【Gold】

The U.S. futures market was closed for a day on Monday (June 20) due to 19th June Freedom Day or Emancipation Day which officially became a national holiday in the United States last year.

According to the June 17 report of the Commodity Futures Trading Commission, as of June 14, the net speculative long orders for New York gold futures held by fund management institutions (mainly safe-haven funds) and other large traders decreased by 11.8% from the previous week to 154,598 mouths, a new three-year low.

Gold is currently in a consolidation. Alligator has gradually moved towards entanglement, while the KD's gold cross opening also gradually became smaller. This indicates that the direction is slowly flattening. If you look at the fluctuations of gold, the market has been gradually converging and waiting for a subsequent direction to break through.

XAUUSD-D1

Resistance point 1: 1860.00 / Resistance point 2: 1880.00 / Resistance point 3: 1900.00

Support point 1: 1830.00 / support point 2: 1800.00 / support point 3: 1780.00

【Crude Oil】

According to data released by the General Administration of Customs of China on Monday (20th), the total amount of Russian oil imports, including the supply of transportation through the East Siberia Pacific Ocean (ESPO) and the sea cargo of Russia's European and Far Eastern ports, is close to 8.42 million tons. That figure equates to 1.98 million barrels of crude oil per day, an increase of 1/4 from 1.59 million barrels per day in April.

After Western oil giants and trading companies withdrew due to sanctions, Chinese companies including the state-run Sinopec and Zhenhua Petroleum were lured by discounts and have significantly increased their purchases of Russian oil. Saudi Arabia is China's second-largest supplier of oil and according to statistics, China imported 7.82 million tons of Saudi crude oil in May which is equivalent to 1.84 million barrels per day. This is an increase of 9% per year, but lower than the 2.17 million barrels per day in April.

The price of crude oil fell from $125 per barrel to about $110 per barrel which made the short-term KD slowly enter the low-end passivation. Alligator is entangled at this stage which indicates that the general trend of crude oil has begun to turn from long to short.

USOIL-D1

Resistance point 1: 112.800 / Resistance point 2: 114.500 / Resistance point 3: 116.200

Support 1: 108.500 / Support 2: 106.200 / Support 3: 104.800

【Bitcoin】

The cryptocurrency market suddenly saw a sharp snap on Saturday, with the price of bitcoin plunging nearly 14 percent to below $18,000 and plunging more than 35 percent over the past week. It is the first time since December 2020 where it depreciated more than 73 percent since its all-time high of $69,000 last November.

Because of the recent avalanche of the cryptocurrency market, Zhao Changpeng, the richest Chinese and founder of The world's largest cryptocurrency exchange, Biance, has shrunk by nearly 90% and evaporated more than 2.54 trillion Taiwan dollars.

After Bitcoin fell all the way down and after a few days of consolidation, the long-term Alligator shows a death cross. Bitcoin has not completely escaped the pressure of the short side. The short-term KD shows a golden cross. The longer the consolidation, the more helpful it could be in stopping the decline.

BTCUSD-D1

Resistance point 1: 21000 / Resistance point 2: 21500 / Resistance point 3: 22200

Support point 1: 20200 / support point 2: 19500 / support point 3: 18800

【Japanese Yen】

The Yen continues to decline. For Japanese families and most enterprises, the cost of living is raised and miserable, but for Japanese multinational companies, such as Takeda Pharmaceutical, Nintendo, etc, it is a benefit as it can increase profits by exchange rates. As for the tourism industry, many people could take advantage of the great depreciation of the currency value. According to the statistics of the Bank of Taiwan, since June, every day, there are more than 800 million yen of cash withdrawals, which is more than 4 times that of the past.

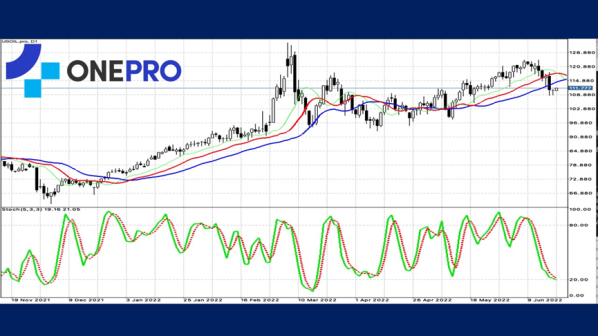

USDJPY's Alligator shows a golden cross, while the KD shows a high-end passivation. This indicates that the buying of USDJPY is still very strong. At this stage, whether it is by looking at the index price that is constantly reaching new highs or the continuous easing of the Bank of Japan policy, it should be difficult for the Yen to be strong in the short term.

USDJPY-D1

Resistance point 1: 136.200 / Resistance point 2: 137.500 / Resistance point 3: 138.800

Support point 1: 134.800 / support point 2: 131.500 / support point 3: 129.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply