【Dow Jones】

The US Labor Department reported on Friday that 431,000 new non-farm payrolls were created in March, and the unemployment rate slipped from 3.8 percent to 3.6 percent. Hourly wages also rose sharply in March, up 5.6% year-on-year. May will be the next period where the Fed is expected to raise interest rates and in April there are a large number of US companies that will release their earnings.

Although last Friday there was a pullback in the Dow Jones, the price did not fall below the low point of the consolidation range. The overall bullish pattern has not been broken but the KD still shows a death cross. The key to note this week is whether the low point of the swing has been broken as this would lead to a reversal in trend.

USA30-D1

Resistance point 1: 35200 / Resistance point 2: 35500 / Resistance point 3: 36000

Support point 1: 34500 / support point 2: 34200 / support point 3: 33800

【EUR】

The eurozone's inflation index in March reached 7.5% compared to last year, the highest figure since 1999.

The highest growth figure is due to the price of energy, which has increased by 44.7% as compared to last year, while food and beverage has also increased by 5%. Inflation has far exceeded the 2% set by the Euro central bank, and the deputy governor of the European Central Bank said that the ECB would plan structural bonds at the end of the third quarter.

After the euro broke through the consolidation range, the market has been pulled back to the consolidation range. From the perspective of the daily line, it is still showing an upward pattern. The strength of both buyers and sellers on the short term is relatively strong.

Coupled with the daily KD crossing to a gold cross, the bulls are prone to some selling. Investors are recommended to wait for the support of the pullback and not to chase orders.

EURUSD-D1

Resistance point 1: 1.10800 / Resistance point 2: 1.11200 / Resistance point 3: 1.11500

Support point 1: 1.10200 / support point 2: 1.09800 / support point 3: 1.09500

【Gold】

The better-than-expected employment data in the United States and the rise in bond yields have made the dollar index rise. The means that the price of gold denominated in US dollars will be suppressed. There is some selling pressure in the short-term.

From the technical line of the gold daily line, the Alligator moving average is entangled while the KD shows a golden cross. This indicates that the current stage of gold is more biased towards to trading in the consolidation range. Gold has been oscillating at $1900 per ounce and it is easy to change trend direction on the technical line.

XAUUSD-D1

Resistance point 1: 1930.00 / Resistance point 2: 1940.00 / Resistance point 3: 1950.00

Support point 1: .1910.00 / support point 2: 1900.00 / support point 3: 1890.00

【Crude Oil】

The two biggest news of crude oil has been on the release of the largest war reserve oil reserve in the United States, releasing 1 million barrels per day for the next six months. It is expected to release 180 million barrels of crude oil.

The other is that India and Russia signed a contract to purchase crude oil, and the price will be another $35 per barrel discount of the price before the Ukrainian-Russian conflict.

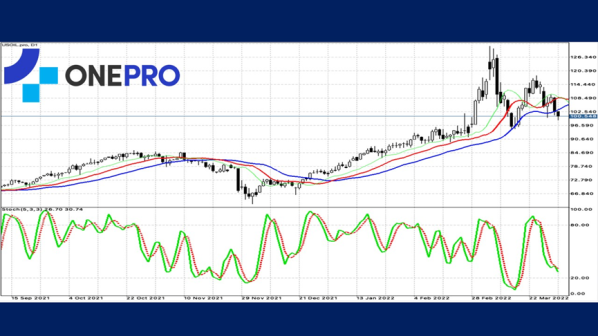

These two messages indicate that the price of crude oil is bound to decrease in the short term.

From the daily technical line of crude oil, the Alligator moving average is entangled while the KD shows a death crossover. This indicates that the market movement is more biased towards the pattern of consolidation range and the bearish side.

The price of crude oil has begun to converge into a triangle and this indicates that there may be a large market breakthrough in the follow-up.

USOIL-D1

Resistance point 1: 101.500 / Resistance point 2: 103.200 / Resistance point 3: 105.500

Support point 1: 99.200 / support point 2: 98.200 / support point 3: 97.500

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply