While the word leverage is commonly used, few investors know the definition of leverage and how it is incorporated into their profits and losses.

Leverage is a double-edged sword and while it can help you generate enhanced gains, it can also accelerate your losses. If you plan on using leverage while you are trading the forex markets you need to have a complete understanding of the benefits of investing with borrowed capital.

What is Leverage?

You probably have used leverage before in your life without realizing it. If you have purchased a house or car or even used a credit card you are using leverage. When you purchase a house, you generally take out a mortgage which is a loan that is collateralized using the house. The term collateral refers to the asset that the lender will take if you are unable to pay off the loan. In many cases, you will only put up 20% of the purchase price while a bank will lend you 80% of the value of your new house. By using borrowed capital you are able to purchase a home for a cost that is likely more than you could afford if you did not borrow from the bank.

When you trade in the forex market, you can borrow capital to place a trade. Your broker will lend you capital and your collateral is the value of the currency pair. For example, your broker might require that you post 5% on a EUR/USD trade that has a total notional value of $10,000.

In this case, you would need to have a minimum of $500 in your account to initiate this transaction. With leverage, instead of placing a trade that has a total value of $500, you can borrow $9,500 from your broker and make a $10,000 trade. In essence, leverage is the ability to control elevated levels of capital by borrowing money from a forex broker.

What is a Margin Account, and How Do You Use It?

Before your broker will hand over borrowed capital to allow you to trade the forex markets, you will need to open a margin account. Margin is a term that describes a good faith deposit, which is used by your broker as a portion of the collateral on your trades. Remember, your forex broker is in business to make money by facilitating trades. They will not take losses on your behalf. They will not put themselves in a position where your losses will exceed the amount of money you have in your account.

When you open a margin account at a forex broker it is in some ways similar to applying for a credit card. Your broker will question about your trading background including your experience. They want to know how long you have been trading, as well as your investing goals. Your broker might also ask about the potential account size, as well as other accounts that you currently have open. All of these questions are used to determine if they should provide you with a margin account and the type of leverage they should offer you.

Your brokerwill charge interest on the money that is used in your margin account. So, if you make a EUR/USD trade that has a notional value of $10,000, and borrow $9,500, your broker will charge you a margin interest rate on that balance for as long as you have a trade open. Once you close the trade, the interest charge ceases. The interest rates that are charged on margin are generally market rates.

Prior to trading using margin you should find out the rate that your broker charges. If it is out of line with other market rates you might consider using a different broker. A 5% difference on $9,500 for an entire year would come out to be $475. Remember, you are only charged for margin when your trades are active. For example, if you borrow $9,500 for 1-week, at a rate of 5%, you will be charged $9 =(5% * $9,500)/52.

What is a Margin Call?

When you open a margin account and use leverage, your broker will require that you maintain your account. The margin that you use to open trade can change as the profits and losses accrue for each transaction. If you place a trade, and the exchange rate moves against you, your broker will require that you have enough capital in your account to meet the new margin requirements.

If your trade is underwater, your broker will begin to charge you for the borrowed losses you have accrued, on top of the money that you used to initially place a trade. This is referred to as the maintenance margin.

For example, if you borrow, $9,500 to buy $10,000 of EUR/USD and the value of the trade declines to $9,500, you will have to pay interest on the initially $9,500 as well as interest on the additional $500. So there is a charged on the initial margin and a charge on the maintenance margin.

If the equity in your account drops below the maintenance margin level, your broker will generate a margin call. This is an alert to you that you have a certain number of days, to deposit additional capital in your account. If you do not meet the margin requirements following a margin call, your broker will have the right to liquidate your position. Prior to making your first leveraged transaction, you should find out exactly what the margin requirements are as it pertains to a margin call.

Because you have the potential to lose more money in your account that is initially deposited, the requirements to open an account are generally rigorous. Your broker wants to make sure you understand how the process works before you begin to risk capital on forex investments. They also want to understand the broker‘s rights and what will happen if you don’t comply with a margin call. If a broker liquidates your position to meet a margin call, they will not try to get out at the best exchange rate. They will sell your position at the market and you will incur any slippage from the liquidation of the trade.

You broker will post the amount of margin that is currently being used on trades, as well as the total available. You might see a designation called “used margin” as well as “available margin”, in your account balance.

Margin Requirements and Leverage

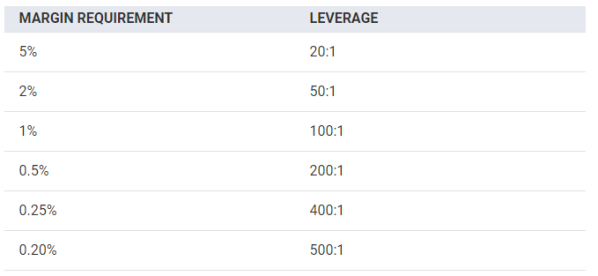

The amount of margin that is required determines the maximum leverage on your account. For example, if you are required to post a 5% margin, the leverage you can generate is 20:1. As the margin requirement falls, the leverage increases.

For example:

High levels of margin are generally granted by reputable brokers such as Multibank. By using well-known platforms such as MT4 and Mt5, Multibank can offer leverage up to 500:1 on liquid currency pairs:

Your margin-based leverage is the total transaction value divided by the margin that is required. For example, if you place a EUR/USD trade that has a notional value of $10,000, and the margin that is required is $500, then your margin-based leverage is 20:1.

There is a theory that some refute that margin increases the amount of capital that you are willing to rise. Just because you can control more capital, does not mean that you are willing to lose more money.

Even if you only have to post 2% of the value of a trade, it does not preclude you from adding more money to your account if one of your trades moves against you. This means that your risk is more of a function of real leverage than margin leverage. Your real leverage is the amount you are able to leverage based on your discretionary capital. You would calculate real leverage by dividing the average margin requirement by your discretionary capital. For example, if you are willing to risk $10,000 on forex trading then your real leverage using 5% margin is $200,000 ($10,000 / 5%).

How Does Leverage Effect Your Trading

Its important to understand the pros and cons of using leverage. Here is an example.

You place a $10,000 EUR/USD trade using 5% margin which is leverage of 20:1. This means that you would post $500 and borrow $9,500. Assume that the margin interest rate is 5%. In this hypothetical trade, you achieve gains of 2%, on the entire notional value of the trade which is $200 ($10,000 * 2%). Your trade only lasted 1-week.

This would allow you to achieve gains on the capital you risk of nearly 40%. Your gain of $200 is reduced by $9.13 as an interest charge for 1-week of margin on $9,500 ($9,500 * 5%) / 52-weeks in a year. Your net gain is $200 – $9.13 = $190.87. Since you only posted $500, your net return is 38%. Your annualized gain is 1,985% = (38% * 52).

What is important to understand is that while the gains are robust, leverage is a double-edged sword. A loss of 5% on $10,000 ($500) would wipe out the entire amount of equity you have in this trade. In addition to a margin call, you would be subject to an interest charge on the initial $9,500 as well as the $500 of borrowed capital to handle your unrealized loss as maintenance margin.

Risks of Trading with Leverage

The risks stem from the amounts you can lose from small changes in the value of a currency pair:

-

You are exposed to market risks, especially if you are unaware that your position has moved during hours when you are not watching the market.

-

You also are subject to political risks, that can affect the value of your position, and make it impossible for you to exit your position. This is more likely to happen with an emerging currency pair as opposed to a major currency pair.

-

You are exposed to interest rate risks. If interest rates rise, the cost of borrowing capital will also increase.

Why Is Leverage Offered in Forex Trading

There are several reasons why brokers offer leverage. Leverage is offered in many instances of capital markets trading, but forex leverage is generally much higher than any other trading vehicle. The leverage that is offered for US equities is approximately 1.5 times the value of the stock. So your margin is at most 50% the notional value of the trade.

Forex leverage can reach levels up to 500:1. Brokers are comfortable offering this type of leverage for several reasons.

-

Forex markets are very liquid – You can enter and exit with very little slippage. If a broker has to liquidate your position, they can easily exit.

-

Forex markets are less volatile – The average volatility on major currency pairs is close to 10%. This compares to 40% volatility in many equity shares

-

Forex markets are open around the clock – you can trade in and out 24-hours a day, 6-days a week. Many other markets are only open during exchange hours.

Conclusion

Trading the forex markets is popular as it can enhance your gains and allow you to generate robust returns with only a portion of your portfolio. Many investors are attracted to forex trading as the margin requirements are low relative to the value of the capital you can control.

Leverage is a double-edged sword and while it can help you generate enhanced gains, it can also generate large losses. There are several risks involved in trading forex with leverage, but the most obvious risk is market risk. When you trade with borrowed capital, your broker will charge a margin interest fee. Make sure you are aware of all the fees related to leverage before you place your first trade. Lastly, spend time going through examples of how leverage will affect your projected gains and losses and make sure you have allocated enough capital to an account before you begin to trade with a margin account.

Leave a Reply