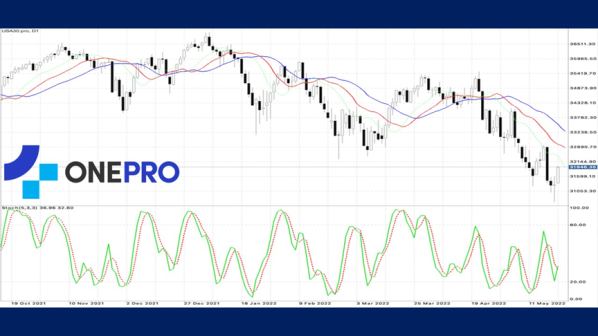

【Dow Jones】

U.S. President Joe Biden said at a press conference in Tokyo earlier that when he ended his trip to Asia and returned to the United States, he would discuss the tariffs imposed by the United States on Chinese products with Treasury Secretary Yellen. Dealing with inflation is currently the top internal affair of the US government, and they are considering withdrawing the tariffs imposed by the Trump administration on China to help reduce inflation.

Alligator shows a death cross, while the KD shows a gold cross. This shows that there is short-term buying power. The recent economic data of the United States has not been good and some key policies may cause a rebound.

USA30-D1

Resistance point 1: 32500 / Resistance point 2: 32800 / Resistance point 3: 33200

Support point 1: 31200 / support point 2: 30800 / support point 3: 30200

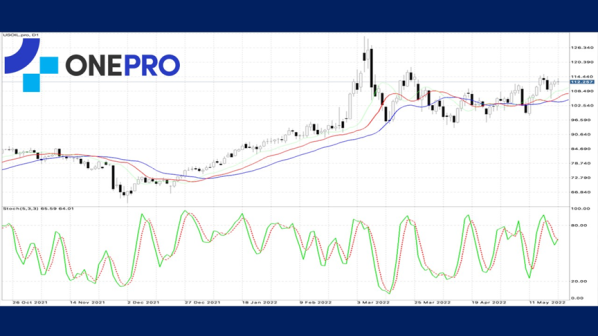

【Crude Oil】

The European Union countries and the United States boycotted Russian refining products and Russian refineries were forced to cut production by 1.73 million barrels / day in the second quarter. The European countries then turned to East Asia to inquire about diesel, which led to the increased cost from 2.4 yuan / barrel in January to 9.8 yuan / barrel in May. The supply continued to be tight, with Russia inquiring about India and other countries to buy more crude oil. In addition, with the lifting of the global epidemic, aviation fuel demand increased.

Analysis pointed out that the estimated third quarter cost will be to US$12 yuan / barrel. The supply is loose, mainly due to the consideration of cooling with the war, the European Union countries and the United States. The high price of gasoline and diesel necessary for the people's livelihood will still bring some demand. This wave of supply-driven price increases will eventually be reversed by demand. The high price structure will continue to the third quarter at most.

In the daily technical line of crude oil, Alligator shows a golden cross while the KD also shows a golden cross. This indicates that the short-term crude oil buying power is there and the follow-up looks to challenge the previous wave highs.

USOIL-D1

Resistance point 1: 113.800 / Resistance point 2: 115.500 / Resistance point 3: 117.200

Support 1: 111.500 / Support 2: 109.200 / Support 3: 107.800

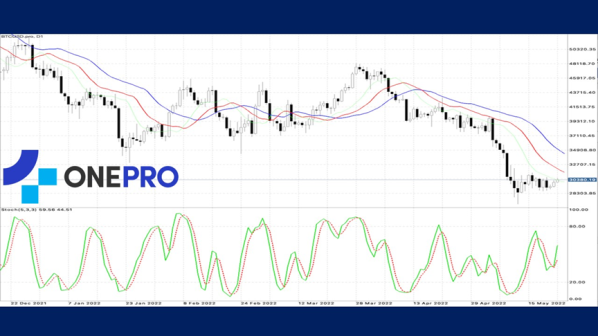

【Bitcoin】

The recent collapse of bitcoin caused the Central American country of El Salvador into a financial crisis. The country's holdings of $105 million bitcoin market value sharply shrunk by more than 1/3 and have a floating loss of about $40 million.

Experts point out that the sharp fall of bitcoin will greatly increase the risk of debt default in El Salvador.

Since El Salvador officially adopted bitcoin, it has fallen by 45%. Losses due to Bitcoin have made the deeply indebted country worse. As of December 2021, El Salvador's debt amounted to $24.4 billion, up from $19.8 billion at the end of 2019.

The country must repay the $329 million in interest on its international bonds this year, as well as $800 million in bonds due next January.

Recently, Bitcoin has also been very disappointing, continuing to fall below the swing low. The current price of Bitcoin is still consolidating at the bottom. Alligator shows a death cross, while the KD shows a gold cross. This shows a long-term short square pattern. If this lowest point is not held, it may drop below the support again.

BTCUSD-D1

Resistance point 1: 30800 / Resistance point 2: 31200 / Resistance point 3: 31800

Support point 1: 29800 / support point 2: 29200 / support point 3: 28800

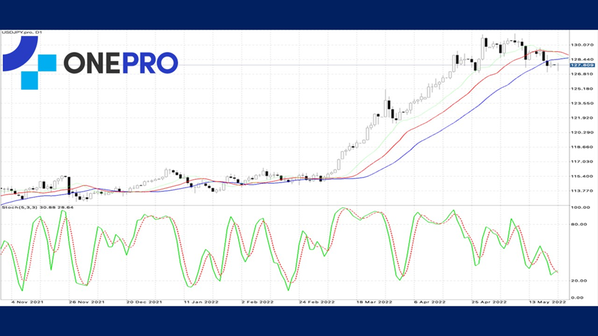

【Japanese Yen】

The yen's purchasing power plummeted to a nearly 50-year low in April due to a sharp weakening of the yen's nominal value and a faster rise in foreign inflation.

According to data compiled by the Bank of Japan based on data compiled by the Bank for International Settlements (BIS), the Real Effective Exchange Rate (REER) index of the Yen fell to 60.9 in April, writing its lowest monthly average since 1971.

The Bank of Japan insisted on keeping interest rates to a minimum but most major central banks raised interest rates to curb inflation. This intensified the depreciation pressure on the yen. The decline in the yen has caused the market to worry about the Japanese economy as corporate profit margins and household budgets are squeezed by rising import costs. Japan is highly dependent on foreign resources.

USDJPY has been consolidating at the high end. Alligator has begun to tangle due to the consolidation. The focus in observation is not the price level, but rather which side of the price it will break through for the clearer direction.

USDJPY-D1

Resistance point 1: 129.200 / Resistance point 2: 131.500 / Resistance point 3: 133.800

Support point 1: 125.800 / support point 2: 123.500 / support point 3: 121.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply