $264,666.58 in 2031.

Analyst views on BTC forecast for 2030

The majority of analysts are expecting the coins price to continue rising over the long term, yet potential interest-rate hikes due to the heightened inflationary environment appeared to dampen their bitcoin outlook.

A panel of 33 analysts surveyed by Finder in January 2022, for example, expected the coin to surge to $192,800 by 2025, taking a more conservative stance from its $206,351 prediction back in October 2021, all due to the potential tightening of monetary policy. In 2030, the panel predicted the price to surge to $406,400, down somewhat from its October 2021 prediction of $567,471.

Meanwhile, a report published by ARK Invest analyst Yassine Elmandjra in mid-January 2022 gave an even more positive outlook for bitcoin in 2030, expecting the price to reach $1m.

Faliushin agreed with ARK Investments bullish outlook, noting that solid cryptocurrency regulation will be required to attract more institutional money into the space and boost the price of bitcoin by 2030.

“In 2030, it could be very realistic that BTC will reach $1,000,000 per BTC, given that many funds are just starting to pay attention to it and many can't even hold it on their balance sheet due to regulations,” Faliushin told Capital.com.

“When the whole industry will be more transparent and regulated, we are expecting to see new money coming into the market. This could lead to a sharp price rise,” he concluded.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, told Capital.com that limited supply and rising demand would suggest a bullish bitcoin projection. The analyst expects that by 2030, the $100,000 mark will become a support rather than a resistance on the BTC/USD price chart.

“The bottom line is that supply is declining, by code and demand, and adoption is rising. I expect those trends to continue for bitcoin, which is well on its way to becoming the digital collateral benchmark in a world going that way,” McGlore added.

HOKK Finances Basa, on the other hand, gave a more bullish bitcoin price projection. He expects the token to reach $1m in the next eight years.

“I think about it like this: A whole new generation of young people are going to be introduced to easier ways to buy bitcoin and interact with crypto. Theyll be faced with a much higher cost of living, US debt, inflation and a housing market almost out of reach,” he told Capital.com.

“If they learn about bitcoin, and how its really their money, they are going to opt out of investing in the most common stocks and look at an asset that just keeps growing and growing due to its limited supply and decentralised nature,” he concluded.

Bitcoin long-term forecast: Overtaking fiat money?

In terms of the bitcoin price predictions for 2050, its extremely difficult to estimate the value of the coin so far ahead, as there may be factors at play that could drastically change the landscape of the cryptocurrency markets.

Yet, some believe that bitcoin could replace fiat currency by 2050, as revealed by a panel of 42 cryptocurrency analysts surveyed by Finder. Over half (54%) of respondents said that the digital token had potential to overtake global finance in just below 30 years. Others had an even more positive outlook, expecting the token to overtake fiat money by 2040 and even 2035.

Please note that price predictions and analyst views can be wrong. Forecasts shouldnt be used as a substitute for your own research. Always conduct your own due diligence before investing, and never invest or trade money you cannot afford to lose.

Leave a Reply