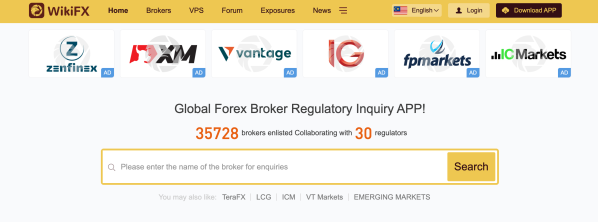

WikiFX is a global forex broker regulator query platform that holds verified information of over 35,000 forex brokers while working closely with 30 national regulators worldwide. WikiFX was established with the main mission to keep traders away from scam brokers or high-risk brokers that do not have a legitimate business operation.

Traders need to learn to protect themselves from scams by unscrupulous brokers from the very beginning, especially in certain countries where the lack of regulation and transparency makes investment scams all the more common. Here are 4 crucial self-protection steps that WikiFX recommends for traders upon engaging with a forex broker:

1. Do a deep and all-rounded background research on that specific forex broker.

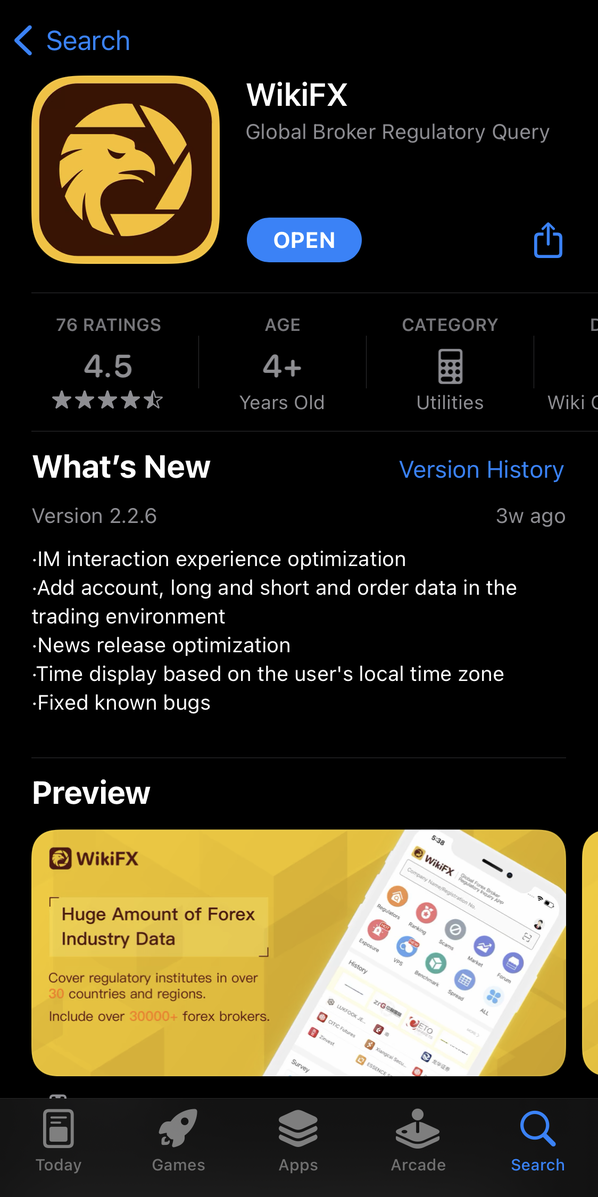

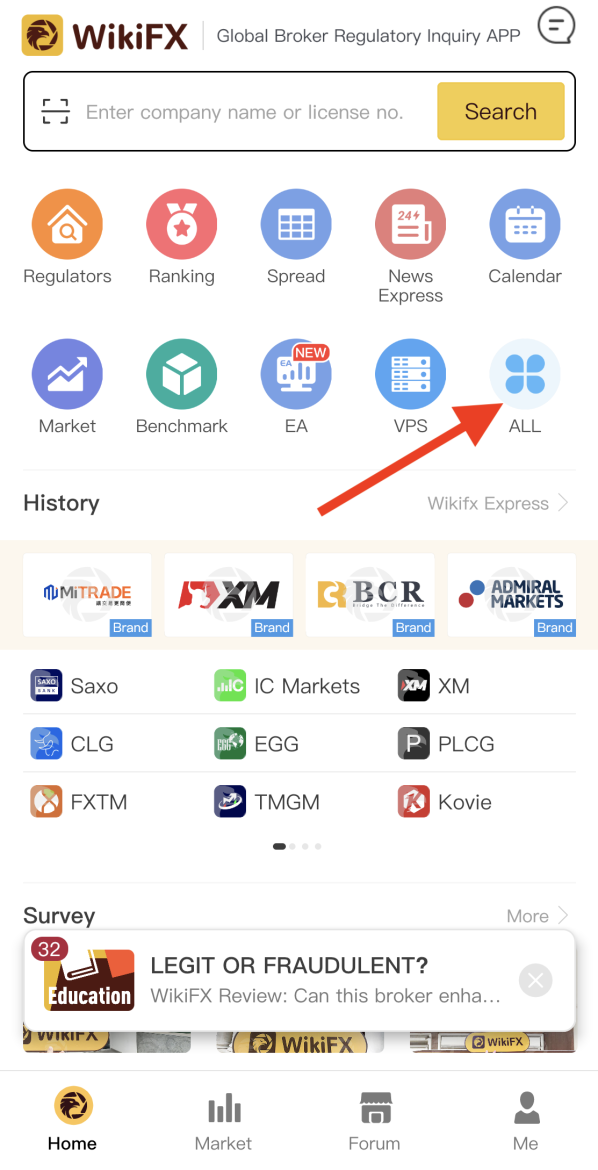

To do this efficiently and effectively, simply log on to www.wikifx.com or download the free WikiFX mobile application from Google Play or App Store.

Then, simply type in the broker of your choice into the search bar to see WikiFXs assessment, review, evaluation, and ranking from all major aspects.

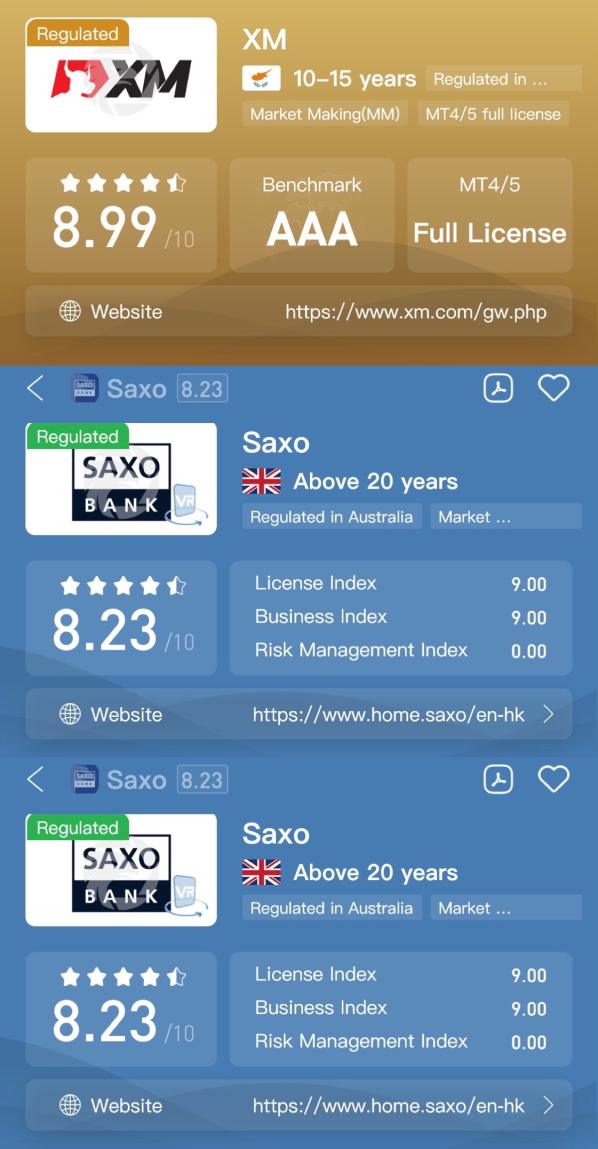

It is important to choose a broker with a high WikiFX rating and ranking as this means that the broker is credible enough to be trusted.

Below is an example of brokers that are considered good by WikiFXs strict and high standards:

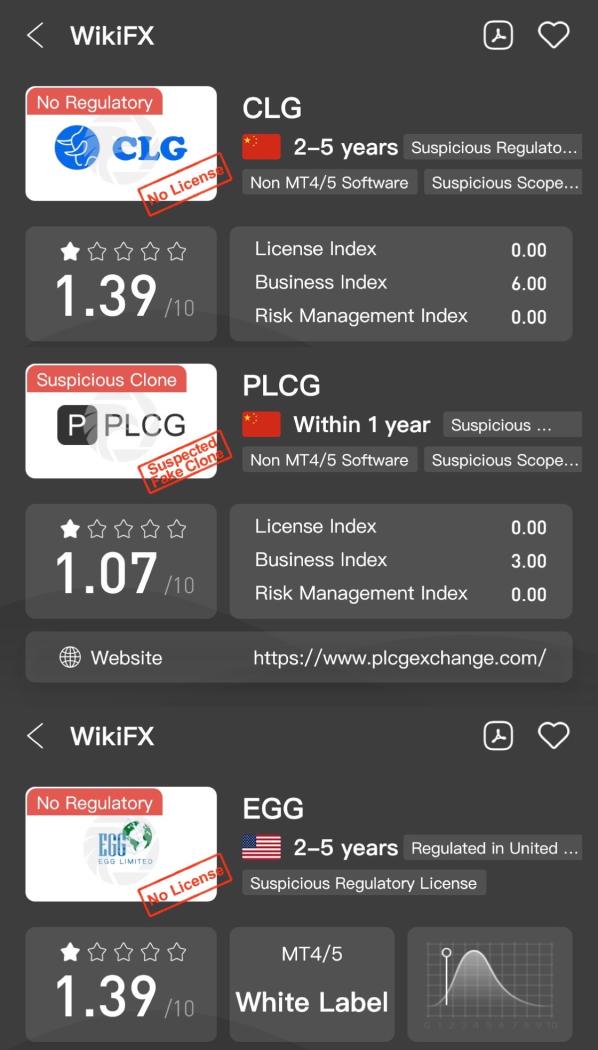

This, on the other hand, is an example that showcases brokers that might possess underlying risks as they are not regulated:

2. Read honest reviews posted by other trading clients. This could be easily done through the WikiFX Exposure page: https://exposure.wikifx.com/en/revelation.html – because there is no better way to know more about a broker than through their own clients.

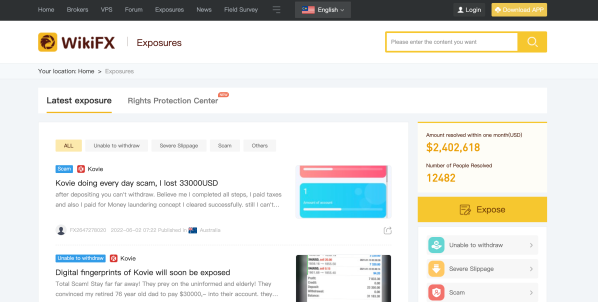

This is WikiFXs Exposure page (web version):

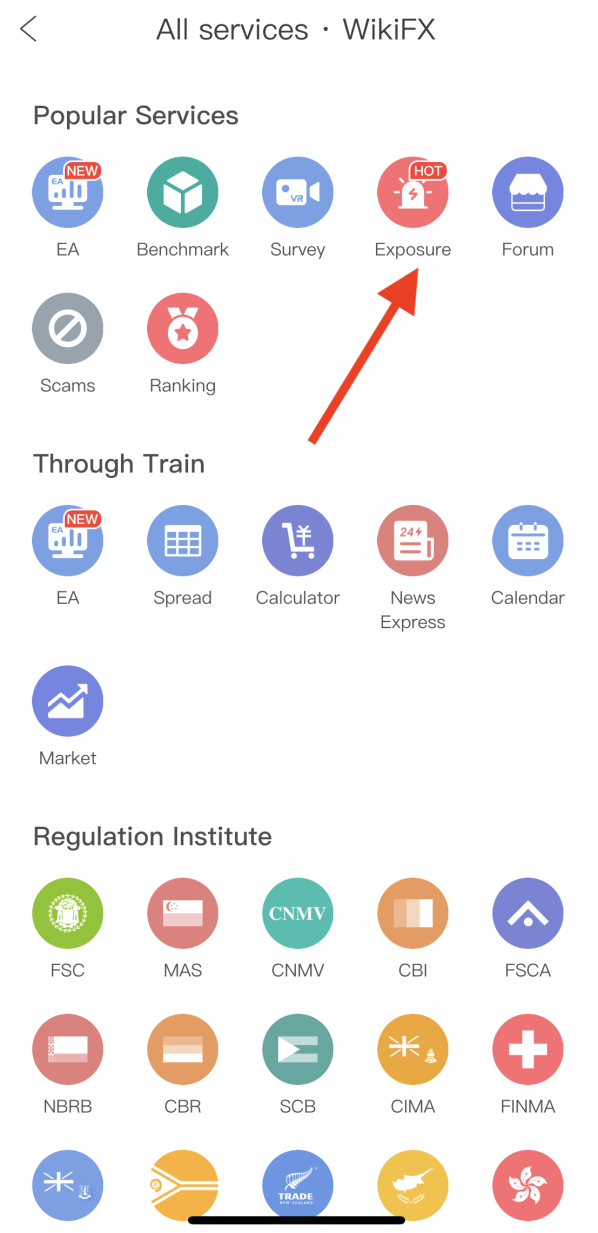

On the mobile application, you can find the Exposure page by following the red arrows:

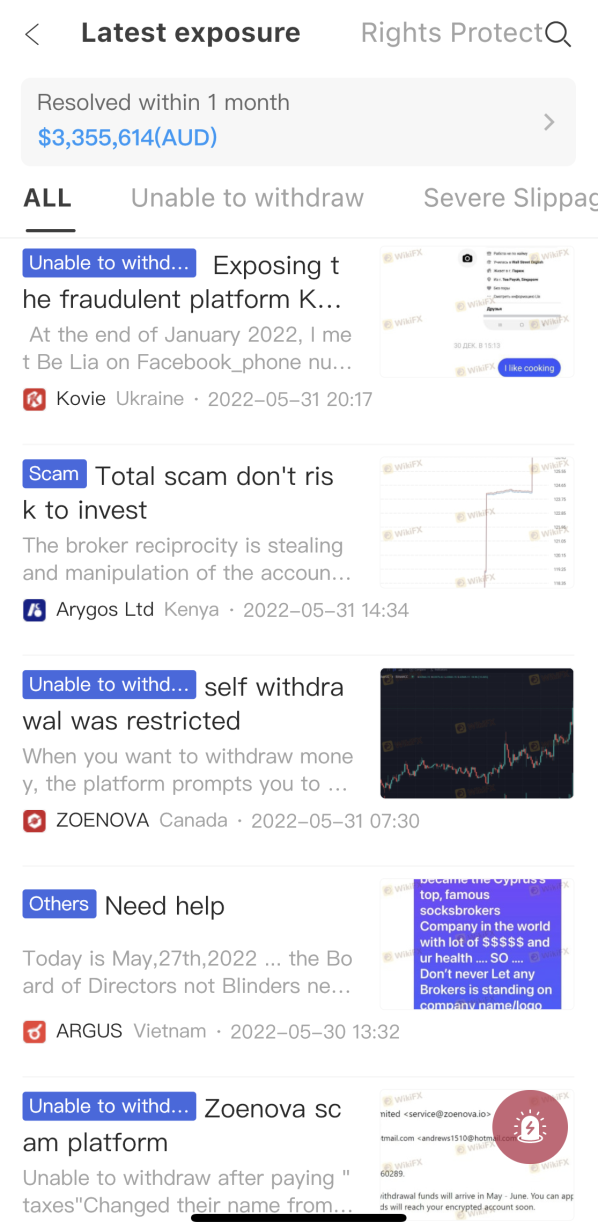

Here, you can see various disputes that trading clients have with their respective forex brokers:

3. Read the relevant documents as well as terms and conditions carefully when opening an account or taking on any sort of promotions offered by forex brokers, especially some deals that might seem too good to be true. The incentives offered at the time of account opening may also be used to prevent you from withdrawing your funds. For example, a trader deposited $1,000 and received a $2,000 bonus. Later the trader losses money and wants to get the rest of the funds back, at which point the broker may tell him that he cannot withdraw the money because the bonus cannot be withdrawn.

This is an example for a trader that fell prey to a brokers promotional “bait”:

4. If you are satisfied with a broker after searching for information, you can open a mini-account or deposit a small amount of money in the account first. If and only if it goes well, then consider depositing more money.

Below is an example of a user who had an issue when trying to withdraw a small amount of money and it avalanched into a bigger issue with a bigger amount:

In conclusion, traders should always remember the golden rule “it is better to be safe than sorry”. We know it sounds cliché, but this statement is cliché for a reason. Just like trading, it is always a traders job to protect his/her capital and that starts with choosing the right broker.

If you need more tips in choosing the right broker, please feel free to refer to this article that is titled “6 Factors to Consider When Looking For A Forex Broker”: https://www.wikifx.com/en/newsdetail/202206012274264618.html

Leave a Reply