【Dow Jones】

The US House of Representatives voted that the United States would cancel its trade relations with Russia and Belarus. The final vote was 424-8 with strong bipartisan support for the legislation, which will next head to the Senate.The United States could impose tariffs on Russia with all its might.

The most coveted focus at this stage is actually the risk of Russian debt default. With the sanctions imposed by Western countries, SWIFT is prohibited and this will make Russia is difficult to exchange currencies to repay the debt. Russia has decreed that all bonds now use the Rubles but these bonds are foreign currency bonds. Many banks and countries hold a large number of Russian bonds and Russia has repaid the first wave of dollars. We will have to monitor what the situation is, otherwise countries and banks may face a wave of losses.

From the perspective of The Dow Jones's daily technical line, the Dow Jones Index continues from yesterday's upward trend. It opened low but went higher. The Alligator still shows a death crossover while the KD is higher. This shows that the Dow Jones Index may face great selling pressure if it is directly rushes up.

USA30-D1

Resistance point 1: 34500 / Resistance point 2: 34800 / Resistance point 3: 35200

Support Point 1: 34200 / Support Point 2: 33800 / Support Point 3: 33200

【Euro】

ECB President Christine Lagarde said that the European Union, which was previously plagued by deflation, has now brought inflation to a normal level because of the factors of the Russian War. If the Russian War ends, there is little chance that inflation will return to its previous weak state. For the medium to long term, the inflation figures are also favourable.

Lagarde said that the pace of future interest rate adjustment should be in a gradual manner. A gradual approach should be taken and the strategy of raising interest rates must be implemented only when it is determined that there is a need for a rate hike in a well-founded state.

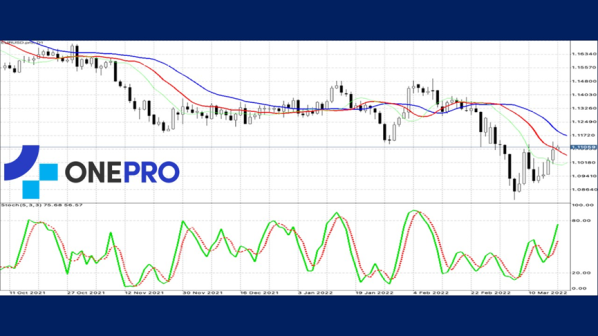

The Alligator is showing a death crossover and it indicates that after the euro has fallen below the previous wave. The strength of the decline is still relatively large.

Although there has been a recent rebound, KD has appeared in a state of high-level divergence which is a sign that there is a possibility of a reversal. From the technical line, the actual buying power of this wave of rebound lacks support.

However, by combining the above signs, the strength is still stronger when going up.

EURUSD-D1

Resistance point 1: 1.11500 / Resistance point 2: 1.11800 / Resistance point 3: 1.12200

Support point 1: 1.10800 / support point 2: 1.10500 / support point 3: 1.10000

【Gold】

When the price of gold was at 1900USD per ounce, the short-term decline began to meet strong buying support. According to the 16th GOLD Index Fund's gold holdings data, gold holdings increased by 8.7 metric tons to 1070.53 metric tons, the highest holdings in nearly a year.

The price of gold still looks to be the range of 1900 to 2000USD per ounce as there is selling pressure upwards and buying power support downwards.

The chairman of the Jewelry Summit Committee of India said that gold sales in January and February 2020 were good, but the demand for gold decreased by 25% after March. However, the Buddha Full Moon Festival in May should lead to a wave of gold buying in India.

As can be seen from the daily technical lines of the gold, the Alligator began to oscillate on the moving average. This indicates that gold has been fluctuating up and down at the high figure. KD is a gold cross and this indicates that there are still more investors willing to hold gold in the short term.

XAUUSD-D1

Resistance point 1: 1958.00 / Resistance point 2: 1965.00 / Resistance point 3: 1972.00

Support point 1: 1938.00 / support point 2: 1932.00 / support point 3: 1920.00

【Crude Oil】

Oil markets could lose three million barrels per day (bpd) of Russian crude and refined products from April, the International Energy Agency (IEA) said on Wednesday.

Back on the U.S. negotiations with Iran, the United States is considering removing Iran's Islamic Revolutionary Guard Corps (IRGC) from the blacklist of terrorist organizations. There is no decision at this stage, but many signs show that it is essentially imperative to restore the Iran agreement.

In the daily technical line of crude oil, the Alligator slowly entangled while the KD has formed a gold cross. This shows that the current stage of 100USD per barrel of crude oil is the point of a long-short pull war. Oil prices are gradually showing some stability at this point and is looking for a clear direction to move into.

USOIL – D1

Resistance point 1: 105.800 / Resistance point 2: 108.500 / Resistance point 3: 110.200

Support point 1: 102.800 / support point 2: 98.500 / support point 3: 95.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply