It has been almost two years since the last Bitcoin halving in May 2020. The event causes a reduction in the amount of Bitcoin going into circulation by 50%, thus creating scarcity. Bitcoins price is therefore expected to rise following this event.

According to Santiment, the price increase hits its peak between 515 and 545 days following the halving. This was reached in Q4 of 2021 when Bitcoin reached an all-time high of over $60,000. Following that, the next major event to follow is the Mid-halving event. What does this mean for Bitcoin?

How mid-halving events affect Bitcoin

The last Bitcoin halving announced the anticipated price rise last year in line with its historical life cycles. The mid-halving is the last of three events that occur between one halving and the other, and it is happening on 11 April 2022.

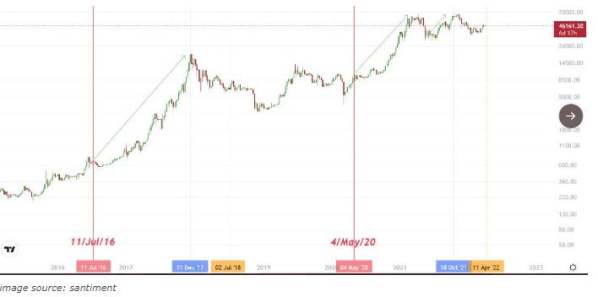

As shown in the image above, after the halving in 2016, the price rose from 11 July to a peak in December 2017. after that, it dropped as a result of the mid-halving in July 2018. the halving in May 2020 raised the price again to peak in October 2021 and the next event is the mid-halving on 11 April.

Ideally, Bitcoin follows a pattern in which the mid-halving is characterized by a significant correction leading to an enduring bear market. It usually encounters a major resistance it cannot break during this time, which pushes the price down. In this case, the major resistance happens to be $50,000. If the asset can break above and maintain itself above this level, then this mid-halving event may differ, or a correction may be imminent on 11 April.

More active users mean a stronger network

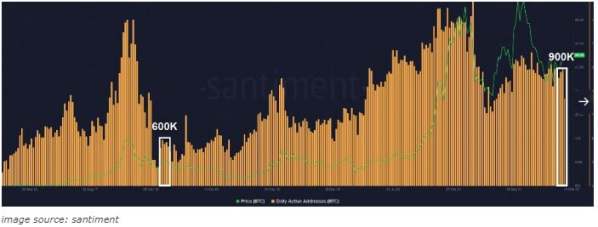

The primary factor that may make this years mid-halving event different is the number of active users on the network. There are currently almost 900,000 daily dynamic addresses, which is much higher than the 600,000 in 2018. This suggests there is more network usage, particularly by whales who have started buying and holding large amounts of Bitcoin.

Institutional Investors:

Since the last halving, there has also been a massive influx of institutional investors. These factors put together may make 11 April better than just a day for mid-halving correction.

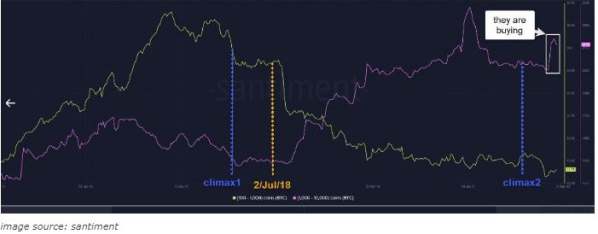

In Jul 2018, the whales or institutions were indecisive, and after a short period, the holders with a balance of 100-1,000 BTC started to sell their bitcoins while the wealthier ones were the buyers.

But currently, the tier of investors(1,000-10,000 BTC) already started buying and expanding their bitcoins when we are just a week away from the Mid-Halving correction.

So this time investors are behaving differently and this bear market is not going to be like the previous one so it does not necessarily mean that BTC is going to the moon but the BTC price trend is definitely maturing and so are the investors.

Leave a Reply