Merchants use shifting time periods to hypothesize in the forex market. The two most normal are long-and momentary time periods which sends through to pattern and set off outlines. Pattern graphs allude to longer-term time span diagrams that help brokers in perceiving the pattern, while trigger outline pick conceivable exchange passage focuses. This article will investigate these forex exchanging time spans top to bottom, while offering tips on which can best serve your exchanging objectives.

Instructions to Conclude BEST TIME TO TRADE FOREX

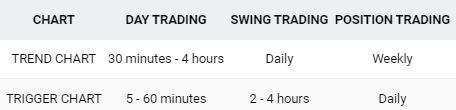

As referenced over, the best time period to exchange forex will fluctuate contingent upon the exchanging methodology you utilize to meet your particular objectives. The table underneath sums up factor forex time spans involved by various dealers for pattern ID and exchange sections, which are investigated in more profundity below:

Central issues FOR FOREX TRADING TIME FRAMES

Merchants use various systems which will decide the time span utilized. For instance, an informal investor will hold exchanges for an essentially more limited period than that of a swing merchant. Peruse our aide for an essential prologue to various exchanging styles.

1) Position exchanging time periods

The position exchanging time period shifts for various exchanging methodologies as summed up in the table above. This could vacillate from everyday to yearly under the 'long haul' definition.

Numerous new merchants will more often than not stay away from this approach since it implies extensive stretches of time before exchanges are understood. Notwithstanding, by many records, exchanging with a more limited term (day exchanging) approach can be undeniably more dangerous to execute effectively, and it frequently takes brokers extensively longer to foster their procedure.

Position exchanging (longer-term) approaches can seek the month to month graph for evaluating patterns, and the week after week outline for potential passage focuses.

Position exchanging model

After the pattern not entirely settled on the month to month diagram (worse high points and worse low points), brokers can hope to enter positions on the week after week graph in an assortment of ways. Numerous dealers hope to use cost activity (as found in the week after week outline beneath) for deciding patterns and additionally entering positions, however markers can totally be used here too.

2) Swing exchanging time periods

After a dealer has acquired solace on the more extended term diagram, they can then hope to move somewhat more limited in their methodology and wanted holding times. This can bring greater changeability into the broker's methodology, so hazard and cash the executives ought to be addressed prior to dropping down to more limited time spans.

Swing exchanging is a fair compromise between a drawn out exchanging time period and a present moment, scalping approach. Perhaps the best advantage of swing exchanging is that brokers can get the advantages of the two styles without fundamentally taking on every one of the disadvantages. Subsequently, this makes swing exchanging an exceptionally well known way to deal with the business sectors.

Swing dealers will check the several times each day in the event that any huge moves happen in the commercial center. This manages the cost of brokers the advantage of not watching markets consistently while they're exchanging. When an open door is distinguished, brokers place the exchange with a stop connected and screen at a later stage to see the improvement of the exchange.

One more benefit of this approach is that the dealer is as yet viewing at graphs frequently to the point of jumping all over chances as they exist. This kills one of the disadvantages of longer-term exchanging which passages are by and large put on the week by week/everyday outlines.

Swing exchanging model

For this methodology, the everyday graph is frequently utilized for deciding patterns or general market heading and the four-hour outline is utilized for entering exchanges and putting positions (see beneath). The day to day diagram shows the new swing high and low individually. Brokers for the most part exchange swings back toward the former pattern – in this model the previous pattern is upwards.

Since the exchange course has been recognized, the swing broker will then decrease the time span to four-hours to search for section focuses. In the model beneath, there is an unmistakable cost opposition level that the swing broker will see while entering a long exchange. When cost breaks or the light closes over the assigned opposition level, merchants can hope to enter.

3) Day exchanging time periods

Day exchanging can be one of the most troublesome techniques of tracking down benefit. Fresher dealers carrying out a day exchanging methodology are presenting themselves to more successive exchanging choices that might not have been drilled for extremely lengthy. This mix of involvement and recurrence opens the entryway for misfortunes that could have been forestalled had the dealer decided on a somewhat longer methodology like swing exchanging.

The hawker or informal investor is in the unenviable place of requiring the cost to move rapidly toward the exchange. Thusly, the informal investor becomes attached to the outlines as they look for the market's patterns for that day. Fixating on diagrams for significant stretches of time can prompt weakness. The more limited term approach additionally bears the cost of a more modest wiggle room.

For the most part, there is less benefit potential in transient exchanging which prompts more tight stops levels. These more tight stops mean higher likelihood of bombed exchanges instead of longer-term trading.To exchange with an exceptionally transient methodology, it's fitting for a broker to become familiar with a more extended term, and swing-exchanging approach prior to dropping down to the extremely brief periods of time.

Looking like longer-term exchanging, informal investors can hope to assess patterns on the hourly outline and find section amazing open doors on the 'minute' time periods like five or ten-minute diagrams. The one-minute time period is likewise a choice, however intense wariness ought to be utilized as the fluctuation on the one-minute outline can be exceptionally irregular and hard to work with. Indeed, dealers can utilize an assortment of triggers to start positions once the pattern not entirely settled – value activity or specialized pointers.

Day exchanging time spans

Day exchanging can be one of the most troublesome methodologies of tracking down benefit. Fresher dealers executing a day exchanging methodology are presenting themselves to more incessant exchanging choices that might not have been drilled for extremely lengthy. This mix of involvement and recurrence opens the entryway for misfortunes that could have been forestalled had the merchant picked a somewhat longer methodology like swing exchanging.

The hawker or informal investor is in the unenviable place of requiring the cost to move rapidly toward the exchange. In this manner, the informal investor becomes attached to the graphs as they look for the market's patterns for that day. Fixating on diagrams for extensive stretches of time can prompt exhaustion. The more limited term approach likewise bears the cost of a more modest wiggle room.

By and large, there is less benefit potential in transient exchanging which prompts more tight stops levels. These more tight stops mean higher likelihood of bombed exchanges instead of longer-term trading.To exchange with an exceptionally momentary methodology, it's fitting for a broker to become familiar with a more drawn out term, and swing-exchanging approach prior to dropping down to the extremely brief periods of time.

Looking like longer-term exchanging, informal investors can hope to assess patterns on the hourly outline and find passage amazing open doors on the 'minute' time spans like five or ten-minute diagrams. The one-minute time period is likewise a choice, however intense mindfulness ought to be utilized as the fluctuation on the one-minute diagram can be extremely irregular and challenging to work with. Yet again brokers can utilize an assortment of triggers to start positions once the pattern not entirely settled – value activity or specialized markers.

Leave a Reply