【Dow Jones】

According to the latest Economic Beige Book report, the US economy continues to grow but it is facing sharp price increase pressure. The production cost of manufacturers has increased the most.

In addition, US companies also expect wages to increase in 2023 so rising labour costs will be a major challenge. Secondly, the unstable supply chain supply is also another problem that needs to be overcome.

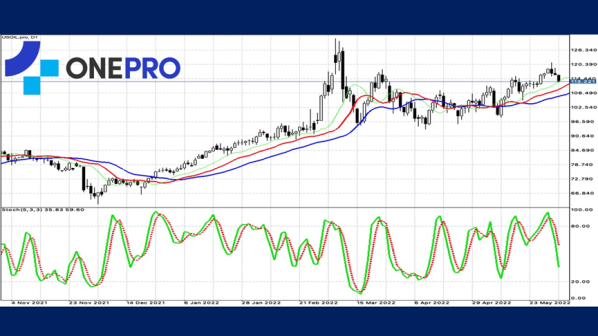

From the daily technical indicators of the Dow Jones index, KD formed a death cross and the price has been pulled back forming a two-day black K. The rising buying support at the bottom of the W still exists.

USA30-D1

Resistance point 1: 33200 / Resistance point 2: 33800 / Resistance point 3: 34200

Support point 1: 32500 / support point 2: 32000 / support point 3: 31800

【EUR】

The U.S. 10-year Treasury yield which rose as high as nearly 11 basis points to 2.95 percent at the time of trading, hit a two-week high since May 18.

The highest of the 30-year period rose nearly 5 fundamental points, rising just below 3.1%. The 2-year period, which is more sensitive to monetary policy, rose by more than 13 basis points, rising above 2.67% and hitting a two-week high.

In addition, the 5-year period also rose by more than 13 fundamental points.

After experiencing two days of decline in the euro, the death cross of the KD indicator began to grow larger. At this stage, the euro pulled back from the previous wave of highs. There may be more buying and selling battles at this position, and the chance of forming a shock may be high.

EURUSD-D1

Resistance point 1: 1.06800 / Resistance point 2: 1.07200 / Resistance point 3: 1.07800

Support point 1: 1.06000 / support point 2: 1.05500 / support point 3: 1.05200

【Crude Oil】

This week, the European Union reached an agreement to ban the export of Russian oil offshore which would immediately cover more than two-thirds of Russian oil imports. By the end of the year, 90% of Russian oil imports will be banned, and the northern pipeline of the Friendship Pipeline, which carries crude oil from Russia to Central and Eastern European countries, will also be stopped.

The price trend of crude oil is still in a bullish trend but it began to pull back after breaking through the previous wave of highs. Although the KD indicator is in a death cross, Alligator is still a golden cross. Investors should try to trade with the trend and not chase orders.

USOIL-D1

Resistance point 1: 115.800 / Resistance point 2: 117.500 / Resistance point 3: 119.200

Support 1: 111.500 / Support 2: 109.200 / Support 3: 107.800

【Bitcoin】

As one of Bitcoin's leading proponents, MicroStrategy CEO Michael Saylor said that a $4 billion loss on the book is not something to worry about as the temporary downturn has little impact on the long-term vision.

MicroStrategy is focused on buying Bitcoin for the long term even though the price of Bitcoin went from a high of $68,800 to around $30,000 today, bringing the company's book loss to $4 billion.

Only a few days ago, the rise sprinted from 30,000 to 32,000 and now from 32,000 back to 30,000. Bitcoin's KD and Alligator are death crosses, so although there was a breakout at the wave high, the selling pressure on the upside are still very strong.

BTCUSD-D1

Resistance point 1: 30000 / Resistance point 2: 31200 / Resistance point 3: 31800

Support point 1: 29000 / support point 2: 29200 / support point 3: 28800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply