The markets slumped this morning amid fears of a recession. Who is stoking the fire, and what does this mean for the markets?

Powell Testifies

Yesterday, Federal Reserve Chairman Jerome Powell began his testimony in front of Congress. The main headline to come from this was decided when Jerome Powell admitted a recession is possible. As a result, a wave of fear flooded the markets as the likelihood of a hard landing increased once more.

This has resulted in very choppy price action over night,with U.S indices like the NASDAQ100 struggling to find any clear direction. Since yesterday, this market has swung by around 400 points, highlighting the strong volatility. Has “max hawkishness” been priced in?

UK hits new 40-year inflation high

Meanwhile, news over in the UK didnt look any brighter. In fact, the UK released its Consumer Price Index report yesterday and it showed a new 40-year high in inflation. The figure came in at an eye-watering 9.1%, with food and energy prices once again stealing the show.

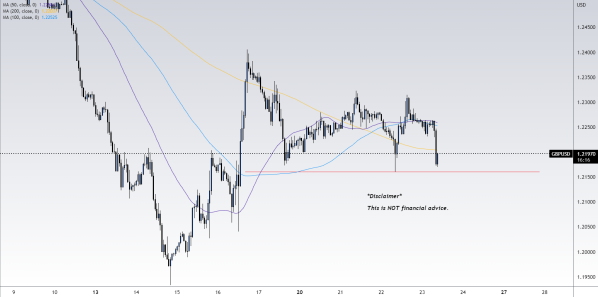

The biggest loser to come from this news is the Pound, which continues to look weaker by the day. With the downtrend confirmed, traders will have their eyes on the low at 1.21600 to be the next key level of support. If the price breaks below here, GBPUSD could be heading back towards the 1.21000 level.

Zenfinexhopes you are enjoying your trading week so far and you are continuing to benefit from this analysis. To check out Zenfinexproducts feel free to visit www.zenfinex.com.

Disclaimer:Trading Foreign Exchange is highly speculative and may not be suitable for all investors. The leverage created by trading on margin can work against you and losses can exceed your entire investment. Only invest with money you can afford to lose and ensure that you fully understand the risks involved.

Leave a Reply