2021 began with the Forex market heavily impacted by the new coronavirus variants and lockdowns around the world. However, the market soon recovered, and prices started increasing, bringing the total markets valuation to $1.93 quadrillion.

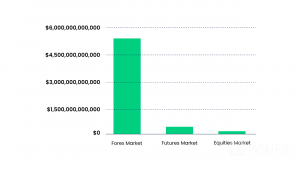

On average, more than $5 trillion dollars were traded every day in the Forex market, and it continued to be the most traded market in the world in 2021.

Amidst the pandemic, which does not seem to stop any time soon, the year witnessed successful Forex traders making at least $100 every day with a $200 deposit, expanding to an earning of $5,000 every day with $10,000 in deposits. Lets take a look at what to expect from the Forex market in 2022.

Where is the Forex market headed in 2022?

Most economies have been witnessing a period of inflation due to lockdowns being lifted. Supply chain bottlenecks are becoming common as economic activities are resuming and consumer prices are surging to an all-time high.

Major economies like the US, the UK, and Europe are recording all-time high consumer price index (CPI) and inflation rates, which will result in the central banks making some changes in the interest rates.

Since interest rates are directly proportional to inflation (to slow the economy and bring the prices down by squeezing money supply from the economy), the interest rates are also likely to rise. The increased interest rates due to soaring inflation are expected to boost the currencies in the Forex market, enabling Forex traders to expand their gains during the uptrend.

For instance, as the year 2021 ended, Federal Reserves Chairman, Jerome Powell, announced an acceleration in bond purchase tapering would result in an interest rate hike. This comment lifted the US dollar immediately and reached its one-month high.

Suppose inflation in economies continues to grow at the same speed. In that case, currency pair prices will rise even further in 2022, which will be an excellent time for new traders to enter the Forex market.

Five important currency pair forecasts for Q1 of 2022

1. AUD/USD

Even though the Federal Reserve is all set to implement the increase in interest rates, the Reserve Bank of Australia (RBA) is still taking things slow with respect to normalising its monetary policy. The AUD/USD currency pair witnessed a fresh low of 0.6993 in October 2021, and due to the contrasting outlooks of both countries central banks, the forecast for AUD/USD seems to be on the bearish side as of now.

Australia‘s inflation rate currently is around 2%, whereas that of the US is reaching 7%, making it justifiable as to why the RBA is taking the ’wait and watch approach until they achieve their actual sustainable inflation range of 2.5-3%. This will result in the currency pair deprecating over the coming three months, signalling traders to take long positions.

2. GBP/JPY

The Japanese Yen is considered a safe currency in 2022 due to Japans extremely low inflation rate (-0.17%)) and stabilised economy. However, the British Pound, being the 4th most traded currency, has been on the bearish side for the traders for more than two years. This is a result of the soaring inflation (5.1%), political instability in the country and the monetary policy tightening plan by the Bank of England in the coming year. Hence, the GBP/JPY currency pair offers long positions to traders in the first quarter to benefit from the rising prices later.

3. EUR/USD

The US dollar is the most popular and widely traded currency in the forex market, and the market strength it holds is not going to fade away anytime soon, according to Wells Fargo, the American financial services multinational corporation.

There is a suggested uptrend for the USD in the coming months. The inflation rate in the EU countries has only been close to 2.5% in 2021, contrasting with the USs increasing inflation and interest rates.

The US dollar will be strengthening in the first quarter of 2022 against the Euro, with a continued bull trend thereon, due to the expansionary monetary policy decisions by the Fed.

4. USD/CHF

With the strengthening of the US dollar, the USD/CHF pair is also expected to witness a boost in the first quarter of 2022. The Canadian Imperial Bank of Commerce expects the USD/CHF pair to increase to 0.96 and continue increasing thereafter, signalling traders to take long positions in the pair.

The Swiss Franc already depreciated against the USD by 3% in December 2021, and the weakening of the currency is expected to continue for the next few months.

5. CAD/JPY

The Bank of Japan (BoJ) has offered to either pump two trillion Yen into the market through temporary government bond purchases or buy seven trillion Yen to fight the rising short-term interest rates by injecting more funds into the market economy. The BoJ does not plan to raise interest rates at all, and on the contrary, the Bank of Canada (BoC) is all set to increase interest rates sharply in 2022.

The widening interest rate differential between the Japanese Yen and Canadian Dollar is going to weaken the currency pair in Q1 of 2022, sending Forex traders a signal of long high yield currency and short low yield currency trades.

Trade Forex in 2022 and capitalise on different currencies

The Forex market has been affected profoundly in the past but has always managed to rise back to where it was, enabling traders to capitalise on the changing currency pair prices every day.

2022 looks like a great year to start your Forex journey. Blueberry Markets can streamline your Forex trading experience through tight spreads, a transparent trading environment, and hassle-free withdrawals.

Leave a Reply