The bar was set very high

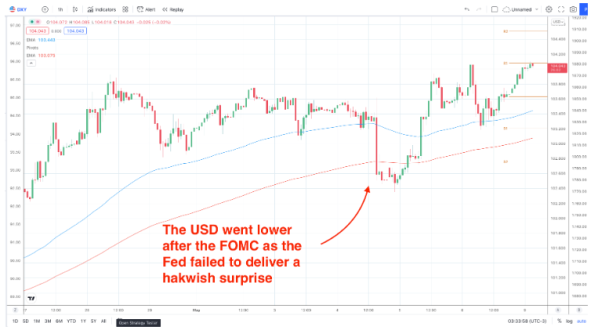

Heading into the meeting we were expecting a ‘buy the rumour, sell the fact response’ and this is what the initial reaction was. The start in QT was based on a phased approach with the Fed expected to take 3 months to bring the level up to $60 bln in treasures and $35 bln in Mortgage Backed Securities. On top of this dovish development Jerome Powell ruled out a 75 bps rate hike, so this all meant the Fed was unable to surprise markets with a more hawkish response, so there was an initial move lower in the USD. See the reaction here:

However, the USD weakness was not sustained post the FOMC. The strength in the USD is also partly due to the slowing global trade situation. As a global reserve currency, the USD tends to gain when global growth slows. So, the recent concerns over slowdowns in China‘s growth have also been a bullish pressure for the USD. This week we have some important inflation data out for the US. The US inflation rate is forecast to fall to 8.1% y/y down from the prior reading of 8.5%. Any signs of ’peak inflation take pressure off the Fed to hike rates and can result in some USD selling. This could boost the EURUSD this week as the ECB is increasingly making calls for a July rate hike. On the other hand, if inflation comes back in high then expect more USD strength.

Leave a Reply