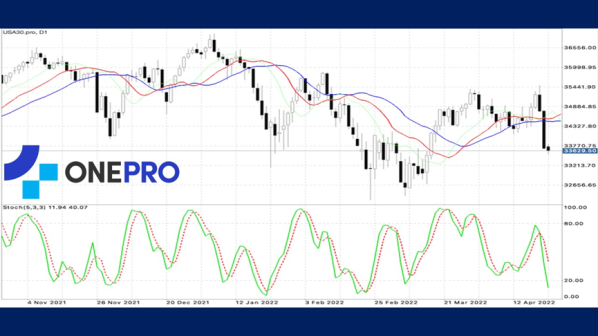

【Dow Jones】

Due to the Russian-Ukrainian war, the poor performance of last week's financial results and the expectations of aggressive interest rate increases by the Us Federal Reserve, the US stock market suffered a decline on Friday (22nd). The Dow Jones dropped nearly 1,000 points and that was the worst single-day performance since October 28, 2020.

From the daily technical line, the current Alligator begun to tangle from a golden cross due to the sharp fall in the past few days. KD has also begun to drop into a low-end area and this indicates that the short-term selling force of the Dow Jones Index is quite strong. Based on the Fed's unexpected aggressive remarks, it can be seen that the interest rate rise is beyond market expectations. Many US stocks and US Bonds are sold off synchronously.

USA30-D1

Resistance point 1: 34200 / Resistance point 2: 34800 / Resistance point 3: 35500

Support point 1: 32800 / support point 2: 33500 / support point 3: 32800

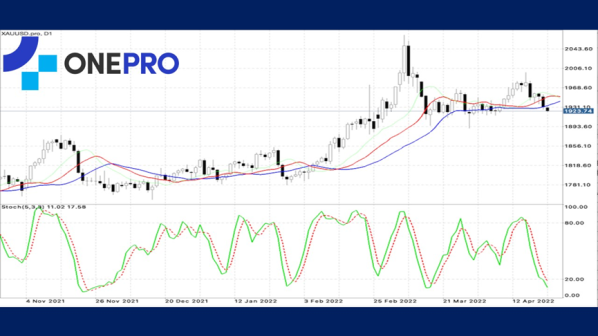

【Gold】

Jim Reid, head of credit strategy and thematic research at Deutsche Bank, said that if calculated on the basis of the consumer price index (CPI), the real interest rate is still deeply negative, and it is predicted that it will continue to be negative throughout his career.

Lawrence Lepard, an operating partner at Equity Management Associates, predicts that gold has a chance to hit $3,000 within two years. He was sceptical of the idea that inflation had peaked and questioned the Fed's ability to push inflation back to 2 percent.

Lepard predicts fed tightening for the coming year until the economy is in recession and markets will force the central bank to take a dovish stance.

From the technical line, gold has been pulled back to the position of 1920 per ounce due to the stronger US dollar. Alligator is in a tangled situation while the KD fell into the low-end area. This shows that the selling pressure of gold is in a relatively strong situation and while the current world instability factors are still very high, gold still has a certain buying support.

XAUUSD-D1

Resistance point 1: 1930.00 / Resistance point 2: 1940.00 / Resistance point 3: 1950.00

Support point 1: 1915.00 / support point 2: 1905.00 / support point 3: 1900.00

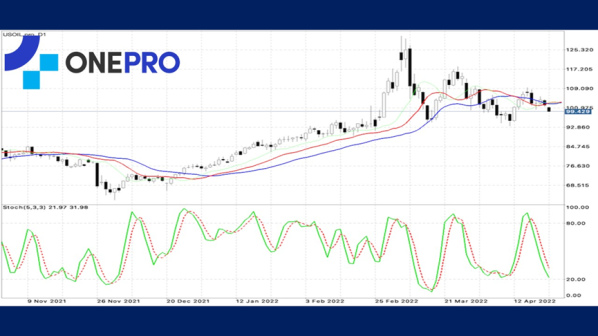

【Crude Oil】

Norwegian Petroleum Directorate (NPD) which is the largest oil and gas exporter in Western Europe, released data on April 21 that Norwegian oil production, including crude oil, gas liquid oil (NGL), and condensate, was 1.96 million barrels per day in March 2022. It is down 20,000 barrels from the previous month. Similarly, the US Department of Energy announced on April 21 that it had produced an average of 1.96 million barrels per day in the week ended April 15. The average daily supply of natural gas in the United States was flat at 100.5 billion cubic feet per day from the previous week, and natural gas production was 0.4% or 400 million cubic feet per day lower than the previous week.

From these reports, it can be known that some of these pipelines that are to replace Russian gas may be difficult to make up for gas supply in a short period of time.

From the daily technical line, it can be seen that the general trend of crude oil is still in the bearish pattern. The recent price of crude oil had a wave of rebound and then began to fall continuously. Alligator is currently tangled while the KD shows a narrowed death cross. Crude oil on the short line has a certain selling pressure.

USOIL-D1

Resistance point 1: 100.800 / Resistance point 2: 102.500 / Resistance point 3: 105.200

Support 1: 98.500 / Support 2: 97.200 / Support 3: 95.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply