【Dow Jones】

Warren Buffett and comrade-in-arms Charles Mungers hate for bitcoin is not new. Their shareholders' meeting recently shelled bitcoin as not a productive asset and has no intrinsic value.

The remarks drew bitterness from Bitcoin loyalist and legendary investor Bill Miller who said, “They're old, they're not used to new things, they're not the kind of people who can embrace new technologies or different ways of doing things.”

From the recent rise in the Dow, daily technical indicators show the Alligator in tangle while the KD is in a high-end blunt. This indicates that the recent buying is still strong. Alligator shows the long-term trend and is not easily changeable in a short period of time. Therefore, it is not easy to have a sharp rise in a short period of time.

USOIL-D1

Resistance point 1: 33500 / Resistance point 2: 33800 / Resistance point 3: 34200

Support point 1: 33000 / support point 2: 32800 / support point 3: 32500

【EUR】

Philip R. Lane, member of the EcB Executive Committee (ECB), pointed out that it is crucial for the outside world to understand the ECB's ideas, and that the two-month interval between April and June monetary policy meetings may be too long. ECB President Christine Lagarde has proposed a roadmap at this time which plans to raise interest rates by one yard each in July and September (25 basis points). Whether inflation is all due to supply chain shocks or internal demand, it makes sense to move away from the negative interest rates in September.

After the euro experienced another wave of rise, KD left the high-end blunt area because of a slight pullback. The focus would be on the KD. If the KD pulls back when the market goes much lower, it means that it may enter a consolidation period again.

EURUSD-D1

Resistance point 1: 1.07800 / Resistance point 2: 1.08200 / Resistance point 3: 1.08500

Support 1: 1.07000 / Support 2: 1.06800 / Support 3: 1.06500

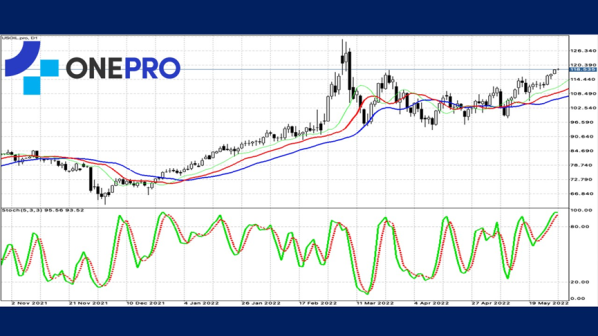

【Crude Oil】

Senior EU diplomats are expected to try to reach an agreement on Russian oil import sanctions at today's (30th May) meeting to avoid showing the EU's disunity in its response to the war in Ukraine.

Reuters reported that according to a new draft of the conclusions of the EU summit, the EU27 leaders will agree that their next round of sanctions will cover Russian oil.

After a few days of rise in crude oil prices, the continuation of the buying force is still very strong. Coupled with the KD high-grade passivation, Alligator shows a golden cross. These indicate that the current buying force is strong and the chance of higher trend waves are very high.

USOIL-D1

Resistance point 1: 119.800 / Resistance point 2: 121.500 / Resistance point 3: 123.200

Support point 1: 117.500 / Support point 2: 115.200 / Support point 3: 113.800

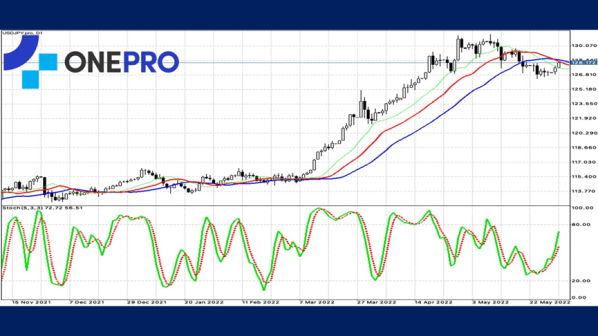

【Japanese Yen】

Bank of Japan (Bank of Japan) President Tohihiko Kuroda promised on the 30th to maintain strong monetary measures to help the economy recover from the downturn caused by the epidemic. Kuroda ignored the proposal to withdraw stimulus measures to boost the Yen exchange rate.

USDJPY's technical line, Alligator remains entangled while the KD shows a golden cross. At this stage, the short-term KD looks like it is waiting for the breakthrough of key resistances for a clearer indication.

USDJPY-D1

Resistance point 1: 129.200 / Resistance point 2: 131.500 / Resistance point 3: 133.800

Support 1: 126.800 / Support 2: 124.500 / Support 3: 122.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply