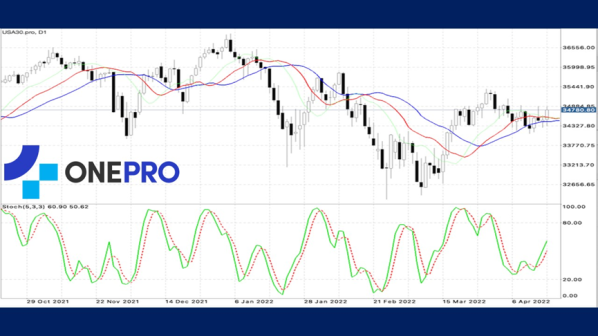

【Dow Jones】

Next week, Apple, Qualcomm, Ultra Micro (AMD), Intel, and Google will all publish earnings reports and future prospects. Reuters reported from sources on March 22 that Chinese regulators have allowed several U.S.-listed Chinese firms to disclose more audit information to keep those companies from forced delisting.

There was a rebound in yesterday's Dow Jones movement. KD is still at a low-end figure and although Alligator has not yet become a golden cross, a few rebounds like this may give the Alligator an opportunity to be a golden cross.

USA30-D1

Resistance point 1: 35000 / Resistance point 2: 35500 / Resistance point 3: 35800

Support point 1: 34000 / support point 2: 33500 / support point 3: 32800

【EUR】

The European Union imposed port sanctions on Russia which prohibits Russian vessels from entering the ports of member states. Just yesterday, Greece's Ministry of Maritime and Island Policy confirmed that they had seized a Russian-flagged crude oil tanker off the southern coast of Evia.

The euro fell below the previous wave of swing lows yesterday and rebounded today. Technical indicators such as Alligator and KD both shows a death cross. It also indicates there is a declining selling pressure with a higher figure than yesterday.

EURUSD-D1

Resistance point 1: 1.08200 / Resistance point 2: 1.08800 / Resistance point 3: 1.09500

Support point 1: 1.07500 / support point 2: 1.06800 / support point 3: 1.06200

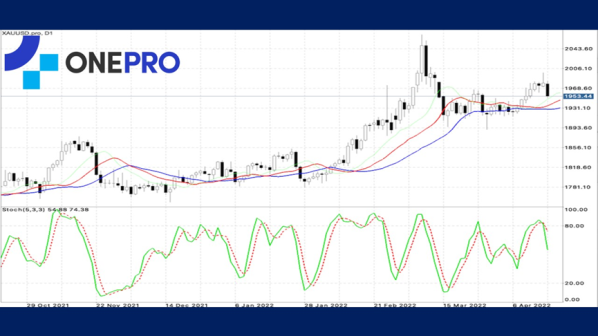

【Gold】

Zelenskyy says negotiations could end if Ukrainian fighters in Mariupol are killed by Russian forces. Turkey has also launched an attack on the Kurdish militants in Iraq. Turkey's military operation was known as Operation Clawlock. It is mainly believed that the PKK plans to launch a large-scale attack on the Turkish state.

The Alligator shows a golden cross and indicates that the price has broken through the consolidation range but KD is a death cross. The KD indicates that the current price has allowed some investors to start taking profits.

XAUUSD-D1

Resistance point 1: 1970.00 / Resistance point 2: 1980.00 / Resistance point 3: 2000.00

Support point 1: 1930.00 / support point 2: 1920.00 / support point 3: 1900.00

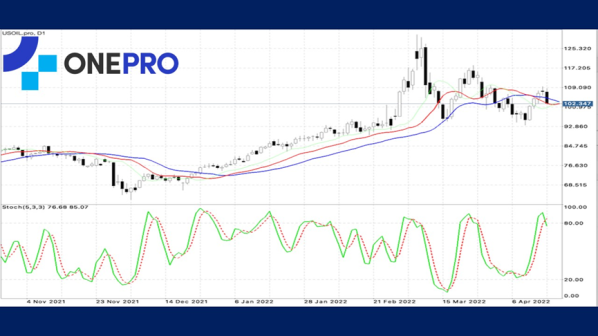

【Crude Oil】

According to the U.S. Department of Energy, the average daily demand for gasoline in the United States is 8.736 million barrels, which is the highest in nearly 4 weeks. However, the demand is relatively low compared to last year's 8.944 million barrels. The use of crude oil has gradually increased recently but the supply of crude oil in Syria has been affected by protest groups. There was not only the closure of the Al-Fil field, but also the closure of the country's largest oil field, Sharara.

At present, the current Alligator is in a tangled state while the KD indicator leaves from the high-end blunting area to become a death cross. There should be a lot of selling pressure on crude oil in the short term.

USOIL-D1

Resistance point 1: 105.500 / Resistance point 2: 108.500 / Resistance point 3: 110.500

Support 1: 101.800 / Support 2: 100.500 / Support 3: 98.200

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply