【XAUUSD】

Ukraine's war with Russia continues to heat up and international sanctions on Russia are becoming more and more intense. Many investors are hedging gold and the price of gold once hit $2067 per ounce. However, the market began to spread that Russia may soon start to sell a large number of gold reserves to cope with the financial problems caused by international sanctions. In a trading day of gold, there was nearly $80 of fluctuations.

The daily technical line of gold, Alligator is still on a gold crossover while KD is also at a high-end figure. This shows that the purchasing of gold is still quite strong. The current stage of gold fluctuations is much greater than before and trading with leverage should be considered carefully.

XAUUSD – D1

Resistance point 1: 2050.00/ Resistance point 2: 2080.00/ Resistance point 3: 2100.00

Support point 1: 2020.00/ Support point 2: 2000.00/ Support point 3: 1980.00

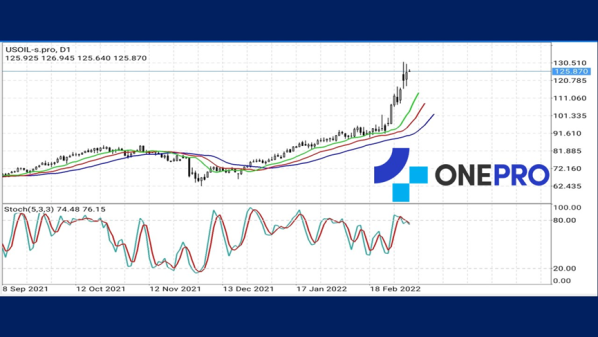

【USOIL】

After the United States issued a ban on the import of Russian oil, the United Kingdom also began to announce the ban on the import of Russian oil. With this news, the price of crude oil continued to rise but did not exceed the previous day's high of 130USD per barrel. During this period, oil companies do not dare to import Russian oil. A British veteran oil company have personally experienced being scolded by the media and masses around the world when buying Russian oil. Basically, Russia and Ukraine have just finished the third negotiation. Although there is no special conclusion, it feels that the Ukrainian president's remarks about the lack of effort by western countries are considered by the market.

The daily technical line of crude oil shows that an Alligator gold cross but because the opening is large, it will be difficult for a reversal trend during the short period. KD begins to leave from the high-end area and became a death cross. This indicates that there is a chance for the short-term trend to corrected at the high-end.

USOIL – D1

Resistance point 1: 126.500/ Resistance point 2: 128.500/ Resistance point 3: 131.800

Support point 1: 123.200/ Support point 2: 120.500/ Support point 3: 117.800

【Dow Jones Index USA30】

The dramatic Dow Jones Index looks to be staged yesterday. It first thought that Ukraine's war with Russia was exhausted and that the worst situation has passed. This caused the market to go up by 500 point. After US President Biden came out and said they want to ban the import of Russian oil, the Dow Jones Index began to collapse again and finally ended 180 points below.

From the perspective of technical analysis, the current KD shows a low-end figure while the Alligator shows a death crossover. Coupled with international instability factors like interest rate increases, wars and inflation, it is easy to fall into a bear market. Investors are advised to pay attention to risks on this one.

USA30 –D1

Resistance point 1: 33200/ Resistance point 2: 33800/ Resistance point 3: 34500

Support point 1: 32500/ Support point 2: 32200/ Support point 3: 31800

【EURUSD】

Europe has made a move! It is reported that the EUROPEAN Union is considering issuing a joint bond which is intended to strengthen the relevant sectors of energy and defence. Although it is not known what useful function this debt will have for the EU's economy, the euro finally ended falling and changed positions from a lying on the floor to squatting on the floor. There will be a central bank interest rate meeting this Thursday for the EU. Investors will take note on whether the ECB will issue any more encouraging remarks after the meeting.

In terms of technical lines, the Alligator show a death cross while the KD a gold cross. This indicates that the short-term line has a buying force. The market look to have some expectation for the European Central Bank and this could also be due to the US banning Russian crude oil imports.

EURUSD – D1

Resistance point 1: 1.09500/ Resistance point 2: 1.09800/ Resistance point 3: 1.10200

Support point 1: 1.08800/ Support point 2: 1.08000/ Support point 3: 1.07500

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply