【EURUSD】

St. Louis Fed President Bullard said he intends to start raising rates at the March meeting and continue to raise rates in subsequent May and June meetings. By refuting the idea of starting a tight cycle with a 50 basis point rate hike, how high the Fed ultimately needs to raise rates depends largely on how inflation evolves this year. The recent rise in the euro price is mainly related to the weakness of the dollar index. It is still trading within the range of 1.118 to 1.138 and waiting for the next news release with the euro area interest rate to give a special direction.

EURUSD – D1

Resistance 1: 1.11845/Resistance 2: 1.13815/Resistance 3: 1.14836

Support 1: 1.10161 /Support 2: 1.07681

【XAUUSD】

The dollar index has recently fallen and that drove non-US currencies and gold up. Some market analysts believe that the main reason for the dollar's weakness is because Fed officials have downplayed the possibility of a 50-basis point rate hike. However, the recent inflation is really severe and may last longer than expected. The dollar may need a stronger economic foundation rather than simply adjusting interest rates if it wants to return to its former glory. Gold is still basically trading around $1800 an ounce and it has been hard to jump out of this zone. It is advisable for investors to wait but If they really want to trade, it would be prudent to use a short time zone to do a range breakout strategy. Not chasing the price too far away from the 1800 figure has been a simple and clear way to trade recently.

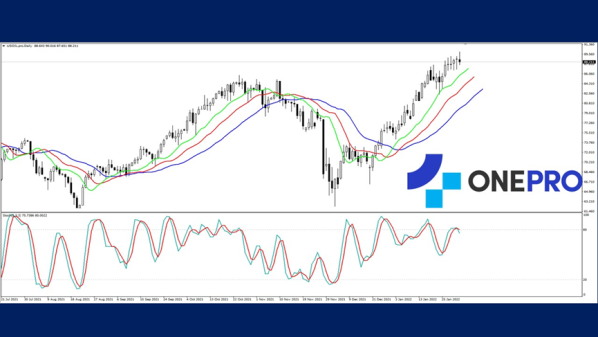

XAUUSD – D1

Resistance 1: 1814.50 / Resistance 2: 1832.20

Support 1: 1789.50 / Support 2: 1757.00/ Support 3: 1722.50

【USDJPY】

Japan's single-day covid cases exceeded 90,000 people and had a number of reported deaths of 80 people. These two figures are a record of a new single-day high and this shows that the epidemic in Japan is not yet under control. Recently, due to the weakening of the US dollar, the current index is near 114.33. From the technical line view, both the Alligator and KD shows a death cross. This indicates that the bearish force is relatively strong. One thing to note would be that the Japanese dollar did not have a relatively large fluctuation, the key is still whether the dollar is appreciating or depreciating.

USDJPY -H4

Resistance 1: 115.520/ Resistance 2: 116.050/ Resistance 3: 116.350

Support 1: 114.950 / Support 2: 114.680/ Support 3: 113.150

【USOIL】

Russian media reported that the price of Russian oil exports — Ural crude — broke through $92 a barrel for the first time since the fall of 2014. The unique combination of rising oil prices and devaluing of the Russian rubles is extremely beneficial to Russia but dangerous to the U.S. economy. Along with the rising oil prices and devaluation of rubles, it will bring excess revenue to the warring nations. In short, crude oil has been on the high level.

USOIL – D1

Resistance 1: 87.180/ Resistance 2: 87.800

Support 1: 85.120/ Support 2: 82.800 / Support 3: 81.820

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply