【Dow Jones】

According to media reports, the U.S. Department of Commerce said that retail sales rose 0.9% month-on-month in April and is the fourth consecutive month of growth. It is better than the market estimate of 0.8%, and the annual growth rate reached 8.2%. This shows that even if the US inflation rate hit the highest in 40 years, the US Federal Reserve (Fed) will accelerate the pace of interest rate hikes. The demand for goods in US consumer goods is still strong.

Recently, the shares of Microsoft, Apple, Tesla and Amazon, which have been under heavy selling, have risen by 2% to 5.1%, pushing the S&P 500 and Nasdaq higher.

At this stage, the rebound of the Dow Jones Index quickly led to the high-end figure of the KD. The Alligator shows a death cross and showing that the rebound is prone to some selling pressure. The current Dow Jones Index is consolidating near the previous wave of lows. If there is no big rise again in the near future, KD can become a death cross easily.

USA30-D1

Resistance point 1: 33000 / Resistance point 2: 33500 / Resistance point 3: 34200

Support point 1: 32000 / support point 2: 30800 / support point 3: 30200

【Crude Oil】

Fuel prices have continued to rise and this made the crude oil rally even more solid. It is driven by falling inventories over the past few weeks.

While the implicit demand for gasoline has declined, summer season in the US is just around the corner (starting with the Memorial Day weekend).

Tight distillate supplies have also led to a surge in diesel prices, which also provides support for crude oil prices.

Meanwhile, Shanghai eased lockdown restrictions on Monday and boosted demand for crude oil and putting a check on oil prices.

The technical indicators of crude oil are actually quite strong, Alligator shows a golden cross while the KD shows a high-end figure. Yesterdays price broke the previous wave high and showed that the short-term crude oil buying force is quite strong. The focus would be on crude oil challenging that high.

USOIL-D1

Resistance point 1: 114.800 / Resistance point 2: 116.500 / Resistance point 3: 118.200

Support point 1: 110.500 / support point 2: 118.200 / support point 3: 106.800

【Bitcoin】

Sam Bankman-Fried, founder of cryptocurrency exchange FTX, said that Bitcoin is not a suitable tool for payment as it is extremely inefficient and environmentally costly and has not developed into the future.

Coupled with the huge energy consumed by Bitcoin, it has been criticized by people and groups who paid attention to the environment for many years. The delay of transactions is very long, and it is also very inconvenient to use.

Bitcoin's technical line is quite weak. KD shows a death cross and Alligator also shows a death cross. The price at this stage is still near the recent low and consolidating. If it falls below this support, I am afraid that it will fall for a while.

BTCUSD-D1

Resistance point 1: 30500 / Resistance point 2: 31500 / Resistance point 3: 32800

Support point 1: 29000 / support point 2: 27800 / support point 3: 26200

【Japanese Yen】

The yen has recently performed weakly. It once depreciated the 130 yen to 1 dollar mark at the end of April which a new 20-year low. Tokyo Steel Managing Director Kiyoshi Imamur “Imamura Kiyo” revealed that more and more Japanese manufacturers, from auto parts, cosmetics to consumer electronics manufacturers, have moved overseas business back to Japan, this trend is expected to accelerate by the end of this year.

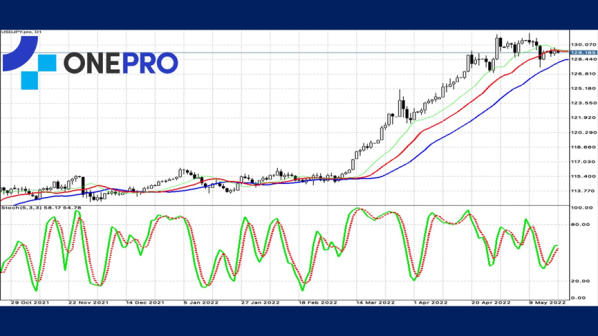

The price of USDJPY continues to consolidate near the price of around 130, and the high-end consolidation has made Alligator change from a strong golden cross to an entangle. KD has gradually begun to become a golden cross, indicating that this price position is a long and short observation point. The next breakout would give a clear trend.

USDJPY-D1

Resistance point 1: 132.200 / Resistance point 2: 133.500 / Resistance point 3: 135.800

Support 1: 128.800 / Support 2: 126.500 / Support 3: 124.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply