【EURUSD】

The eurozone central bank interest rate has not changed as the market expected. The euro area inflation in January published the previous day came to 5.1%. The market assessment was that although interest rates will not change in the short term, the euro area should rise by about 0.25% by the end of this year.

The ECB said it could choose where and when to invest the 1.6 trillion euro bond maturity funds purchased under the Emergency Asset Purchase Program.

The recent wave of euro was a V turn reversal pull. From the technical line, the Alligator entanglement has no clear direction and the KD high-end figure shows that the short-term buying force is strong. The current price has come under pressure at the previous wave of highs.

EURUSD – D1

Resistance 1: 1.14838 / Resistance 2: 1.15230 / Resistance 3: 1.16928

Support 1: 1.13880 / Support 2: 1.11900 / Support 3: 1.11203

【GBPUSD】

The Bank of England raised interest rates by 0.25% as expected by the market. This is another rate hike since the UNEXPECTED increase in the UK last year. Four members of the decision-making board asked for a 0.5% rate hike. In addition, the Bank of England decided to reduce the portion of the bonds it held.

At this stage, the UK is currently the fastest country in all European and American countries to carry out austerity policies, and the problems facing the UK at this stage are not small. There was a consumer price index of 5.4% and also a sharp increase of 50% in household energy.

From the technical line type, the Alligator shows a golden cross while the KD shows a high-end figure which indicates that the buying strength is strong. The current price level is also between the highs and lows of this wave. The strength of the technical line is particularly important in making an analysis.

GBPUSD – D1

Resistance 1: 1.37482 / Resistance 2: 1.38337 / Resistance 3: 1.39138

Support 1: 1.33585 / Support 2: 1.31625

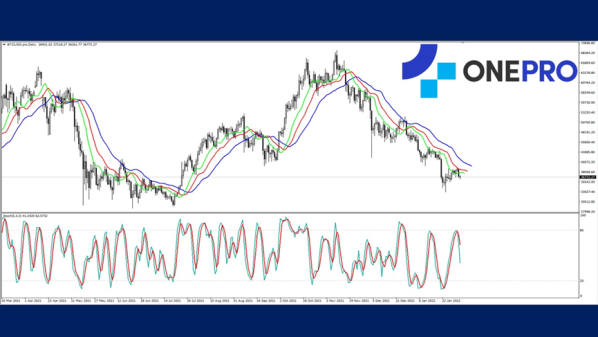

【BITCOIN】

Texas in the United States is about to usher in a winter blizzard. To avoid last year's power outages, The Texas bitcoin miner Riot Blockchain announced that it will voluntarily shut down from Feb 2nd to save electricity. This electricity amount is enough to save 60,000 households.

India, on the other hand, announced the launch of digital currencies from April 1. They also imposed a 30% tax on the transfer of assets in cryptocurrencies at the same time.

Despite doubts about the production of cryptocurrencies and the approval of digital currencies by central banks, the price of Bitcoin still fluctuates around 36800 with no particular upward or downward fluctuations.

BITCOIN – D1

Resistance 1: 39608 / Resistance 2: 41715 / Resistance 3: 45439

Support 1: 32965 / Support 2: 31019 / Support 3: 28976

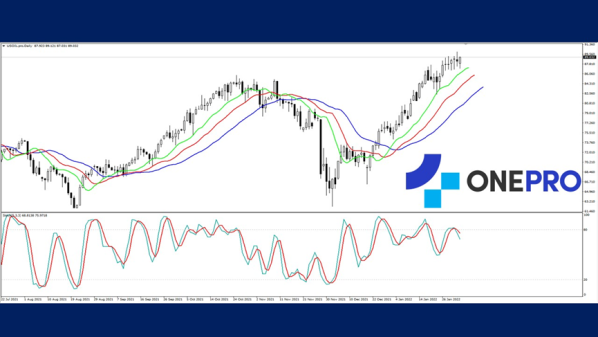

【USOIL】

The OPEC meeting decided to raise the crude oil plan by another 400,000 barrels per day. Although OPEC is facing many problems at this stage where not all member countries are actually producing according to the original plan, the United States wants OPEC to increase more production. There was still a slight increase in the production gap.

In the past few days, I have heard that some civilians on the border between Ukraine and Russia have been shot by stray bullets. The actual situation is not clear but the market believes that this indicates that the relationship between Ukraine and Russia is becoming more and more tense.

USOIL – D1

Resistance 1: 87.180 / Resistance 2: 87.800

Support 1: 85.120 / Support 2: 82.800 / Support 3: 81.820

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply