While investors typically understand the inherent market risk and are willing to bear it to some extent, nobody wants to get ditched by their brokers. Therefore, regulatory authorities monitor financial intermediaries to protect investors against possible financial fraud. However, scammers like FxNextGen have always been able to find their way to scam people. Let us share why we believe FxNextGen to be a shady broker.

FxNextGen – A Quick Overview

FxNextGen (https://www.fxnextgen.com/) is a forex and CFD broker based in the Republic of Georgia. The company offers retail trading services across multiple financial markets, including forex, commodities, shares, indices, and cryptocurrencies. Besides providing access to the industry standard MT4 and MT5 trading platforms, the company also offers educational resources featuring basic information about the currency and stock market. Further, funds management service is also available for a minimum deposit of $100. Other services and features include flexible account types and multiple deposit and withdrawal methods.

Is FxNextGen Regulated?

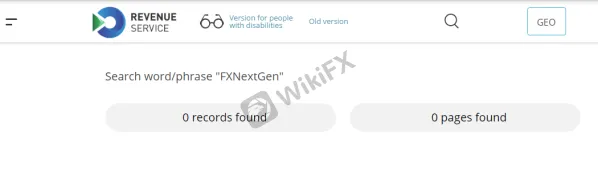

No, FxNextGen is not regulated. Though the company claims to have regulatory oversight of the Hualing Free Industrial Zone in the Republic of Georgia, the search results came empty when we tried to verify its license status on the respective authority's website. More importantly, the mentioned agency in Georgia does not regulate forex activities or issue forex licenses.

Notably, the broker is neither registered nor regulated anywhere else.

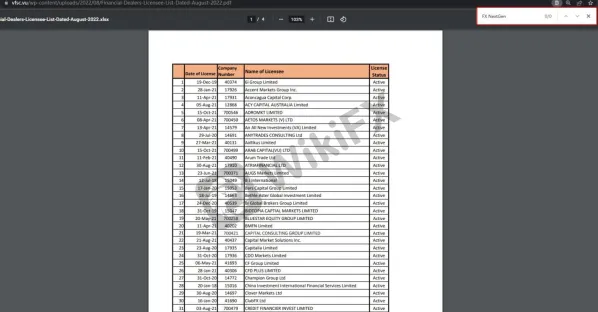

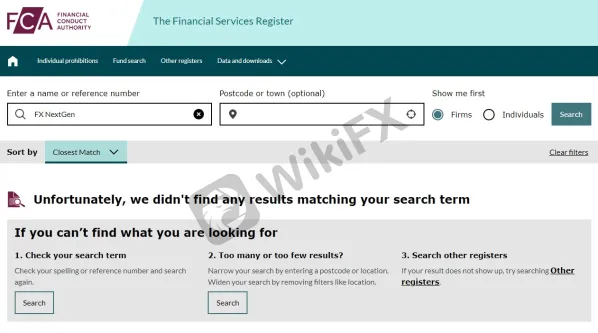

According to the website, one of the scam's offices is located in Vanuatu. And its trading servers are located in London, the UK. So we searched the forex regulators – Vanuatu Financial Services Commission(VFSC) and UK FCA – in these two countries. The result is that the broker is not authorized to provide forex services or sell forex products by the two regulators.

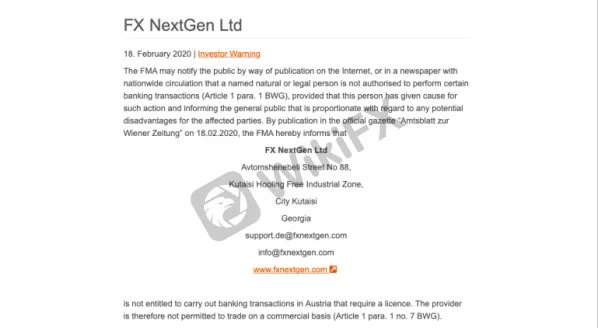

Moreover, the Austrian Financial Market Authority (Austria FMA) warned Austrian investors that FxNextGen does not have authorization to conduct forex activities.

What do users say about FxNextGen?

FxNextGen holds a poor reputation among investors. Clients have repeatedly reported the company for its malicious code of conduct. You can also read clients' feedback on multiple independent reviewers' websites. Most users complains that the company doesn't let them withdraw their funds. The broker also receives critics for poor customer support. Below are some screenshots captured from various platforms.

What makes FxNextGen A Dubious Broker?

While many factors make the company look suspicious, let us share a few.

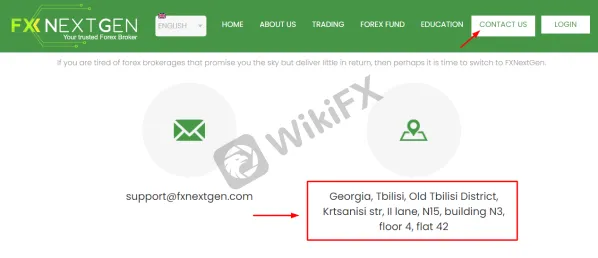

First, the broker claims to have been registered with and licensed by the Hualing Free Industrial Zone while it is not. Secondly, the broker shares misleading information on its website concerning contact details. For instance, the company provides two addresses on the home page to reach it. However, it mentions an entirely different address on the contact page.

Further, there is no contact number to connect with the broker over the phone.

Above all, the clientele feedback about the company speaks for itself.

How to check if a broker is legitimate?

Brokers typically list complete information on their homepages, such as the inception date, the regulatory status and the name of respective regulatory authorities, the company's registration and license number, measures for the safety of funds, contact details, etc.

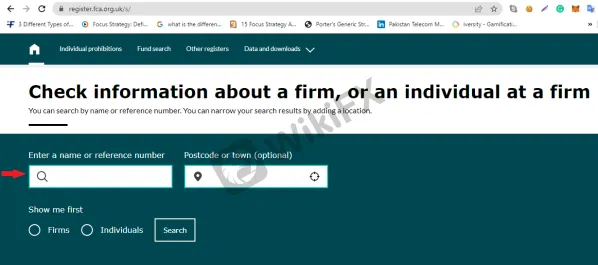

You can track the company's registration number in the concerned regulator's database. For example, if a company claims to hold FCA regulations. You can verify its licensing status from the FCA's register, as shown in the image below.

Moreover, you can also read customers' feedback and check for the broker's rating on independent reviewers' websites like wikiFX.com to assess whether it is worth signing up with it.

Bottom Line

Despite strict regulations, financial frauds are irrevocable. Scammers always show up with new tricks. The best thing you can do is to remain vigilant and take the necessary precautions. Try signing up with regulated entities, preferably located in your home country. Although the regulation doesn't guarantee that your funds are 100% safe, it makes you legally protected at least.

Leave a Reply