【Dow Jones】

U.S. stocks rebounded on Friday led by big tech stocks. Fed President Jerome Powell reiterated his determination to fight inflation, but thought it would be appropriate to raise interest rates by two halves at future meetings. Adding that while the process of fighting inflation would be accompanied by some pain, he believed the economy could avoid a serious downturn. US inflation data for April has slipped from March, which helped to stabilize market concerns about inflation.

Last Friday, when the Dow Jones Index opened a wave of rebound, the KD index on the daily line was out of the low-end figure. The strength of the bears temporarily encountered some resistance, but the long-term pattern still shows a bearish trend. Alligator is still a death cross, and the overall Dow Mark index is still biased towards the bearish pattern.

USA30-D1

Resistance point 1: 32800 / Resistance point 2: 33500 / Resistance point 3: 34200

Support point 1: 31500 / support point 2: 30800 / support point 3: 30200

【Euro】

Eurozone's economic outlook with the Russo-Ukraine war and coupled with the European Central Bank's (ECB) monetary tightening steps, are expected to be slower than the US Federal Reserve. This dragged the euro dollar down more than 8% this year. HSBC Holdings (HSBC) and RBC Capital Markets have also estimated that the euro dollar will depreciate to parity this year which is the first in 20 years.

The recent euro's daily pattern continues to maintain a downward pattern. The strength of the bears is strong. Under the influence of the Alligator death cross, the entire pattern is biased towards the bottom. Investors are advised to avoid counter-trend trades.

EURUSD-D1

Resistance point 1: 1.04500 / Resistance point 2: 1.04800 / Resistance point 3: 1.05200

Support point 1: 1.03500 / support point 2: 1.03200 / support point 3: 1.02800

【Gold】

The current market conditions clearly show that despite the bond market sell-off, investors did not immediately enter the gold market as the US dollar is firmly leading to the high holding cost of gold. The inflation does not show clear signs of cooling, and there is still a lot of investment demand for safe-haven funds this year. On the other hand, THE FED Eagles Director Brandard once said that the cooling of the core price index is a sign of optimism. The CPI core price index fell at 6.5% in March and fell to 6.2% in April, which fell for 2 consecutive months. It shows that there seem to be signs of inflation in the United States.

From the technical line, it is obvious that gold is now facing the bearish pressure. Alligator shows a death cross, while the KD shows a low-end figure. Coupled with the recent US dollar rising, it may be harder to find a support for the trend of gold.

XAUUSD-D1

Resistance point 1: 1825.00 / Resistance point 2: 1835.00 / Resistance point 3: 1845.00

Support point 1: 1805.00 / support point 2: 1800.00 / support point 3: 1790.00

【Crude Oil】

Mohsen Khojastehmehr, the director and general manager of the Iranian National Oil Company, said Iran has the ability to double its oil exports if there is demand in the market. Iran will do its best to recover the share of Iranian crude oil in the market and regain its customers.

Bloomberg reported that while Iran does not publish data on national oil production or exports, analysts estimate the country can sell 1 million barrels per day.

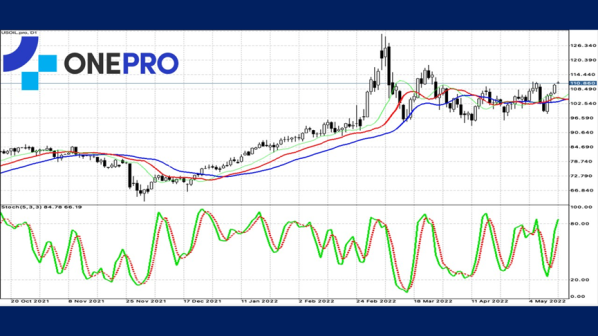

The daily pattern of crude oil has not beaten yesterdays high. Alligator slowly changed from an entanglement to a gold cross. The KD index also began to enter the high-end figure. This shows that the strength of the buyer has gradually emerged. However, it is being slowly pulled back. It is not easy to have a big breakthrough.

USOIL-D1

Resistance point 1: 112.800 / Resistance point 2: 114.500 / Resistance point 3: 116.200

Support point 1: 108.500 / support point 2: 106.200 / support point 3: 104.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply