Gold prices remain pressured as fresh risk-off sentiment renews US dollar buying.

Key pivot points lure sellers ahead of Januarys low, bulls need validation from $1,835.

Gold (XAU/USD) prices remain pressured around a three-month low, reversing the early Asian rebound, as the risk-off mood underpins the USDs safe-haven demand. Also keeping the gold sellers hopeful is the clear downbeat break of an ascending trend line from August 2021, portrayed the previous day.

Market sentiment sours after China reported downbeat figures for April month‘s Retail Sales and Industrial Production, backed by fresh covid fears emanating from Shanghai and Beijing. Additionally challenging the previous risk-on were fears that Germany isn’t going to respect Hungary‘s push for no total ban on Russia’s energy imports. Furthermore, news that the military actions in Donbas continue to accelerate underpin the risk-off mood, as well as favor the US dollars safe-haven demand.

Read: Gold, Chart of the Week: Bulls are moving in, but weekly levels are eyed

Gold Price: Key levels to watch

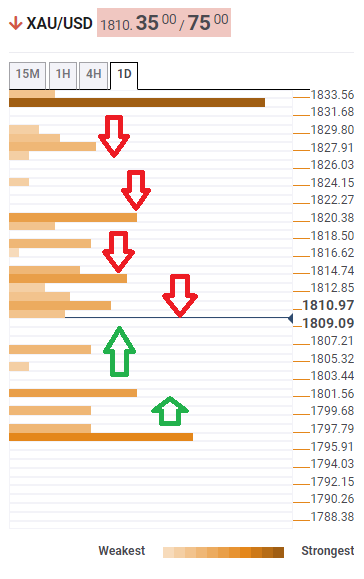

The Technical Confluences Detector shows that the Gold Price is eyeing a test of the Pivot Point 1 month S2 and Pivot Point 1 Day S2, surrounding $1,797.

Should the quote drops below $1,797, which is more likely considering Fridays key trend line break, lows marked during January around $1,780 will be in focus.

Its worth noting that the Bollinger Band Lower on 4H and 1D could offer immediate support around the $1,800 threshold.

On the contrary, SMA 5H and Middle Bollinger on 1H may test recovery moves around $1,815.

Following that, 23.6% Fibonacci retracement for one week, around $1,820, will test the upside momentum.

Even if the gold buyers manage to cross the $1,820 hurdle, a clear upside break of the $1,833-35 region, comprising 38.2% Fibonacci retracement on one week, as well as Middle Bollinger on 4H, becomes necessary to retake controls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Leave a Reply