<WikiFX Malaysia Original: Editor – Fion

If you want to invest in the foreign exchange market, you should have a basic understanding of the Forex market. What separates the Forex market and stock exchanges is that the Forex market does not have a trading center and is decentralized.

The forex market is the most famous and largest over-the-counter (OTC) market wherein transactions are carried out through a network of banks instead of exchanges for 24/5.

In the OTC market, market participants decide who they want to trade with based on trading conditions, attractive prices, and the reputation of the counterparty.

The USD is the most traded currency, accounting for 84.9% of all forex transactions. The second is the Euro with a share of 39.1% while the Japanese Yen is in third place with a 19% market share. Therefore, it is highly necessary to keep a high level of attention on the USD as it is the most dominant player in the forex market. In fact, according to the data provided by the International Monetary Fund (IMF), the USD accounts for almost 62% of the worlds official foreign exchange reserves.

There are other reasons why the dollar plays a central role in the foreign exchange market:

-

The United States is the world's largest economy.

-

The U.S. dollar is the world's reserve currency.

-

The U.S. has the largest and most liquid financial markets in the world.

-

The U.S. has an ultra-stable political system.

-

The U.S. is the world's prominent military power.

-

The U.S. dollar is the primary monetary medium for international cross-border transactions. For example, oil is denominated in U.S. dollars. Therefore, if Mexico wants to buy oil from Saudi Arabia, it can only do so in dollars. If Mexico did not have dollars, it would have to sell pesos to buy dollars before being able to purchase oil.

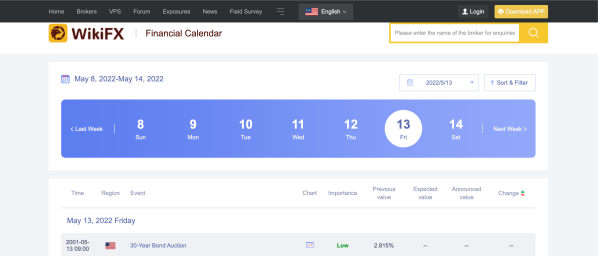

Therefore, it is important to keep an eye on crucial news and/or economic events that could impact the USD as that can also cause significant domino effects on the movement of many currency pairs. To do this, traders can simply refer to the free WikiFX Financial Calendar tool https://live.wikifx.com/en/calendar.html to stay informed.

It is worth noting that commercial and financial foreign exchange transactions make up a big part of the total volume in the foreign exchange market. However, there is also a vast majority of forex transactions are conducted based on speculation, which causes the intraday price movements. Retail traders usually attempt to take advantage of the intraday momentum.

From an investors point of view, liquidity is very important because it determines how easily prices can fluctuate in a given period. Without the fluidity of price movements, it would be very difficult for the high volume of transactions to take place within the forex markets.

Liquidity differs for each currency pair and it could change before and after a certain economic event or with a news release, especially one with high impacts.

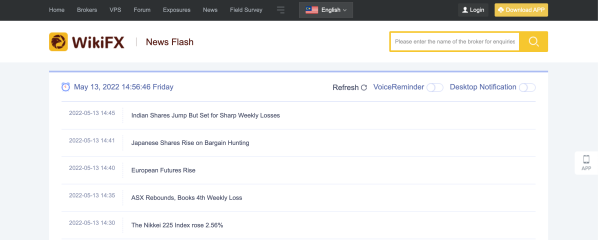

The aforementioned WikiFX Financial Calendar tool goes hand in hand with the 24-hour News Flash section https://live.wikifx.com/en/7×24.html that is coupled with an alert function that could send voice reminders or desktop notifications to help you make sound trading decisions in a timely manner.

<WikiFX Malaysia Original: Editor – Fion>

Leave a Reply