【Dow Jones】

The Fed is expected to announce a rate hike in the early hours of Thursday morning. The market expects a 2-yard rate hike which is the largest rate hike since 2000.

Interest rates are expected to increase this week and the market have begun to react in advance. The Dow Jones index fell all the way down in the past few days but had some buying support yesterday. In terms of technical lines, Alligator shows a Death Cross while the KD shows a Golden Cross. This indicates that there is a battle between the bulls and bears at this region. Coupled with the imminent interest rate hike of the Federal Reserve, investors have begun to shrink their trades and wait for a clearer breakthrough.

Long-term investment analysis also recommends to look into diversification and risk control before release of the interest rate increase data.

USA30-D1

Resistance point 1: 33500 / Resistance point 2: 33800 / Resistance point 3: 34200

Support point 1: 32800 / support point 2: 32200 / support point 3: 32000

【Japanese Yen】

Masaaki Kanno, chief economist of Sony Financial Group, said: “The possibility of the Japanese Ministry of Finance interfering in the Yen ahead of the Fed meeting is ”almost zero“, because if the intervention fails, the Ministry of Finance will no longer have options available. They tend to use that as a last resort.”

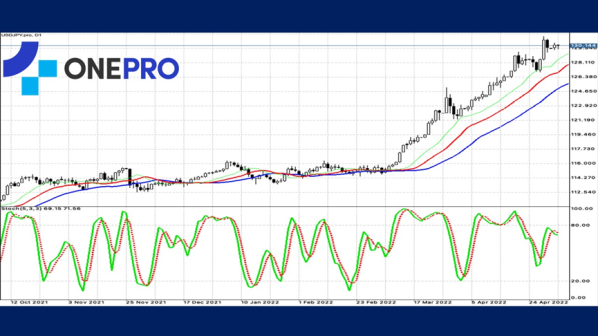

At this stage, USDJPY is still soaring all the way in the sky as the Japanese government maintains a loose policy. As the Federal Reserve is expected to raise interest rates again, investors are still relatively unoptimistic about the trend of the Japanese yen. The technical line shows that the golden cross of the Alligator is still very exaggerated.

USDJPY~D1

Resistance point 1: 132.200 / Resistance point 2: 133.500 / Resistance point 3: 135.800

Support 1: 128.800 / Support 2: 126.500 / Support 3: 124.800

【EUR】

Data released on Tuesday showed that the eurozone's Producer Price Index (PPI) surged more than expected in March amid energy prices that are more than doubled year-on-year. Unemployment continued to hit new lows.

Eurostat said factory prices in the eurozone's 19 member states rose 5.3 percent month-on-month and 36.8 percent year-on-year, all higher than expected. Reuters survey economists forecast a monthly increase of 5.0 percent and a yearly increase of 36.3 percent.

The euro is basically under the influence of the US dollar which has been going higher. The euro is going all the way down!

Coupled with the imminent interest rate hike of the Federal Reserve, investors have begun to shrink their trades and wait for a clearer breakthrough. The euro is trading at a low-end consolidation and waiting for further information.

EURUSD-D1

Resistance point 1: 1.05800 / Resistance point 2: 1.06200 / Resistance point 3: 1.06500

Support 1: 1.04800 / Support 2: 1.04200 / Support 3: 1.03800

【Gold】

SPDR Gold Shares (GLD), the world's largest gold-backed ETF, saw its gold holdings fall by 2.32t to 1,092.23t on the 2nd May.

Basically, the Ukrainian-Russian war has slightly diluted in the market. The price of gold has not improved much in a short period of time. With the Federal Reserve expected to release the latest tightening policies, investors are holding their breath on the movement of US denominated gold.

XAUUSD-D1

Resistance point 1: 1880.00 / Resistance point 2: 1900.00 / Resistance point 3: 1920.00

Support 1: 1850.00 / Support 2: 1830.00 / Support 3: 1810.00

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply