【Dow Jones】

The US inflation is severe and the Federal Reserve has taken an aggressive interest rate hike route. It has also triggered economic slowdown concerns, and the April non-farm payrolls data far exceeded expectations which made the market more determined that Fed will accelerate the interest rate hike process. The 10-year US Treasury yield also rose to 3.125%.

Apple, Google and Facebook all fell more than 1%, while Amazon fell nearly 1 percent. Semiconductor stocks fell – Esmol, AMD and Fluorea fell more than 3 percent, and Intel fell about 1 percent.

The Dow Jones index fell below the band low of the previous wave, and the closing was also below the swing low. Alligator and KD show death crosses which indicates that the momentum of the short side is quite strong.

US30-D1

Resistance point 1: 32800 / Resistance point 2: 33500 / Resistance point 3: 34200

Support point 1: 31500 / support point 2: 30800 / support point 3: 30200

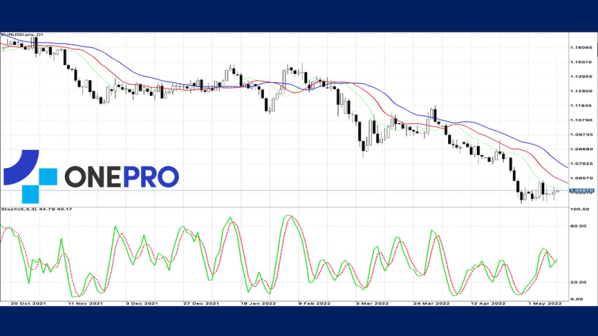

【EUR】

The Federal Reserve has raised interest rates to combat inflation and that has caused the dollar index to rise by 6.7% in the past month and hit a 20-year high. The market is focused on the inflation data to be released this week. Hozman, a hawkish member of the EUROPEAN Central Bank's decision-making class, said in an interview with foreign media a few days ago, “I think at least 2 or 3 rate hikes are reasonable.” It can be adjusted slightly, such as a 0.25% increase at a time.

The trend of the entire euro is still near the bottom of the short pattern trend. Non US currencies are under great pressure because of the rising USD. Although the euro is still the low point of the swing, the euro finally has news of an interest rate rise. As there is still a period of time to the actual policy, the bear side still has an advantage.

EURUSD-D1

Resistance point 1: 1.05800 / Resistance point 2: 1.06200 / Resistance point 3: 1.06800

Support point 1: 1.05200 / support point 2: 1.04200 / support point 3: 1.03800

【Gold】

THE WORLD'S LARGEST GOLD-BACKED ETF, THE SPDR GOLD SHARES (GLD), SAW ITS GOLD HOLDINGS FALL BY 6.10TS TO 1,075.90TS ON THE 9MAY. Fitch reports predict that gold prices will remain supported by safe-haven demand triggered by the Russo-Ukrainian war, and Adrian Day, CEO of Adrian Day Asset Management, believes that the monetary policy environment remains generally favorable. This may help gold prices move higher in the short term.

The price of gold has been going low and is challenging the previous wave of lows. There is indeed support but the strength is not as strong as imagined. The current Alligator death cross represents the long-term trend, while the KD golden cross represents short-term buying. It indicates that gold is not a commodity that look optimistic.

XAUUSD-D1

Resistance point 1: 1880.00 / Resistance point 2: 1900.00 / Resistance point 3: 1920.00

Support point 1: 1830.00 / support point 2: 1810.00 / support point 3: 1780.00

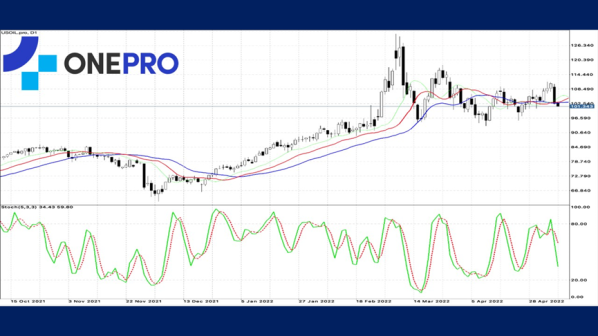

【Crude Oil】

The European Union looks set to ease the intensity of its sanctions package against Russia. Saudi Arabia has also lowered crude prices for Asian buyers which suggests weaker import demand Chinese mainland.

Although the price of crude oil once fell from $110 per barrel to $100 per barrel, it is still oscillating in the range and it indicates that it is slightly pulled back. Alligator entanglement has no direction, while the KD shows a death crossover. This indicates that the short-term selling force is currently in control of the market. Investors are recommended not to actively chase orders and wait for an appropriate trade point.

USOIL-D1

Resistance point 1: 103.800 / Resistance point 2: 105.500 / Resistance point 3: 108.200

Support point 1: 98.500 / support point 2: 96.200 / support point 3: 95.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply