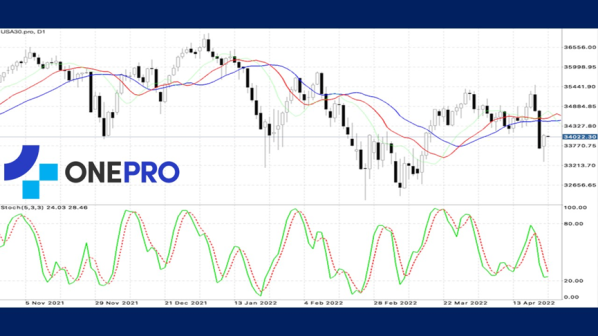

【Dow Jones】

With China's worsening epidemic and the impact of the Fed's tightening policy concerns, many land stocks and European stocks fell. US stocks also fell on Monday (25th) and opened very low. Energy stocks were mainly the cause of it and U.S. treasury yields also fell. During the trading session, US stocks rebounded and closed more than 230 points above the opening.

Investors can pay attention to the earnings of the earnings of these companies – Microsoft and Alphabet on Tuesday, Meta on Wednesday, Apple, Amazon and Intel on Thursday.

On the daily line of the Dow Jones Index, a distinct lower shadow appears in the rally from the bottom and this indicates a clear buying support at this price level.

From the technical line, Alligator shows entanglement while the KD's still shows a death cross. This indicates that the selling pressure has not been completely eliminated. The upper side still has an advantage.

USA30-D1

Resistance point 1: 34500 / Resistance point 2: 35200 / Resistance point 3: 35500

Support point 1: 33500 / support point 2: 33200 / support point 3: 32800

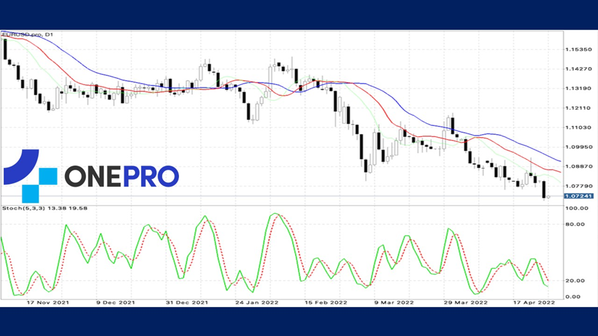

【EUR】

French President Macron defeated right-wing rival Le Pen in the presidential election and said he would seek to make up for improvements in his second term. in other European countries, Macron's victory was seen as a cushion of the impact of Brexit and the rise of a new generation of right-wing nationalists.

European Council President Michel said late Sunday that in these turbulent times, they need a solid Europe and a France that is fully committed to pushing for a more sovereign and strategic EU.

From the daily technical line of the euro, the Alligator shows a death cross and indicates that the short selling pressure of the long-term euro is still strong. KD is also showing a low-end figure and this indicates that selling on the short line also has an advantage.

EURUSD-D1

Resistance point 1: 1.07800 / Resistance point 2: 1.08200 / Resistance point 3: 1.08500

Support point 1: 1.06800 / support point 2: 1.06200 / support point 3: 1.05800

【Gold】

MarketWatch reported that Jeff Wright, chief investment officer of Wolfpack Capital, pointed out that the prospect of expanding China's lockdown measures did not provide safe-haven support for gold. The dominant market force of gold in the past few trading days has been the rise in US Treasury yields weakening the attractiveness of non-yield gold.

Basically, the Fed is almost certain to raise interest rates in May and June and the probability of raising interest rates in July is also very high. The US dollar has a good chance of rising, which is not good for dollar-denominated gold.

In the technical line of gold, Alligator is gradually turning into a death cross from the entanglement, while KD has become a low-end figure. This indicates that gold has short-term selling pressure. The wave of decline also fell below the previous wave low and has become a bearish pattern on the charts.

XAUUSD-D1

Resistance point 1: 1910.00 / Resistance point 2: 1930.00 / Resistance point 3: 1950.00

Support point 1: 1890.00 / support point 2: 1880.00 / support point 3: 1870.00

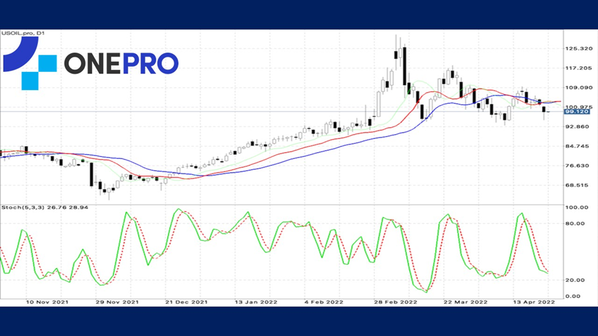

【Crude Oil】

China, the world's largest crude oil importer, is facing its worst oil demand shock since the outbreak of the coronavirus outbreak this month.

Petrochina executives revealed that gasoline demand in eastern China fell about 40 percent in April, mainly due to the lockdown measures in Shanghai.

China's demand for gasoline, diesel and aviation fuel is expected to decline by 20% annually in April and that is equivalent to a 1.2 million barrels reduction in crude oil demand per day.

The daily pattern of the overall crude oil is showing a bearish trend but the speed of decline is relatively slow. Both Alligator and KD are showing a death cross.

USOIL-D1

Resistance point 1: 100.800 / Resistance point 2: 102.500 / Resistance point 3: 105.200

Support point 1: 98.500 / support point 2: 97.200 / support point 3: 95.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply