With the advancement of technology, automated trading has expanded to cover various trading techniques.

Algorithmic trading, social trading, and copy trading are examples of these.

Automation has been in some form or another in exchange trading since the 1980s, however, the notion of rules-based trade strategies stretches back much longer, to the 1940s. As retail investment has grown in popularity throughout the globe, prominent trading platforms have evolved to allow forex traders to develop and publish their automation, sometimes known as “trading robots.” Similarly, the advancement of computer processing capacity has resulted in the creation of increasingly complex kinds of automation.

WikiFX is a research platform that also provides both EA and VPS with a seamless trading environment. This solution will decrease slippage and fulfill the latency requirements of broker trading brokers. It is available on Trading Environment Rankin. WikiFX offers over 30 EA available for purchase, each for $1.99. WikiFX VPS regular accounts cost $.99, while VPS Pro accounts cost $6.99. More information is available on the WikiFX EA VPS page.

What Exactly Is Automated Trading?

'Automated trading,' like many other phrases in retail investing, refers to a wide variety of activities aimed at making market monitoring and trade execution quicker and more efficient by delegating some chores to computer programs.

Basic automation may comprise entering a set of buy and sell parameters into your favorite trading program, followed by a command to execute an order when those criteria are satisfied. Automation sophistication is generally determined by the intricacy of your trading strategy and programming ability, with more experienced traders adding more tight criteria and interlocking sets of instructions.

Whether it's a basic set of buy-sell price criteria or a complex collection of if-then instructions, all automated trading is dependent on a computer program to complete each step of the trading process. Once you've entered your order requirements, you may walk away from the computer while the dedicated robot persistently explores the markets for opportunities, acting quickly to act on your behalf when it discovers a good deal.

With the advancement of technology, automated trading has expanded to incorporate additional trading types such as algorithmic trading, social trading, and copy trading.

Trading Algorithms

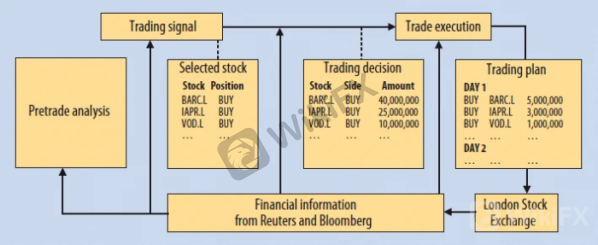

Algorithmic trading enables traders who handle huge amounts of assets to control trading expenses by splitting orders into smaller tranches that would otherwise be too big to execute effectively under favorable circumstances.

Many traders use the terms 'algorithmic trading' and 'automatic trading' interchangeably, although they are not synonymous. However, the algorithm that gives the trading technique its name only handles one component: the splitting of the order and its execution.

Copy Trading and Social Trading

When a specific investor puts an order, social trading and copy trading employ specifically designed trading bots to send signals to a trader. Separate automation then replicates this order in the event of copy trading, or merely observes and evaluates if you are a social trader.

What Are the Advantages of Forex Trading Automation?

Given its enormous popularity, you may be wondering what makes automatic trading so unique.

For some traders, the practical benefits outweigh the disadvantages of self-managed methods; allowing a trading bot to watch markets frees up crucial time for strategy refinement. Others appreciate the concept of reducing risk by trading on various platforms at the same time. However, in general, the advantages of automated trading may be described as 'quick' and 'rational.'

Enhanced Trading Discipline

The same volatility that makes forex a rewarding trading environment may devastate your trading approach if you let emotion take control. You're more likely to trade impulsively and forsake your carefully-planned strategy if you're watching the markets rise and fall, riveted to your computer, and looking furiously for a chance to increase your gains or limit your losses. Or maybe you can't bring yourself to place an order even though every sign shows you'll win the deal.

Because your involvement in the trading process starts and stops with devising a strategy and directing or constructing a trading robot to act on your behalf, automated trading minimizes the chance of deviating from the best-laid plans owing to anxiousness or over-optimism.

More refined strategies

Is manual trading the only method to test a strategy? Place your money in the market and monitor your progress over time to look for trends in your wins and losses. It's a costly and time-consuming learning process that either intentionally passes up chances or holds tight through downturns, both of which are emotionally exhausting.

In contrast, automated trading allows you to observe how your trading rules would have fared versus historical data. Backtesting not only provides a risk-free chance to fine-tune the rules you apply to your trades, but it also makes it much simpler to determine what is and is not working in your approach. You have access to clear, actionable information without the 'noise' of one-off transactions you couldn't help but make and months, if not years, of historical market data to utilize as a testing ground.

Risk Reduction

Trading robots that operate on numerous accounts or platforms may help you reduce the inherent risk of trading in extremely volatile markets in a variety of ways. Without the need to continually watch markets and enter orders, you may trade across many asset classes at the same time, dispersing risk as you see appropriate. Alternatively, you may assign multiple tactics to individual trading robots within the same asset class to ensure you're always on the right side of a market trend.

Improved Order Execution

One of the first things new traders learn is that seconds matter. The phrase “time is money” has never been more true than in the context of forex trading, when entering or quitting a deal at the precise instant may make the difference between large gains and merely breaking even.

Automations respond quickly to market situations, executing orders as soon as your required preconditions are satisfied. While your brain must notice such circumstances, analyze them, and then tell your body to take action, the trading bot not only opens your position but also produces the required orders to safeguard your money or execute the trade. All of this happens in less time than it takes a human trader to blink.

Of course, no trading method, instrument, or technique is flawless, and automated trading has limitations as well. If you are unfamiliar with programming or unwilling to learn, you may be forced to trade using algorithms devised by others rather than a tool tailored to your approach. If, on the other hand, you can completely develop your automation, you risk over-optimization: constructing an algorithm that is so tightly customized to fit previous data that it fails in actual market circumstances.

When you rely on computer software to trade on your behalf, you risk missing out on opportunities or placing losing orders in the case of technical problems or mechanical malfunctions. You may also find it difficult to realize the advantages of automation if your chosen broker does not provide direct market access or comparable trading conditions.

With successful automated traders promoting trading bots, copy portfolios, and 'algorithmic methods' on social media platforms and in renowned forex publications, the popularity of trading bots, copy portfolios, and 'algorithmic techniques' has surged in recent years. The MetaTrader Marketplace alone has over 1,700 individual Expert Advisors, and according to 2019 research, automation completely executes 92 percent of deals in the forex market.

Before abandoning manual trading in favor of automation, I propose that you ask yourself a few critical questions:

-

Have I established a trading strategy? If you're still learning the fundamentals of forex and experimenting with various trading strategies to figure out what works best for you, you'll probably need more experience to reap the full advantages of automated trading.

-

Is automation a good fit for my trading style? Some trading strategies, especially those based on high volumes, such as scalping, are well suited to automation. However, if you are more of a swing trader, the time and effort required to adjust to automation may not be worth it.

-

What is my personality like? A little self-awareness may go a long way in trading, as it does in life. If you despise uncertainty and never feel certain that you have adequate knowledge, an automated, rules-based trading system would likely assist you. Automations, on the other hand, are generally not for you if you struggle to keep to a single strategy and earn your money by synthesizing facts and methods on the fly.

-

Is it possible for me to learn to code? While 'off-the-shelf' bots and wizard templates may assist novices to bridge the gap between manual trading and automation, learning to code is likely required to fully realize the advantages of this trading instrument. If your strategy is based on approaches like supply and demand, support and resistance, or candlestick patterns, creating effective automations that can handle your variables requires you to be actively involved in the construction process.

If you feel that automations will improve your trading experience or lead to better profits, you may begin the process of migrating to totally or partly machine-controlled trading by following these steps:

-

Investigate your broker. Not all online brokers offer automations, especially in regions where retail investing is strictly regulated. Others enable trading using algorithms and machines, but only on specified platforms. Others, however, permit certain forms of automated trading but not others.

-

Investigate your trading platform. If you want to utilize automatic trading as a hedge, be sure your selected platform permits you to trade from numerous accounts. Because of variations in programming languages, the automations you design for one platform may not transfer to another if you move later. Pay attention to the variety of automations accessible for purchase in the platform's marketplace if you don't know how to code.

-

Begin with no-coding solutions. Before plunging into the deep end of automated trading, try some easy automations using a no-code solution like MetaTrader 5's Wizard or Ninja Trader Strategy Wizard. Before you commit to learning how to code, the process of entering your trading rules and backtesting will offer you a taste of the automated trading experience. You may also choose to download ready-made automation from your platform's marketplace.

-

Set aside time for coding and backtesting. When scheduling time to study the programming language of your chosen platform, be sure you schedule some time to practice backtesting. Backtesting is an art as well as a science, and it may make or break the effectiveness of your automations. You'll need some experience to balance curve-fitting with flexibility.

In Conclusion

Day trading for individual investors has been transformed by automated trading, which enables regular traders to compete with much bigger institutional investors and benefit from market volatility.

However, before using an 'algorithmic trading strategy,' you should consider if this form of forex trading fits with your current trading style, financial resources, and even personality.

Leave a Reply