【Dow Jones】

The Markit Composite Purchasing Managers' Index (PMI) for May showed growth in services but manufacturing fell to monthly lows. Releases in the United States on Tuesday reflected hyperinflation, supply chain bottlenecks and slightly weak consumer demand.

In addition, new home sales in the United States fell for the fourth consecutive month in April which is the lowest level since the epidemic. Soaring house prices and soaring mortgage rates are the main reasons for the data.

The price of the Dow Jones Index is in a short-sided pattern. At this stage, the rebound force of the short-term KD golden cross still exists, while the Alligator death cross indicates that the long-term line is still dominated by the bears. The key would be on when this wave of rebound is over which will cause a change in the KD golden cross.

USA30-D1

Resistance point 1: 32500 / Resistance point 2: 33200 / Resistance point 3: 33500

Support point 1: 31500 / support point 2: 31000 / support point 3: 30800

【EUR】

Spain's Economy Minister Nadia Calvino said on Tuesday (24th) that the Spanish government plans to spend 12.25 billion euros (about $13.12 billion) in the semiconductor industry by 2027, of which 9.3 billion euros will be used to fund the construction of factories. The Spanish government pointed out that 1.1 billion euros will be used to subsidize research and development and 1.3 billion euros will be used for chip design. It will support strategic projects developed by Spanish companies at the European level and establish a $200 million chip fund to fund the entrepreneurship and expansion of the Spanish semiconductor industry.

As seen from the daily technical indicators of EURUSD, KD has entered the high-end blunting area which shows that the buyer's strength is strong. Alligator is in a tangle which indicates that the buying does not have a long-term support. The chance of a breakthrough today is not large as it may be met with selling pressure.

EURUSD-D1

Resistance point 1: 1.07000 / Resistance point 2: 1.07500 / Resistance point 3: 1.08200

Support point 1: 1.06000 / support point 2: 1.05500 / support point 3: 1.04500

【Gold】

Wall Street has built walls of fear, and now nothing seems to be stopping gold from rising.

Inflationary pressure is expected to continue. There are big unknowns in the development of the epidemic in China. The continuous downward adjustment of the outlook of US companies means that gold prices should be supported.

The recent gold index rebounded upwards from $1800 per ounce. The KD index shows a high-end figure. Consolidating near the price region of $1850 per ounce, KD has begun to turn from a high-end figure to a death cross which indicates that the strength of the bears is still a little stronger.

XAUUSD-D1

Resistance point 1: 1860.00 / Resistance point 2: 1880.00 / Resistance point 3: 1900.00

Support point 1: 1830.00 / support point 2: 1810.00 / support point 3: 1800.00

【Crude Oil】

U.S. Energy Secretary Jennifer Granholm said the Biden administration does not rule out a ban on oil exports.

Carsten Fritsch, a commodity analyst at the German Commercial Bank, reported that the oil market is still mired in fear of the consequences of the recession and China's COVID-19 clearance policy. On the other hand, supply is tight especially for petroleum products. Gasoline demand will pick up with the upcoming summer driving season in the United States.

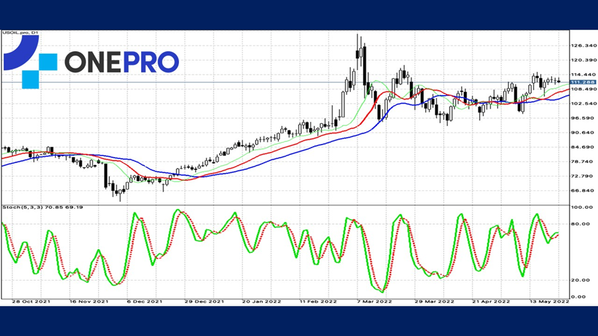

The price trend of crude oil still maintains an upward pattern but has not broken the resistance at the previous wave high. KD shows a golden cross, while the Alligator also shows a golden cross. The indicators indicate buying strength. The short-term buying power of crude oil is still relatively strong. Investors are advise to trade with the trend and not chase orders.

USOIL-D1

Resistance point 1: 113.800 / Resistance point 2: 115.500 / Resistance point 3: 117.200

Support 1: 109.500 / Support 2: 109.200 / Support 3: 107.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply