Trading is carried out on the investor‘s account: funds are not transferred to the manager’s account. At the same time, the trader does not dispose of the subscribers deposit and does not guarantee absolute success. But on the other hand, he can freely trade, based on the size of his capital, which allows a timely and flexible response to changes in the market situation.

In the Forex industry, a lot of brokers offer this service to traders. Alpari is not an exception. With Alpari CopyTrading you can choose strategy managers, follow them and automatically copy their trades. Only after a successful trade, you will be required to pay a commission fee.

How Does Alpari CopyTrading Work?

With Alpari CopyTrading everything is simple. If you are new to trading you can choose from Strategy Managers that are available on the website and automatically copy their trades. To explain things more easily we can provide an example:

Imagine that you have a starting capital of $2000 and choose the strategy manager who makes a $500 profit on his next trade. With the help of CopyTrading, the manager will get 10% ($50) and you will be left with $450 which will add to your starting capital.

In order to start copy trading on Alpari, you need to deposit at least $100. The platform is convenient – you do not need to research anything as everything is provided. The account is safe and secure and works perfectly on every device. Up-to-the-minute updates, real-time market information, and full control over your account will not leave anyone disappointed. The account is accessible from any part of the world and is simple to manage.

Alpari CopyTrading Account Details

The Alpari CopyTrading account, as we have already mentioned above, is easy to use. In order to start using this feature on the brokers website, you will need to follow several steps. Firstly, you should register or log in to your existing account. Next, you need to choose the strategy manager that best fits your needs and preferences. The list is available. After that, you need to verify your account. The final step is to make a minimum deposit of $100 and watch the strategy manager doing the job for you. What makes Alpari CopyTrading even more attractive is the fact that you can also become a strategy manager.

Available Trading Platforms

On Alpari in order to use CopyTrading you need to use MetaTrader 4 platform. At the same time, Alpari is also available on mobile devices and with the development of modern technologies, more and more people are gradually switching to cell phones, which can help them improve the trading process.

Available Leverage

The maximum available leverage on Alpari is 1:1000 and starts from 1:25 depending on the currency pairs and instruments you are going to choose. At the same time, there are two types of accounts on Alpari – Standard and Pro. Both of them have different requirements and leverage rates.

As for the margin, it is the level that the funds on your account need to be at. The margin requirements on demo accounts resemble the ones on live accounts. We should also point out that micro accounts have a fixed leverage of 1:400. You can also encounter leverage as low as 1:3.

Spreads Range

Spread is the difference between the Bid and Ask price. When you trade currency pairs – does not matter which one we are talking about, the spreads are considered commission fees that exist during trading. It should also be noted that there are several types of spreads: fixed, floating, and variable. Fixed spreads are set and do not change depending on the market conditions. Floating spreads are adjusted to market conditions. Variable spreads also represent the current market conditions. Depending on the trading instruments and accounts you are going to have on Alpari, spreads could be different.

Pros & Cons of Alpari CopyTrading

Copy Trading is without a doubt helpful for new traders because some people who are just learning the basics of Forex need some assistance in the beginning. While there are a lot of advantages of CopyTrading on Alpari we can also note some cons. Lets look at both of them below.

Pros

We should start with the pros. As you can probably guess, the main essence and advantage of CopyTrading are the possibility of maximizing your winnings. When you copy a trader who has decent experience in trading and notable statistics you can be sure to get some profit for yourself.

First of all, you do not need to waste time developing your own trading system. Everything is already ready for you and you just need to wait, before your trade is accomplished successfully.

Furthermore, there is no need to monitor the situation in the Forex market. If you trade yourself, of course, you need to keep track of the ongoing events on the market – what is the currency rate, how markets react to the events, etc, but when you are trading automatically, there is no need to do that.

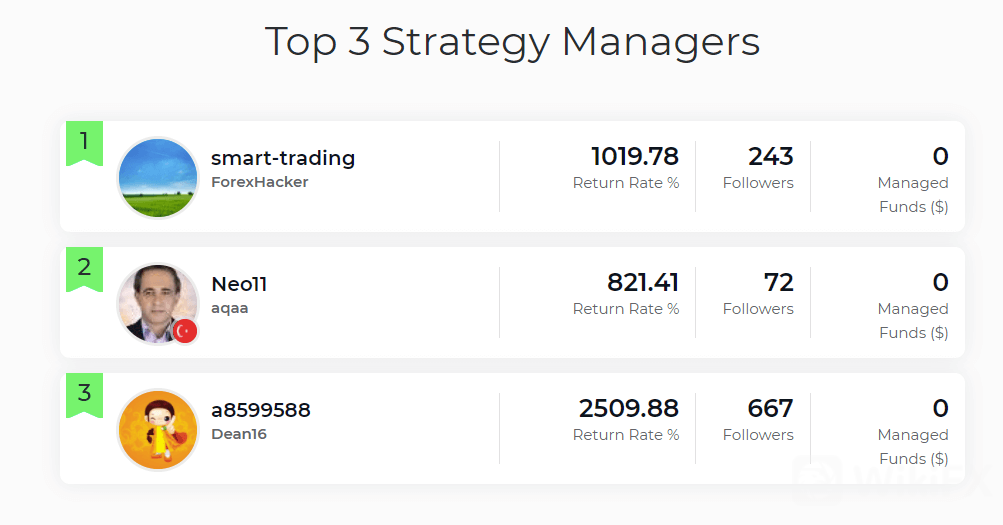

On Alpari, there is a huge selection of signal providers and strategy managers. There is a wide array of managers whose trades can be copied. To make everything simpler there is a list of top performers.

With Copy Trading you can diversify risks when copying transactions. You can copy transactions to your account from several traders, which reduces the risk of losing your deposit.

The psychological factor is also necessary to point out. Many novice traders cannot cope with emotions when opening trades on their own. Watching the market and the growing minus, a novice trader can panic and make a wrong trading decision. True, even when copying, you can close deals on your own, but this opportunity is used by more experienced traders.

Cons

We should also have a look at some of the disadvantages of using the CopyTrading platform. No question this feature is full of pros and useful things for new traders. However, even the experienced ones turn to it frequently. As for the cons we can single out risks associated with trading.

First of all, the trader who provides the ability to copy his trades is not responsible for the result. True, a particular strategy manager could have incredible results in the past, but it does not affect future performance.

With copy trading, there is no fixed income, no guarantees, but there is a history of trading of successful traders. True, you need to understand this story very well, and without experience in independent trading, it is problematic to do it. In addition, by buying a signal, you will not master the market and will not develop as a trader. It turns out some dependence on other traders.

Copying rules is another key factor. It is necessary to be able and correctly set up the copying of trades.

Leave a Reply