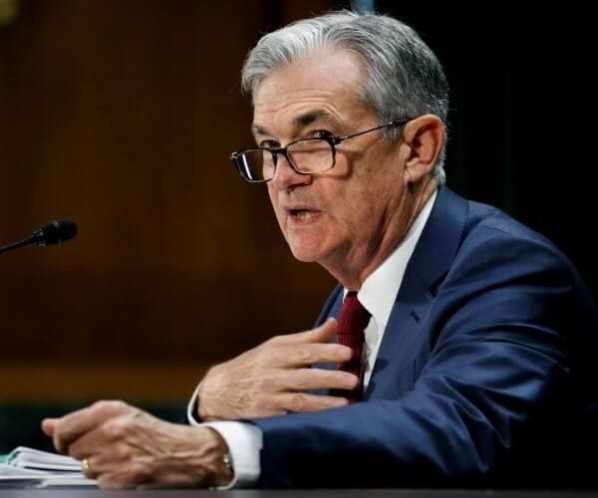

The Federal Reserve on Wednesday intensified its drive to tame high inflation by raising its key interest rate by three-quarters of a point — its largest hike in nearly three decades — and signaling more large rate increases to come that would raise the risk of another recession.

The move the Fed announced after its latest policy meeting will increase its benchmark short-term rate, which affects many consumer and business loans, to a range of 1.5% to 1.75%.

The central bank is ramping up its drive to tighten credit and slow growth with inflation having reached a four-decade high of 8.6%, spreading to more areas of the economy and showing no sign of slowing. Americans are also starting to expect high inflation to last longer than they had before. This sentiment could embed an inflationary psychology in the economy that would make it harder to bring inflation back to the Feds 2% target.

In addition, U.S. bank JPMorgan Chase & Co said on Wednesday it had raised its prime lending rate by 75 basis points to 4.75%, effective Thursday. For more forex news, please download WikiFX – the Global Dealer Regulatory Inquiry APP.

Leave a Reply