【XAUUSD】

Global gold ETF exchange fund gold holdings increased their holdings of 46.3 metric tons in January and increased another 35.3 metric tons in February. North America's gold holdings increased by 70.3 metric tons, the European market increased by 28.1 metric tons, and the Asian market decreased by 17.4 metric tons. This shows that in times of uncertainty, European and American countries have the most gold demand and Asian markets tend to take profits on highs.

Gold's volatility was huge and it first rushed to the highest 2070 USD per ounce and then pulled back 1976 USD per ounce. The source of this gold buying power lies in the war between Russia and Ukraine.

When the Ukrainian prime minister expressed his willingness to negotiate peace, the market pulled back violently. With the war and sanctions not over, and the United States raising interest rates in the future, the support of gold still exists.

However, in the technical line of gold, KD became a death cross. There seems to be room for correction on the short line.

XAUUSD – D1

Resistance point 1: 2000.00 / Resistance point 2: 2020.00 / Resistance point 3: 2050.00

Support 1: 1980.00 / Support 2: 1950.00 / Support 3: 1920.00

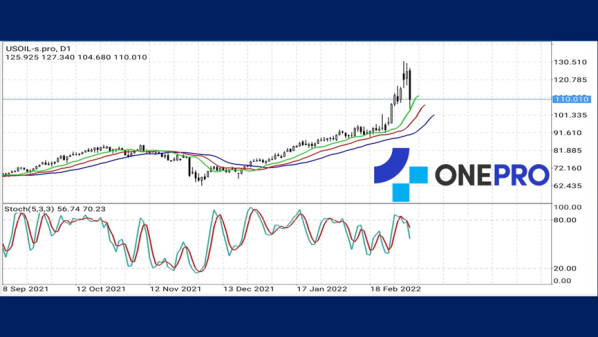

【USOIL】

U.S. crude inventories fell 1.7 million barrels last week. OPEC+ members' February quotas from S&P Global Commodity Insight were 38.38 million barrels per day and this is 764,000 barrels less than the target set, according to the U.S. Energy Agency EIA data.

From these reports, the current supply of crude oil is still insufficient to cope with the market's demand. Russia's crude oil exports account for 8% of the U.S. crude oil. With the United States banning the import of Russian crude oil and if all other European ban it, the daily crude oil supply will be reduced by 4.2 million barrels. This will make the supply of crude oil tighter.

The crude oil market fell sharply on the evening of March 9 from 130USD per barrel to 110USD per barrel. This is mainly because of two reasons, one is the Ukrainian president's willingness to communicate peace talks on the original Russian demands, and OPEC+ calling on member countries to increase crude oil output.

Because of yesterday's sharp decline, the KD shows a death cross but the price has not yet pulled back on the Alligator short-term moving average. This shows that the buying strength still exists as crude oil supply is still deemed insufficient. With insufficient supply, it is difficult for crude oil to fall.

USOIL – D1

Resistance point 1: 115.500 / Resistance point 2: 120.500 / Resistance point 3: 122.800

Support point 1: 108.200 / support point 2: 105.500 / support point 3: 102.800

【Dow Jones Index USA30】

The Russian and Ukrainian Foreign Ministers will hold talks in Turkey on March 10. As the number of peace talks has increased, this could be an indication that the war is gradually coming to an end. The US Dow Jones index directly rose by 653 points last week, about 2%.

However, from the technical line type, the Dow Jones index has rebounded but it is still in a downward trend. The price has not dropped below the lowest point and there was a wave of pull up. If the recent small high of 34200 still holds, there will be a clearer signal.

At this stage, only KD left the low-end area, indicating that there is a little buyer power. However, it has not changed the overall trend.

Another key thing to note would be the mid-March dollar interest rate decision and any follow up remarks.

USA30 –D1

Resistance point 1: 33500 / Resistance point 2: 33800 / Resistance point 3: 34200

Support point 1: 33200 / support point 2: 32800 / support point 3: 32200

【EURUSD】

When most of the market news are about the rise of gold, crude oil and raw materials, the price of the euro secretly rushed from the bottom 1.08 to 1.10. The increase of nearly 2500 points was that the dollar index is revised from 99 to 97.8. In addition, the issuance of bonds in the euro has also stimulated investors in the euro in the short term.

From the technical line, the euro's Alligator death cross and KD golden cross actually offset each other. This shows that the strength between buyers and sellers is back and forth. It is still a short distance away from the low of the euro's previous band of 1.11. The possibility of having a consolidation within this range is high.

EURUSD – D1

Resistance point 1: 1.11000 / Resistance point 2: 1.15000 / Resistance point 3: 1.20000

Support 1: 1.10500 / Support 2: 1.10000 / Support 3: 1.09500

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply