【Dow Jones】

US stocks fell on Wednesday. Wall Street received the hawkish remarks of the chairman of the Federal Board of Governors Ball the day before and technology stocks led the plunge. Tesla plunged nearly 7% and Apple probed more than 5%. US retailer Target (Target) reported a poor financial report and triggered a brutal sell-off wave of retail stocks. The panic index VIX soared, and the dollar and US Treasuries rose simultaneously.

The Dow Jones Index is challenging the band lows of the crash. Fortunately, it has not yet fallen below the lows of the band. Both KD and Alligator show death crosses indicating that the long-term and short-term lines are still dominated by bears.

USA30-D1

Resistance point 1: 31800 / Resistance point 2: 32200 / Resistance point 3: 32800

Support point 1: 30800 / support point 2: 30200 / support point 3: 29800

【EUR】

Fears of global growth prospects and soaring inflation led to a sharp sell-off in US stocks. The dollar index rebounded on Wednesday (18th) to halt a three-day decline. It rose 0.54 percent to 103.92 during late trading session in New York, ending its longest decline since mid-March.

The fluctuations of the euro have not been very large recently and it is oscillating in the range. Alligator shows a death cross, while the KD shows a golden cross. The contradictory technical analysis indicates that the price has been oscillating. Investors are recommended not trade against the trend and not chase orders.

EURUSD-D1

Resistance point 1: 1.05200 / Resistance point 2: 1.05500 / Resistance point 3: 1.05800

Support 1: 1.04200 / Support 2: 1.04000 / Support 3: 1.03800

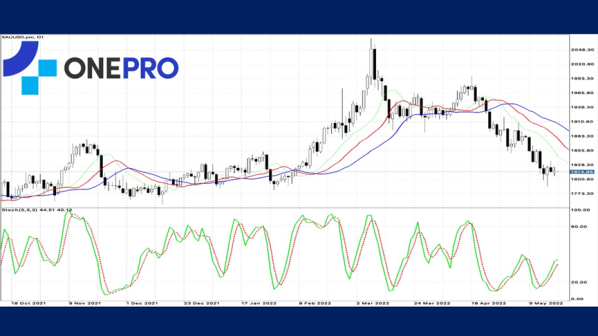

【Gold】

Chairman Jerome Powell said it would continue to raise interest rates until there was “clear and convincing” evidence of inflation subsiding.

The Fed will raise interest rates by two yards in May, while Powell hinted that they will raise rates by the same amount again in June and July.

Spot gold prices have fallen about 12 percent since early March as higher yields on U.S. Treasuries have dampened demand for gold without interest rates. Investors have also favoured the dollar as a safe-haven asset.

Gold prices have recently been challenged the support of $1800 per ounce. Although the main culprit that pulled gold prices down has been the rising dollar index, this price is still supported at this stage. KD shows a gold crossover which indicates that there is some buying at the bottom. Alligator shows a death cross.

XAUUSD-D1

Resistance point 1: 1820.00 / Resistance point 2: 1830.00 / Resistance point 3: 1850.00

Support point 1: 1800.00 / support point 2: 1780.00 / support point 3: 1750.00

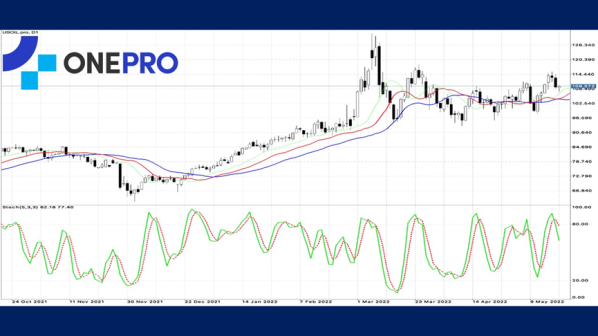

【Crude Oil】

The Energy Information Administration (EIA) announced that last week (ended May 13) that US crude oil inventories fell by 3.4 million barrels, gasoline inventories fell by 4.8 million barrels, and distillate inventories increased by 1.2 million barrels. Matt Smith, chief oil analyst for the Americas at Kpler, said: “Although the Strategic Petroleum Reserve has released 5 million barrels of oil, production and imports have increased, more refining activity and increased crude oil exports have led to a decline in crude oil inventories.”

The recent movement caused the KD index to become a high-grade passivation from a death cross. Alligator shows a golden cross but the opening is not large.

USOIL-D1

Resistance point 1: 111.800 / Resistance point 2: 113.500 / Resistance point 3: 115.200

Support point 1: 107.500 / support point 2: 105.200 / support point 3: 103.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply