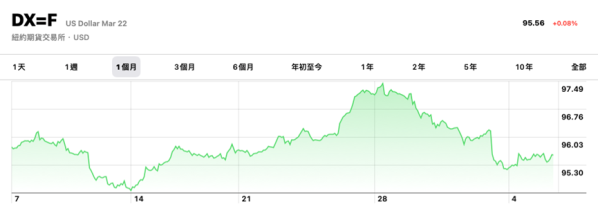

【Dollar index】

This week's news focus is on the U.S. inflation data. The last time when the data went as high as 7%, it was really surprising. The market experts still expect this time the inflation data should be 7.3%. After all, crude oil is still rising.

In the CFTC data of the DOLLAR Index, we can see that the long trading orders of speculative legal persons increased by 2125, but the short orders also increased by 4415. The overall short orders still increased more, indicating that the market sentiment is more inclined towards a bear.

【EURUSD】

In the CFTC data for the euro, we can see that the number is increased by 115. The short order also increased by 1999 and this indicates that it is still relatively bearish. ECB commissioners have publicly stated in the market that the ECB expects to start raising interest rates in the fourth quarter.

From the perspective of technical analysis, the daily Alligator shows a gold crossover while KD also shows a high-end figure. Last week's wave of the euro made some technical lines show a bullish pattern. There is a buying volume on the short line but the resistance at the high of 1.148 is very strong. Unless or before the breakthrough, the bullish pattern is still not clear.

EURUSD – D1

Resistance 1: 1.14838/ Resistance 2: 1.15230/ Resistance 3: 1.16928

Support 1: 1.13880/ Support 2: 1.11900/ Support 3: 1.11203

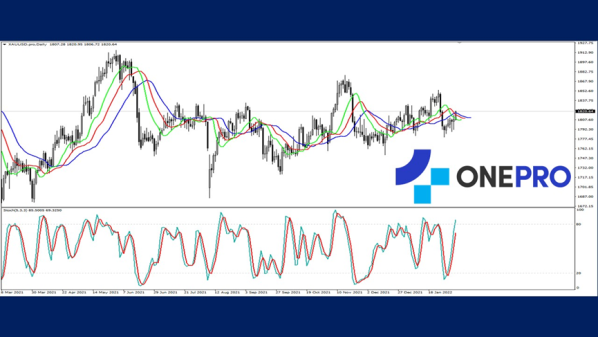

【XAUUSD】

In the CFTC data of gold, the number decreased by 37421. The number of short orders also increased by 10588. There was a large number of short orders entering the market coupled with a large number of multi-orders exits. This looks like a moving layout of short orders done.

Gold's Alligator shows a death crossover while the KD shows a high-end figure. It shows contradicting data because gold has been oscillating between $1800 the past few months. The chips could change with the market's attitude towards risk aversion, the recent inflation and interest rate decisions. These could be the focus of determining the future trend of gold.

XAUUSD – D1

Resistance 1: 1814.50/ Resistance 2: 1832.20

Support 1: 1789.50/ Support 2: 1757.00/ Support 3: 1722.50

【USOIL】

For the CFTC trading list of crude oil, there was a reduction of 4704. The short order also reduced by 193. Crude oil Alligator shows a golden cross while KD shows a high-end divergence. In general, KD divergence is more likely to occur when a transition occurs.

USOIL – D1

Resistance point 1: 93.382/ Resistance point 2: 100.668

Support point 1: 91.147/ Support point 2: 89.239/ Support point 3: 86.694

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply