Fundamentals:

2022 FOMC Votes, Kansas Fed President George said that communicating the direction of interest rates is “much more important” than the speed of policy change, and recession forecasts suggest that a rapid rate hike could make the tightening rate faster than the economy and markets adjusted, so the fed's rate hike needs to be “carefully balanced” with the state of the economy and financial markets. Atlanta Fed President Bostic said the Fed's primary goal is to raise interest rates to a more neutral level, which is expected to be around 3 percent. He also said it would not predict what the Fed might do at its meeting after July, as it would be adjusted based on the data.Atlanta Fed President Bostic said the Fed's primary goal is to raise interest rates to a more neutral level, which is expected to be around 3 percent. He also said it would not predict what the Fed might do at its meeting after July, as it would be adjusted based on the data.

The Eurogroup said on the 11th that due to unfavorable factors such as high energy prices and deteriorating global terms of trade, the 19 member countries of the euro area are now facing further inflationary pressures, and the economic growth prospects of the euro area are weakened. At the same time, the finance ministers of eurozone member countries stressed that the fiscal policies of all countries should aim at maintaining debt sustainability and avoid applying inflationary pressures in order to better achieve the monetary policy goal of maintaining price stability. Reuters reported on Monday that key market indicators of long-term inflation expectations in the euro area had fallen below 2 percent for the first time since March.

Technical:

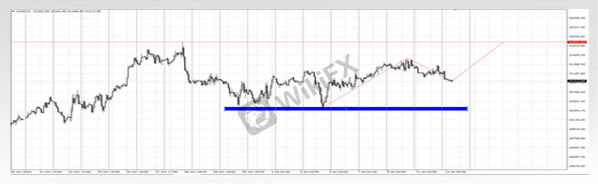

The Dow: The three major U.S. stock indexes opened low and closed low, the S&P 500 closed down 1.15%, the Dow closed down 0.52%, the NASDAQ closed down 2.26%, and the Dow rushed higher and fell back at 31,000, focusing on the position near 31900 above.

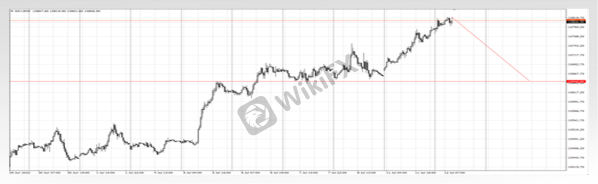

USD: The dollar index soared, rising 1% during the day and standing above 108, hitting a new high since October 2002, and finally closing up 1.244% at 108.24; affected by the strong dollar, the 10-year US Treasury yield fell sharply and fell below 3% to close at 2.993. The dollar is cautious to chase long at all-time highs, and in the short term, it focuses on a small pullback near 106.5.

Gold:Spot gold fluctuated sharply on Friday, climbing to a daily high of 1752.35 and then falling back, finally closing up 0.13% at $1741.82 / ounce. Gold is cautious in chasing bears, focusing on gold's short-term pullback target of 1752.

Crude oil: Crude oil, the two oils fell first and then rose, WTI crude oil once touched a low of $100 during the session, and finally closed down 1.28% at $103.45 / barrel; Brent crude closed down 0.69 percent at $106.26 a barrel. Focus on the crude oil band correction at 103.5.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, investment needs to be cautious)

Leave a Reply