XRP is the native cryptocurrency for products developed by Ripple Labs. Its products are used for payment settlement, asset exchange, and remittance systems that work more like SWIFT, a service for international money and security transfers used by a network of banks and financial intermediaries.

It has been observed that 2021 was a particularly bullish year for Ripples XRP and the broader crypto market. A number of the crypto majors, including Bitcoin (BTC) and Ethereum (ETH) struck new all-time highs late in the year.

The raising adoption and greater market awareness of NFTs, the metaverse and Web 3.0 drove the market cap from a January year-low $736bn to a November year high $3,009bn. The total crypto market cap stood at $2,380bn at the time of writing. Also Demand for alt-coins were on the rise with Bitcoins (BTC) dominance taking a hit. BTC dominance had stood at 73.63% in January before sliding to a 2021 year low 39.56% in September. BTC dominance stood at 40.1% at the time of writing.

Based on CoinMarketCap reviews, XRP is the 7th largest crypto, with a market cap of $43.77bn. XRP had sat at the number 3 spot for a significant period of time before losing ground. The fall from the number 3 spot came in spite of XRP surging by 319% in the year. Others have simply done better, with the SEC lawsuit against Ripple Lab pinning XRP back from larger gains.

The Binance Coin (BNB), now ranked 3rd by market cap, is up 1,356% for the year, with Cardanos ADA (ranked 6th) up 691%. Solana (SOL), currently ranked 5th by market cap, is up by an impressive 12,764% for the year.

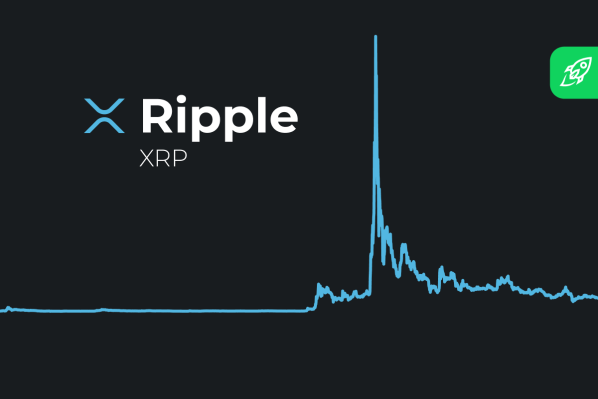

The Moves of XRP in 2021

In January 2021, XRPs had fallen from a previous year high of $0.7872 to a Jan-2021 low $0.2108. Finding support from the broader market, XRP struck a 2021 year high $1.9660 in April before sliding back to $0.50 levels. The SEC lawsuit against Ripple Lab led to the sell-off. Late in the year, however, hopes of a favorable settlement with the SEC saw XRP test resistance at $1.00.

The SEC action against Ripple Lab and two executives alleges that over $1.3bn was raised through an unregistered, ongoing digital assets securities offering. Key to the claim is that the SEC classified XRP as a security. This was in contrast to ETH. In June, the SEC had stated that ETH offers and sales are not securities transactions. The announcement supported an ETH run to an ATH $4,868 in November.

Leave a Reply