What is Support and Resistance?

The purpose of support and resistance levels is to identify favorable entry and exit points.

There are multiple trading strategies that incorporate support and resistance levels. Additionally, there are multiple support and resistance strategies, the most common being the use of pivot levels and their associated major support and resistance levels that are based on a time periods pivot level.

When trading, it is beneficial to use more common strategies as these will tend to be followed by a greater number of traders.

Support

Support levels refer to price levels below which an asset does not drop for an extended length of time.

At support levels, buyers enter into long positions thus delivering support and preventing further downside.

It is important to note, however, that there will be multiple support strategies. These include the use of the most recent lows as an example and Fibonaccis. Pivots and major support levels are the most commonly used levels.

Once a support level has been breached, the support level becomes a resistance level.

Resistance

Similarly, resistance levels are price levels at which sellers will look to exit an asset or enter into a short position.

Here, resistance levels are calculated for time intervals by using the highs and lows of the previous time interval. In the case of using major resistance levels, traders base their resistance levels on the pivot level for a specified time interval, t.

Other resistance levels commonly used include daily, weekly, monthly, yearly, and all-time highs and Fibonaccis.

Once a resistance level has been broken, the resistance level becomes a support level.

How to draw support and resistance

Analysts and traders calculate the pivot and the major support and resistance levels for multiple time periods. These can be as short as hourly and as long as monthly.

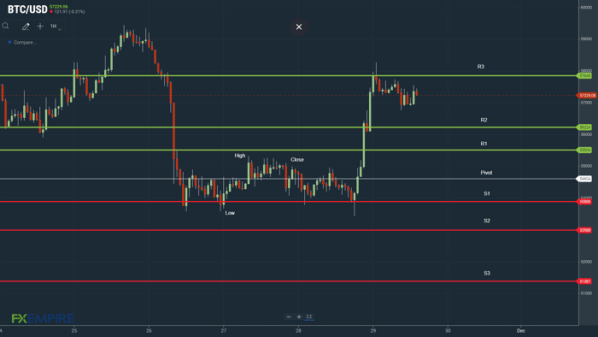

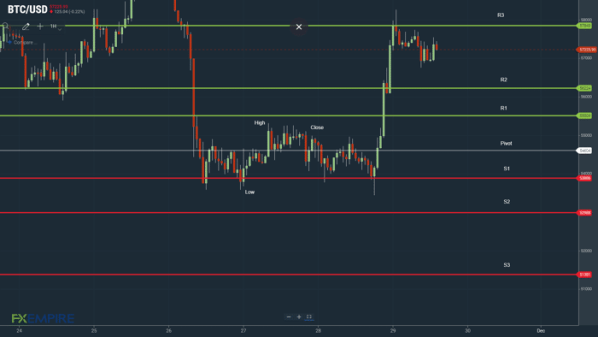

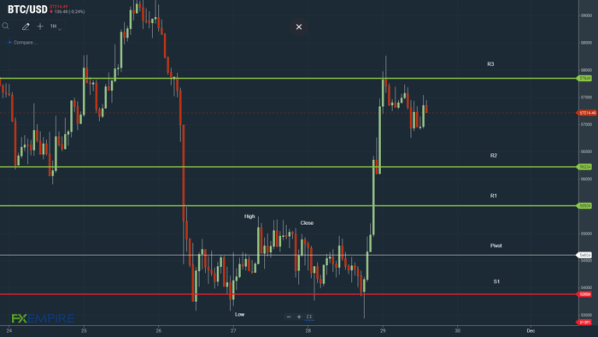

Once you have calculated the pivot and major support and resistance levels, traders and analysts will then plot these on charts to assist in their trading decisions as shown in the chart below.

Calculating Pivot Levels

A pivot level is derived by calculating the average of the high, the low, and the closing price of a time interval, t.

Looking at a 1-hour time interval for the chart below, we would take the average of the day high $55,329, the day low $53,711, and the closing price $54,791 to obtain the next days pivot level. Here the pivot level would be $54,610.

Calculating Support Levels

Once you have calculated the pivot level, the major support levels, these being S1, S2, and S3 can be calculated. In the example below, using an hourly chart, a days pivot and major support levels can be calculated.

First Major Support Level: 2 x Pivot / the previous time interval high. In the example above, this would be (2 x $54,610) / 55,329 = $53,892.

Traders would be looking at the first major support level as an entry price.

Second Major Support level: S2 = Pivot – (Day high – Day low).

In the example above, this would be $54,610 – ($55,329 – $53,711) = $52,992.

Traders would be looking at the second major support level as an entry price in the event of an extended reversal.

Third Major Support level: S3 = S2 – (Day high – Day low).

In the example above, this would be $52,992 – ($55,329 – $53,711) = $51,374.

Traders would be looking at the third major support level as an entry price in the event of a market sell-off.

Calculating Resistance Levels

Once you have calculated the pivot level, the major resistance levels, these being R1, R2, and R3, can also be calculated.

First Major Resistance Level: R1: = 2 x Pivot / the previous time interval low. In the example above, this would be (2 x $54,610) / 53,711 = $55,510.

Traders would be looking at the first major resistance level as an exit price.

Second Major Resistance level: R2 = Pivot + (Day high – Day low).

In the example above, this would be $54,610 + ($55,329 – $53,711) = $56,228.

Traders would be looking at the second major resistance level as an entry price in the event of an extended rally.

Third Major Resistance level: R3 = R2 + (Day high – Day low).

In the example above, this would be $56,228 – ($55,329 – $53,711) = $57,846.

Traders would be looking at the third major resistance level as an exit price in the event of an event-driven breakout.

Support and Resistance trading strategies

As previously outlined, traders can use major support and resistance levels for a range of time periods. It is therefore important to decide the trading strategies to then select the appropriate time periods for calculating the pivot and major support and resistance levels.

For instance, day traders would use 1-minute charts and the previous days high, low, and closing price to calculate the support and resistance levels for the day ahead.

By contrast, swing traders would use 4-hourly and daily charts to calculate the respective pivot, major support and resistance levels.

Pivot and Support Levels

When considering major support levels, the pivot levels play a hand in whether support levels are likely to come into play. There are two ways in which to consider pivot levels:

-

A fall through a pivot level would be needed to bring support levels into play. This tends to be the scenario in a post-bullish or during a bullish session.

-

Failure to move through or back through the pivot level would also bring support levels into play. This tends to be the scenario in a post-bearish or during a bearish session.

Pivot and Resistance Levels

When considering major resistance levels, the pivot levels play a hand in whether resistance levels are likely to come into play. There are two ways in which to consider pivot levels:

-

A move through a pivot level would be needed to bring resistance levels into play. This tends to be the scenario in a post-bearish or during a bearish session.

-

Avoiding a fall through or back through the pivot level would also bring resistance levels into play. This tends to be the scenario in a post-bullish or during a bullish session.

Using Support Levels

In a correcting market, an asset may fall through its first support level, labelled as S1. Once breached, the second major support level will be the next key entry point for investors. In such an event, S1 would then become a resistance level.

The 3rd major support level is generally only breached and a major economic or financial event. These include earnings, central bank and government policy, and other global events.

The below chart shows flight to safety in response to the new Omicron COVID-19 strain. Demand for the Japanese Yen broke down support levels as the Greenback slid to sub-¥114 levels.

Historically, global events would include:

-

The global financial crisis.

-

COVID-19 pandemic.

-

Dot.com

Here, 1st and 2nd major support levels would have provided little interest to investors looking to enter the market.

3rd major support levels, however, may have drawn investors in. Key in using major support levels is for an asset price not to fall below for an extended period of time…

Using Resistance Levels

In a bull market, an asset may move through its first major resistance level, labelled as R1. Once broken, the second major resistance level will be the next key entry point for investors. In such an event, R1 would then become a support level.

The 3rd major resistance level is generally only broken through as a result a major economic or financial event. These include earnings, central bank and government policy, and other global events.

As with the above example, news of the new COVID-19 strain and government plans to contain the spread led to a reversal of EUR carry trades. The EUR broke down the 3 major resistance levels on its way to $1.13 levels against the Greenback.

Historically, global events would include:

-

COVID-19 Pandemic recovery.

-

Post-Global Financial Crisis recovery.

-

Central bank action.

-

U.S Presidential Election

-

In the case of equities, corporate action and earnings.

Here, 1st and 2nd major resistance levels would have provided little interest to investors looking to exit the market.

3rd major resistance levels, however, may have resulted in investors locking in profits. Key in using major resistance levels is for an asset price not to move above a specified price for an extended period of time…

Once a resistance level has been broken, however, the resistance level become a support level that forms part of the major support levels for the time period in question.

Other Major Support and Resistance Levels

There are multiple indicators/strategies that traders. Traders and analysts need to consider these when using pivot levels and the major support and resistance levels described above.

Of particular importance are all-time highs and lows, and daily, weekly, monthly, and yearly highs and lows.

For example, an asset class may face resistance at its current week high that may sit below the first major resistance levels.

Other strategies include the use of Fibonacci‘s, moving averages, Bollinger’s, and MACDs.

Trading without the use of support and resistance levels would likely lead to losses. More significant losses are likely, however, without a trading strategy. Importantly, the two will need to be aligned.

Leave a Reply