Some of you might be wondering, “why do I need to use these uncommon ways when there are so many general tips I could apply?”

The reason is that forex broker scammers evolve. They know how to “upgrade” themselves constantly so they look more promising and convincing to users online. This is also the reason why there are always new marketing-cum-scam tactics that appear out of a sudden that catch the public off-guard.

(1) Look up the forex broker on LinkedIn

If a forex broker is established, it should have a certain number of employees working there. Therefore, if a forex broker is only a shell company or is operating in a grey area, chances are, it will not have many employees, or no employees will be allowed to disclose their job openly on platforms like LinkedIn. Through this, you will be able to judge the scale of business of this forex broker.

Previously, we at WikiFX published an article that highlights the advantages of choosing a bigger scaled forex broker, which could be read here:

(2) Search the name of your forex broker and add a “fake” or “scam” term behind it

Google analytics picks up search terms in a sensitive manner. Using this formula to look up the name (and reputation) of your forex broker is a quick and efficient manner. If a broker comes up with many search results that associate with the words “fake” or “scam”, be sure to avoid it at all costs.

(3) Does your broker cold call you?

A legitimate forex broker should not be contacting you personally with such prompts, joining an exclusive group that is not listed on their website, depositing more money to get special deals, inviting more users to earn commissions, and so on. The reason behind such invitations could likely be that your forex broker is a Ponzi scheme in disguise. They earn more money as you and more trading clients deposit money with them.

(4) Does your forex broker offer more than 20 trading instruments?

An established forex broker will be able to offer a stable trading platform that can accommodate various trading instruments. If your broker is unable to offer more than 20 trading instruments, it could be that it is not a broker that is ready to serve its clients for the time being. Even if the broker is legitimate, you could still need to find a new broker as the trading instrument that it offers cannot suffice your trading needs in the future.

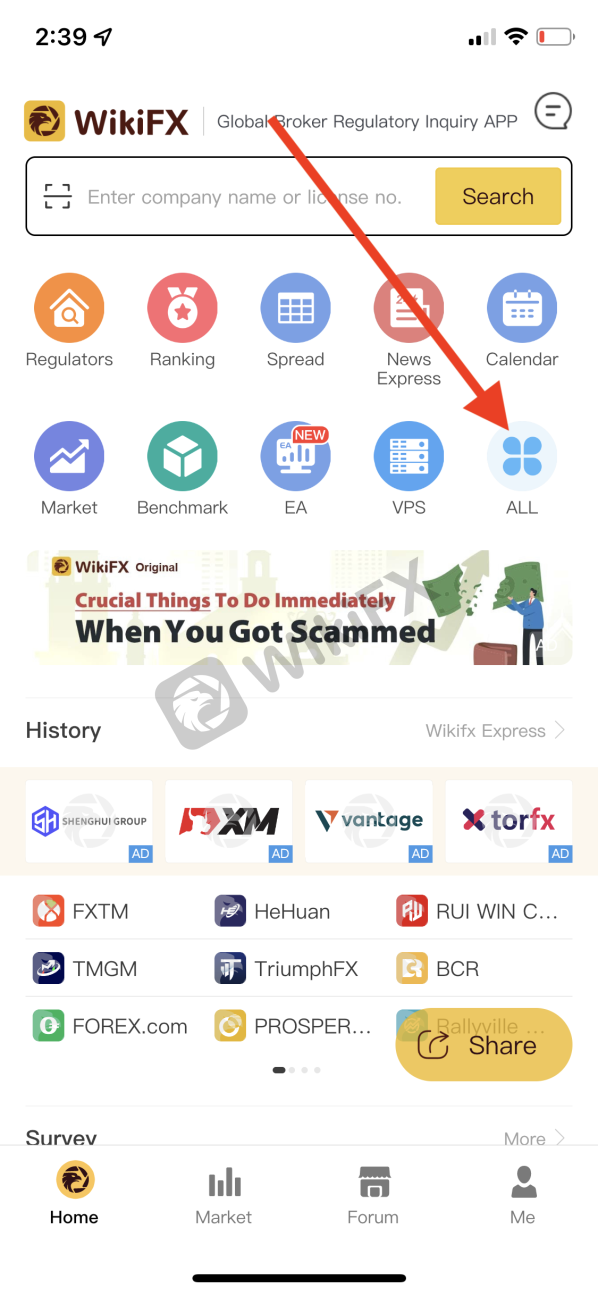

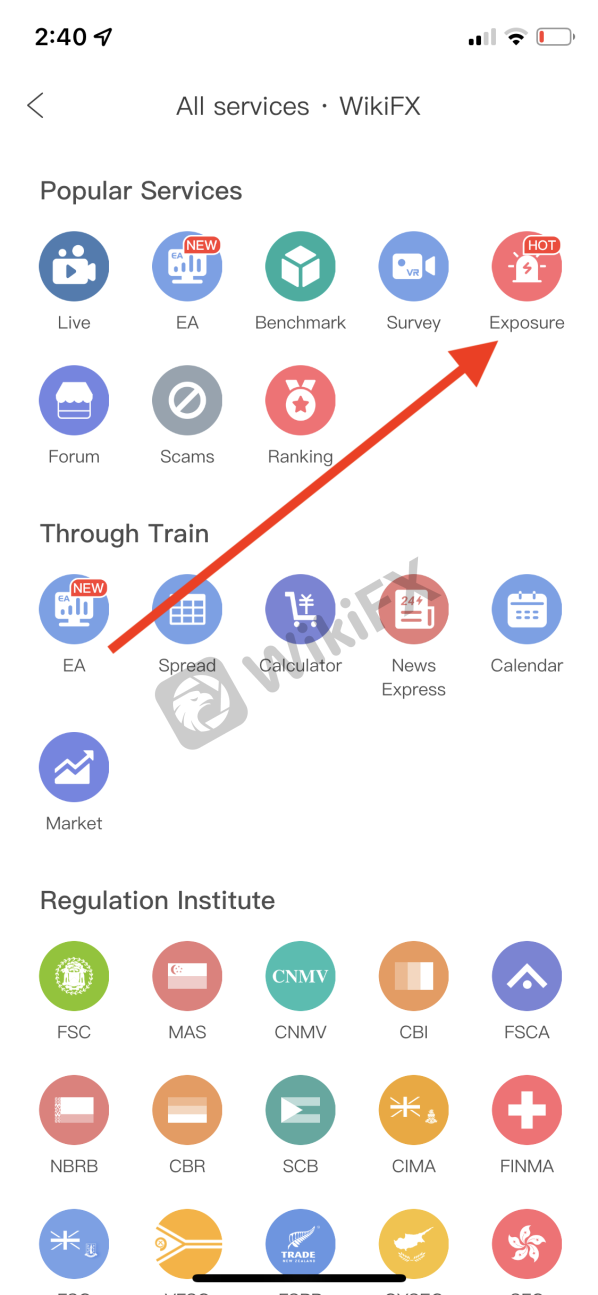

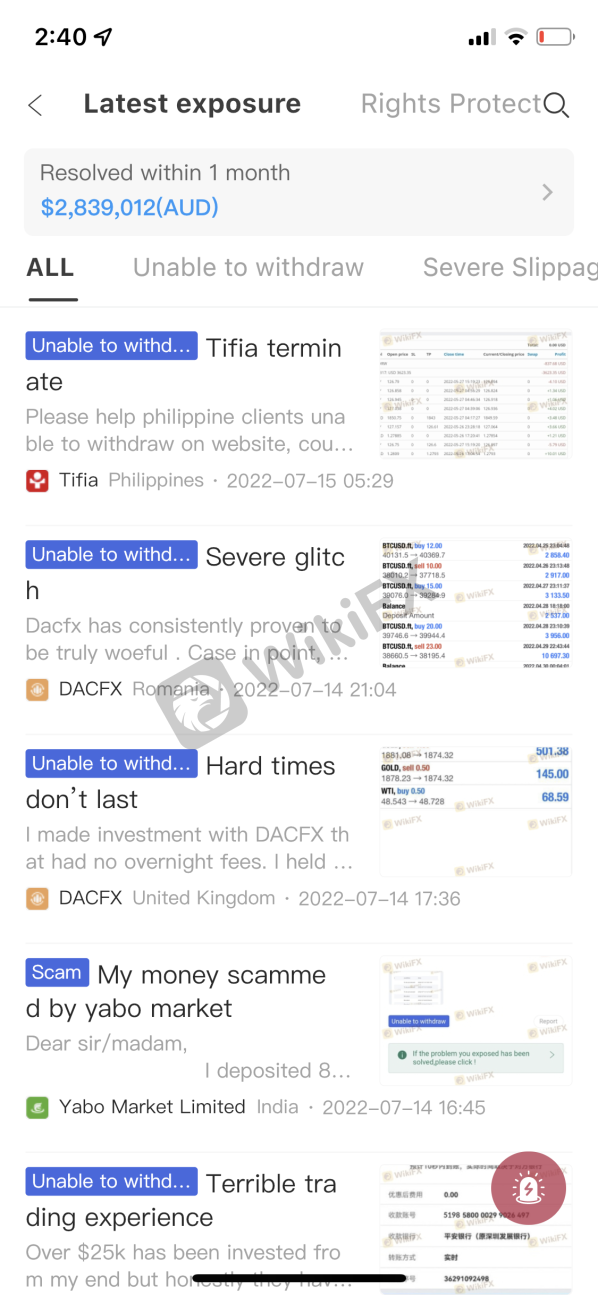

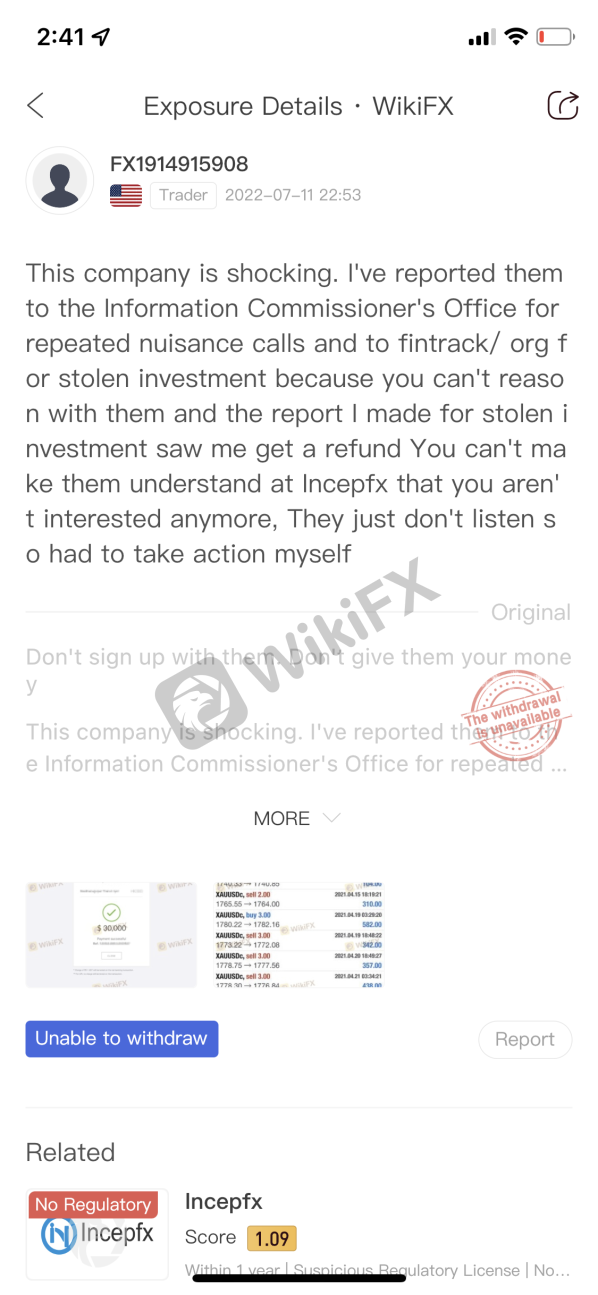

(5) Utilize the Exposure page on WikiFX mobile app or https://exposure.wikifx.com/en/revelation/1.html.

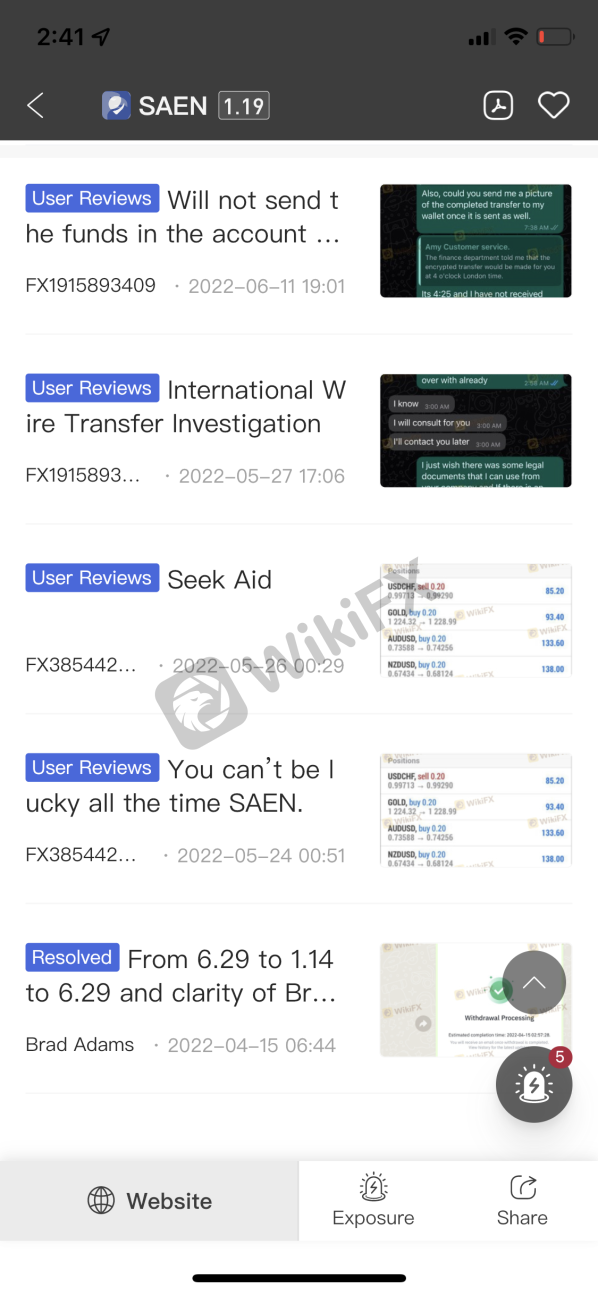

WikiFXs Exposure page is where traders from all over the world can write their honest and transparent experiences regarding their forex brokers respectively. It is a common routine for most of us to read reviews online whether it is buying a mobile phone or prior to visiting a new restaurant, WikiFX allows you to do this for your forex broker at ease without the need to go through several websites and search engines – here you can find everything at your fingertips with just 1 app download.

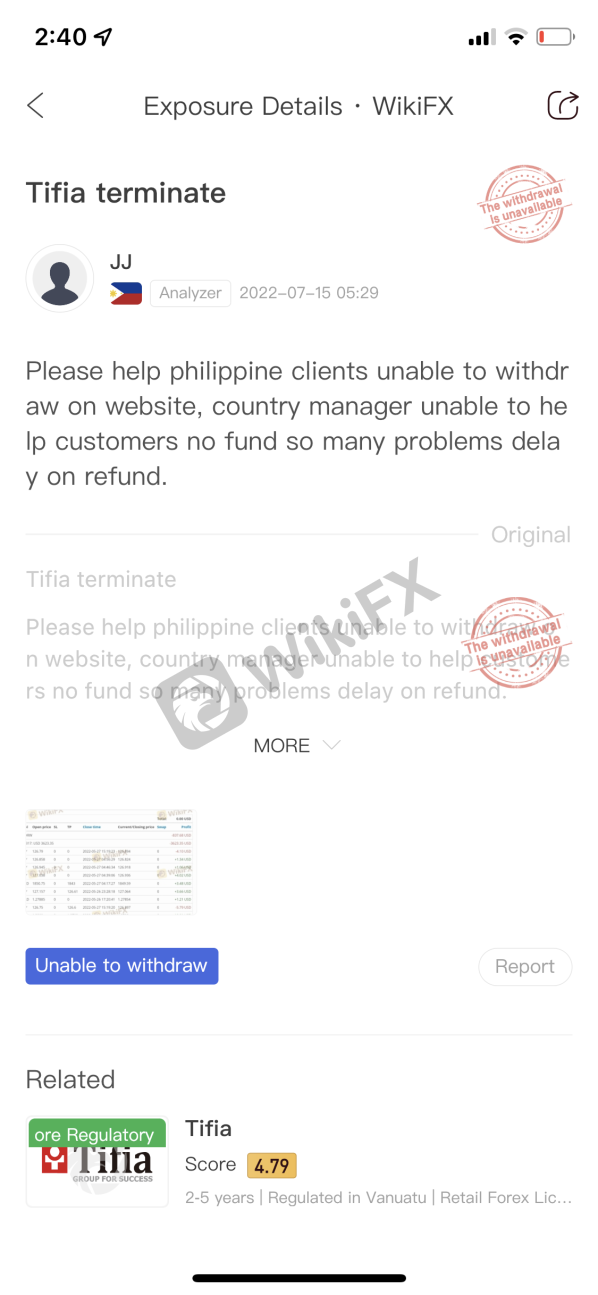

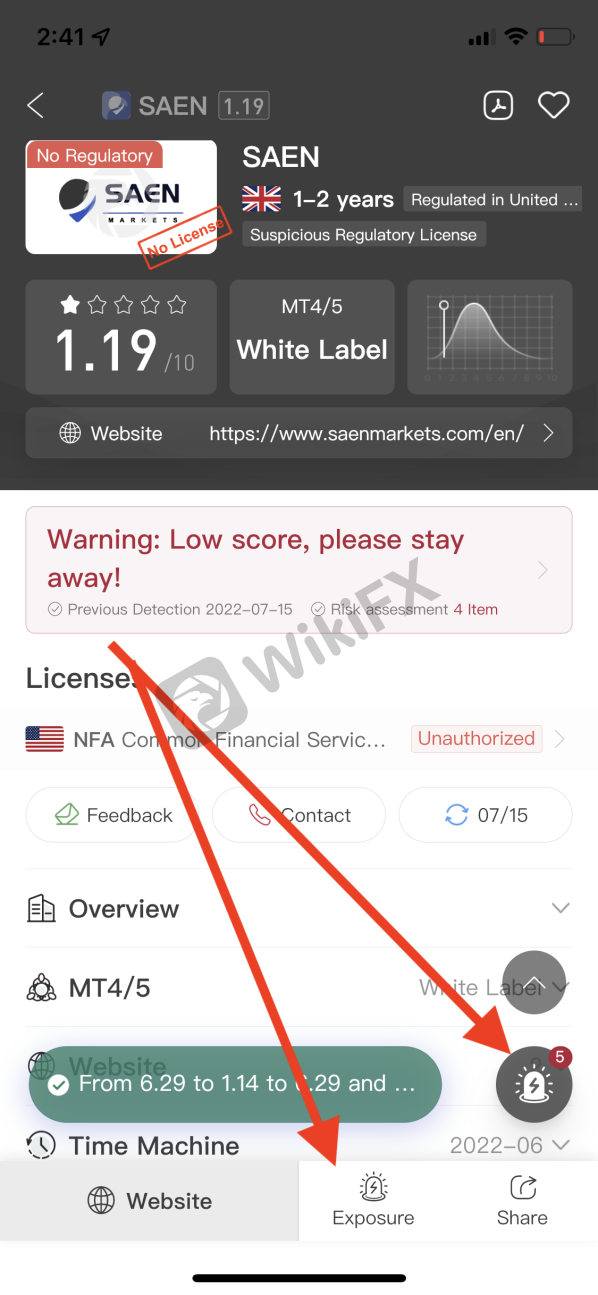

Alternatively, if you would merely like to see the Exposure pieces related to one specific broker, simply type in the broker‘s name into WikiFX’s search bar and pull up its profile, then click either one of these buttons as demonstrated.

Simultaneously, do not neglect the importance of checking a brokers regulatory status, WikiFX score, benchmark score, and licenses held alongside its Exposure information.

Remember these 5 easy yet uncommon steps when you are researching about your forex broker – they allow you to spot flags that others might not be able to see! Thank us later!

Leave a Reply