【Dow Jones】

The US stock market has been shaking recently. The Dow Jones Index fell more than 1,000 points yesterday, erasing all the gains on the 4th May and that was the worst performance since the epidemic.

The U.S. Department of Labor released April non-farm payrolls data which had an increase of 428,000 people. It is higher than expected but the unemployment rate was 3.6%, higher than expected 3.5%. The 10-year US Treasury yield also rose to 3.113%.

Both the Alligator and KD show a Death Cross. The selling strength pulled the price near yesterdays lows. The probability of challenging the recent swing lows is quite high.

US30-D1

Resistance point 1: 32800 / Resistance point 2: 33500 / Resistance point 3: 34200

Support point 1: 32000 / support point 2: 31500 / support point 3: 31000

【EUR】

The U.S. Federal Reserve is trying to curb domestic inflationary pressures. Last week, there was the 2nd rate hike of the year and the first 2-yard rate hike in 22 years.

In view of the rising inflation rate in the euro area, Robert Holzmann, governor of the Austrian Central Bank and member of the Ecbbank's Governing Council, reiterated on the 7 May that the ECB should raise interest rates 2 to 3 times this year to combat inflation in the region.

EURUSDs recent fluctuations are not large, but it has been consolidating for a period of time. Both the Alligator and KD show death crosses which indicates that the current bearish trend is relatively strong. Coupled with the overall line type, the bears still have an advantage.

EURUSD-D1

Resistance point 1: 1.05500 / Resistance point 2: 1.06200 / Resistance point 3: 1.06800

Support 1: 1.04800 / Support 2: 1.04200 / Support 3: 1.03800

【Gold】

After a 2-yard rate hike on the 4 May, it is hinted that interest rates would rise consecutively and there are plans to cut the balance sheet.

New York gold Futures closed red for two consecutive trading days after that and rose 0.4% per ounce on the 6 May to close at $1882.8. Experts believe that gold prices will continue to rise.

Interest rate hikes have always been unfavorable to gold prices but the current federal funds rate is in the range of 0.75% to 1% and the inflation rate in March was as high as 8.5%. With the United States still in a substantial negative interest rate, this could make gold still attractive.

After gold fell below $1900 per ounce, the market continued to oscillate under this support. Alligator shows a death cross while the KD shows a gold cross. This indicates that the bulls and bears are still fighting at this price region. The long line still has more advantages to the bears.

XAUUSD-D1

Resistance point 1: 1900.00 / Resistance point 2: 1920.00 / Resistance point 3: 1950.00

Support 1: 1860.00 / Support 2: 1850.00 / Support 3: 1830.00

【Crude Oil】

Baker Hughes Inc, the world's third-largest oilfield services company, reported that as of May 6, the number of oil and gas exploration wells in the United States increased by 7 to 705 from the previous week and continued to reach a new high since March 2020. Among them, the number of exploration wells mainly used for shale oil and gas exploitation increased by 3 to 646 from the previous week.

The increase or decrease in exploration activity reflects future oil production. Usually every 3-6 months, Baker Hughes counts the number of wells (rigs) set up for the development and exploration of new oil and gas reserves.

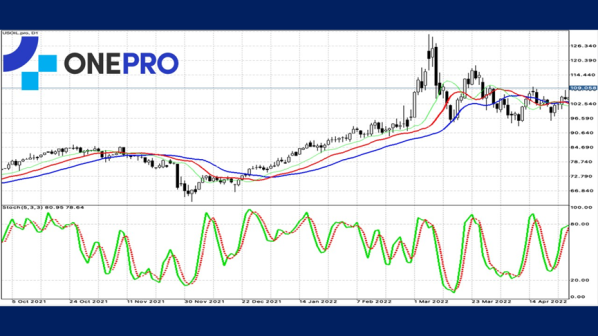

The recent fluctuations in the price of crude oil are still getting smaller. This indicates that subsequent breakthroughs may be getting bigger. Alligator entanglement and KD's golden cross indicates that the market is almost horizontally and waiting for a breakthrough. It is still recommended that investors reduce counter-trend trades on crude oil while waiting for the breakthrough.

USOIL-D1

Resistance point 1: 111.800 / Resistance point 2: 113.500 / Resistance point 3: 115.200

Support point 1: 107.500 / support point 2: 105.200 / support point 3: 103.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply