Market Overview

During the Asian session on January 31, the spot gold fluctuated in a narrow range and is currently trading around $1922. Spot gold closed down 0.28% at US $1923.06 on Monday.The price of gold has risen 17.7% in the past three months and has risen more than 5% since 2023.Although hedge funds increased their bullish bets on gold, analysts warned that the Fed's interest rate decision this week was very important to the gold price trend.If Powell releases hawkish signals, the price of gold will probably fall back.

U.S. oil was trading near US $77.92per barrel; Oil prices continued their decline on Monday, falling by more than 2%, as the main central banks were about to raise interest rates, which would hit demand, and Russian exports remained strong.

During the day, the focus was on the consumer confidence index of the American Chamber of Commerce in January and the PMI of Chicago in January.

The Mohicans Markets strategy is for reference only and not for investment advice. Please read the statement clauses at the end of the text carefully. The following strategy was updated at 15:00 Beijing time on January 31, 2023.

Intraday Oscillation Range: 1903-1911-1929-1937-1951

Overall Oscillation Range:1730-1756-1780-1801-1817-1833-1856-1883-1903-1911-1929-1937-1951-1977

In the subsequent period of spot gold, 1903-1911-1929-1937-1951 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January31. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range:20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1

In the subsequent period of spot silver,22.3-23.1-23.9-24.5-25.3can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January31. This policy is a daytime policy. Please pay attention to the policy release time.

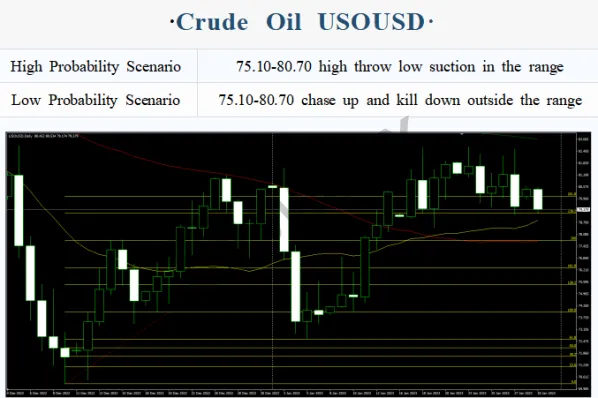

Intraday Oscillation Range:75.1-77.9-78.5-79.9-80.70

Overall Oscillation Range:70.1-71.2-72.3-73.1-73.8-75.1-77.3-78.5-79.9-80.7-82.3-83.5-85.3

In the subsequent period of US crude oil,75.1-77.9-78.5-79.9-80.70can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January31. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0690-1.0755-1.0830-1.0950

Overall Oscillation Range:1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1060

In the subsequent period of EURUSD,1.0690-1.0755-1.0830-1.0950 can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January31. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.2030-1.2135-1.2250-1.2375-1.2400-1.2470

Overall Oscillation Range:1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550

In the subsequent period of GBPUSD,1.2030-1.2135-1.2250-1.2375-1.2400-1.2470can be operated as the bull and bear range; High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on January31. This policy is a daytime policy. Please pay attention to the policy release time.

Leave a Reply