【Dow Jones】

Analysts had predicted that the Fed would announce a 2-yard (50 basis point) rate hike at its decision-making meeting on the 15th June.

However, May consumer price index (CPI) released by the United States on 10 June was higher than market expectations. This prompted more people to believe that Fed will raise interest rates by 3 yards in one go. The Wall Street Journal reported this week that several banks, including Goldman Sachs and JPMorgan Chase, said the market was betting heavily on Fed to raise interest rates by 3 yards.

According to the Chicago Mercantile Exchange's FedWatch instrument, traders see a 3-yard hike as more than 90 percent likely. This is well above the 3.9 percent surveyed a week ago.

Alligator shows a death crossover while the KD shows a low-end figure. Many investors still think that the speed of interest rate hikes will be much faster than expected.

USA30-D1

Resistance point 1: 30800 / Resistance point 2: 31200 / Resistance point 3: 31800

Support point 1: 30000 / support point 2: 29500 / support point 3: 29200

【EUR】

Isabel Schnabel, a member of the ECB's executive board, sent a strong signal on Tuesday that the ECB is ready to create a new bond-buying vehicle in the short period of time to curb soaring bond yields in southern European countries. This reminded people of the EU's debt crisis 10 years ago.

Investors have dumped bonds in southern European countries in recent days after the European Central Bank made plans on Thursday to phase out its sprawling bond-buying program and to carry out a series of interest rate hikes to combat record high inflation.

Italy's 10-year yield has climbed to about 4.2 percent, its highest level since 2013.

The Yield on the Treasury rose nearly 0.75 percentage points in just five trading days.

Although the euro did a little rebound from yesterday's low, but EURUSDs Alligator maintained a dead crossover and the KD was also in the low-end blunt area. This indicates that the bears are currently very strong and the short-term rally could be difficult to attract the return of buyers. It is still the focus on whether the price would fall below the previous wave low.

EURUSD-D1

Resistance point 1: 1.04800 / Resistance point 2: 1.05200 / Resistance point 3: 1.05800

Support point 1: 1.04200 / Support point 2: 1.03500 / Support point 3: 1.03200

【Gold】

Marketwatch reported that Colin Cieszynski, chief market strategist at SIA Wealth Management, pointed out that the US dollar will continue to be driven by the expectation of an interest rate increase until the Fed determines the interest rates on Wednesday. The US 10-year Treasury yield soared to 3.45.

At this stage of gold's technical line, Alligator has begun to enter a death cross while the KD has also entered a low-end figure. This indicates that the selling still has the advantage. The focus would be on whether the previous wave lows will be broken.

XAUUSD-D1

Resistance point 1: 1830.00 / Resistance point 2: 1850.00 / Resistance point 3: 1880.00

Support point 1: 1810.00 / support point 2: 1800.00 / support point 3: 1780.00

【Crude Oil】

Crude oil futures prices gave back their early gains on Tuesday (14th) due to supply disruptions in Libya, reversing the decline. Traders weighed in on several big news: progress on the Iran nuclear deal, an extension to an exemption that would allow U.S. banks to sustainably handle Russian energy deals, and the intention of U.S. senators to impose a federal surcharge on certain oil companies to curb inflation.

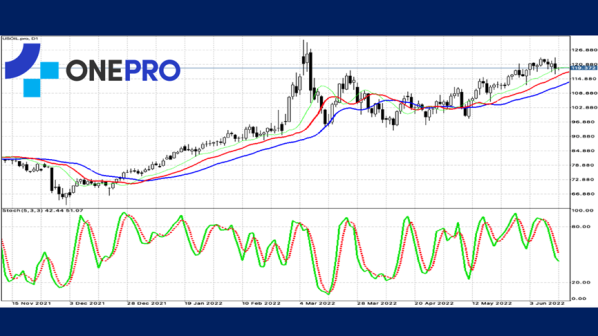

KD shows a death cross but is beginning to retrace. The long-term indicator Alligator shows a large golden cross on the daily line. It shows that crude oil is still walking in a bullish pattern. Some investors are using this pullback to find the right price.

USOIL-D1

Resistance point 1: 121.800 / Resistance point 2: 123.500 / Resistance point 3: 125.200

Support point 1: 117.500 / Support point 2: 115.200 / Support point 3: 113.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply