Fundamentals:

The U.S. Labor Department announced on Thursday that initial jobless claims for the week of July 2 rose by a seasonally adjusted 4,000 to 235,000, compared with analysts' expectations of 230,000. In addition, the number of layoffs also soared to 16 in June. month high. The 2022 FOMC vote committee, St. Louis Fed President Bullard said in the early morning that raising interest rates by 75 basis points in July is “significant”. Once the federal funds rate reaches 3.5%, the Feds can see progress in inflation, and then can Make “adjustments”, including possible rate cuts.

Feds Governor Waller said he supports a 75 basis point rate hike at its July meeting. At the September meeting, he is likely to favor a 50 basis point hike. He believes that the current US economy is quite strong, and it is not clear whether there will be a recession, and expects the non-farm payrolls to be announced tonight at around 275,000. He also said he could not accept 3 percent inflation. If the Fed can bring growth down in nine months to a year, that would be enough to bring inflation down without triggering a recession.

Technical:

Dow: The three major U.S. stock indexes closed higher across the board, the S&P 500 closed up 1.5%, the Dow closed up 1.12%, and the Nasdaq closed up 2.28%. The market is in a strong bullish mood. The Russell 2000 growth stock index rose 3%, the Nasdaq China Golden Dragon Index closed up nearly 4%, and Faraday Future has risen by more than 110% since this month. The Dow rebounded at 31,000 after a deep fall, focusing on the position around 31,900 within the week.

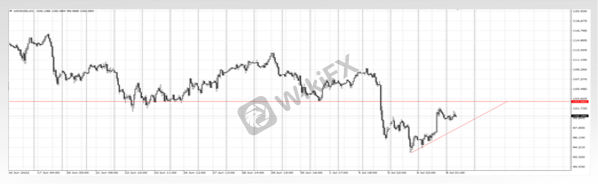

US dollar: The US dollar index fell to a high of 107 in the Asian session, and finally closed flat at 107.09; the 10-year US bond yield once again reached a high of 3%. The US dollar is cautious in chasing more historical highs, and in the short term, it is concerned about the slight correction near 105.5.

Gold: On Thursday, spot gold fluctuated around US$1,740, and finally closed up 0.11% at US$1,740.25 per ounce; gold is cautious in chasing short-term gold, and it is concerned about the short-term correction target of gold at 1773.

Crude oil: In terms of crude oil, the crude oil market has been volatile recently. Following the slump, the two oils rebounded sharply. WTI crude oil regained the $100 mark during the U.S. session, up about $6 from the daily low, and finally closed up 4.12% at $102.15 per barrel; Brent crude oil closed up 4.37% at $104.12 per barrel. Crude oil is chasing after the deep fall and is cautious, focusing on the crude oil band callback 103.5 position.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply