In this article, WikiFX will share with you 6 tips that can help you upgrade your trading performance, and introduce a free WikiFX FX trading education site that many do not know about. Let us begin with 6 useful reminders that could be of great assistance in levelling up your trading performance.

1) You need honesty with yourself to become a good trader. An average trader associates his profits to his skills but blames it on bad luck when he incurs losses. Thus, he could never improve. Be transparent and honest yourself by keeping a trading journal that clearly documents your entry and exit prices, the risk-reward ratio of trades taken, time of the trade taken, reasons for execution, and outcomes.

2) Trading requires patience. A good trader knows how to first observe the market reaction, both the long-term and short-term trends, as well as have a clear understanding of the big fundamental picture. They sit patiently waiting for their targeted price points to open and/or close their orders. Beginners, on the contrary, often trade out of the fear of missing out by impatiently placing their orders and closing them prematurely.

3) Trade with a capital that you can afford to lose. Do not use the funds that could drastically affect your life, such as your emergency funds, tuition money, or rent. This is because that will impose a significant psychological pressure on yourself which could in turn affect your rationality. You would become driven by emotions, which as mentioned above, turns you into a gambler.

4) Be ready to focus on the macro picture. Trading needs a set of long-term goals with a lot of invested time and effort. Trading is a lifelong process. Do not despair or give up on trading just because you are not seeing fruitful results at the moment. Keep your head high with patience and faith in this continuous learning journey.

5) Control your emotions. This is easier said than done. In fact, this is by far the toughest factor to master in forex trading. That is why 90% of forex traders are not successful. When you can control your emotions, you will not get easily swayed by the profits and/or losses. You can analyze the market with an indifferent mind, and place your orders rationally.

6) Allow yourself to make mistakes. Humans are naturally wired to avoid things that we deem are wrong or painful. Errors and misjudgements will certainly happen when you trade live in the currency markets, and they come with a price tag. In this zero-sum game, losing money is a norm that could happen at any time. Accepting and acknowledging this as a natural occurrence could allow you to see beyond the monetary losses and learn from your mistakes. Over time, as you keep elevating your knowledge and sharpening your skills, you can evolve into a disciplined and consistently profitable trader.

Although WikiFX is widely known as a reliable global forex broker regulatory query platform, we also strive to be the most contributing trading companion for all forex traders and investors by providing many free tools and resources.

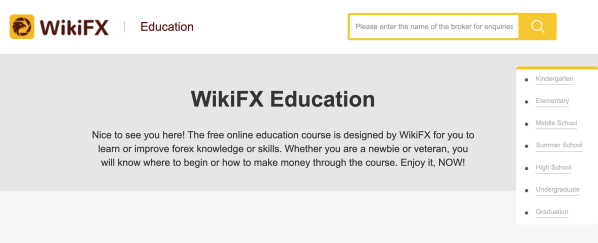

We at WikiFX know that learning forex trading can be as overwhelming as finding the right forex broker. Therefore, in addition to providing verified information about forex brokers around the globe, we have also specially curated a forex trading education site wherein users can learn the ins and outs of forex trading – all for free.

Visit the WikiFX Education site here at https://www.wikifx.com/en/education/education.html for more information.

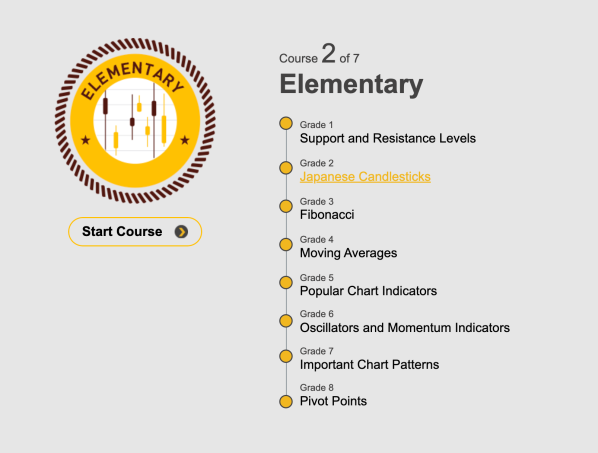

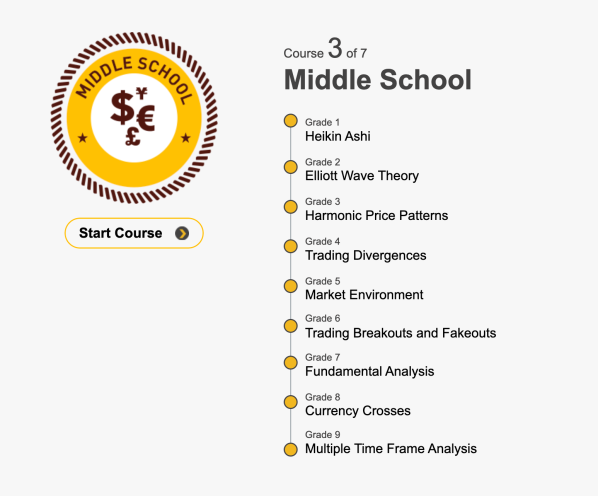

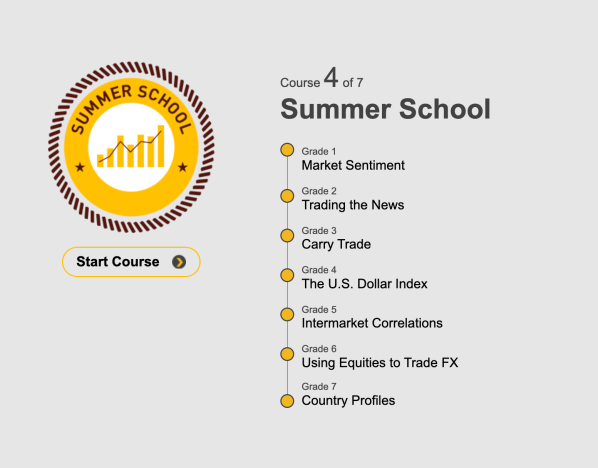

WikiFX has deliberately designed 7 levels for this course to be suitable and useful for traders with different experience levels, which are as below:

https://www.wikifx.com/en/education/kindergarten.html

https://www.wikifx.com/en/education/elementary.html

https://www.wikifx.com/en/education/middle_school.html

https://www.wikifx.com/en/education/summer_school.html

https://www.wikifx.com/en/education/high_school.html

https://www.wikifx.com/en/education/undergraduate.html

https://www.wikifx.com/en/education/graduation.html

Leave a Reply