【XAUUSD】

The war between Ukraine and Russia continues to escalate and the market is full of information. For example, Ukraine's nuclear power plant was attacked. There was news on Russia attacking humanitarian passages and Ukraine saying Russia has no morality. Ukrainian officials say Russia is breaking its promise to allow humanitarian aid into a captured city.

In short, investment has nothing to do with such politics. However, gold has always been the buying money when war escalates. This is because people always think of the importance of gold when there is a crisis.

From the technical line point of view, gold prices on Monday morning jumped high straight to 2000USD per ounce. From the charts, Alligator shows a golden cross because it has recently broken through the high point. KD has a rapid transformation into high-end figure. These are strong signs of buying power and investors are advised not to go against the trend.

XAUUSD – D1

Resistance 1: 1990.00 / Resistance 2: 2000.00 / Resistance 3: 2020.00

Support 1: 1980.00 / Support 2: 1950.00 / Support 3: 1920.00

【USOIL】

Russia is a big supplier of crude oil. Although the world has not sanctioned Russia's crude oil, not many crude oil buyers have not dared to buy Russian crude oil even when the price of crude oil has been discounted by 20%. Many buyers look to Iran's crude oil output. At this stage the market is worried about the future supply of crude oil continues to deteriorate. The price of crude oil has come to about $120-130 per barrel and it is not surprising if it continues to go up. The most terrifying thing of crude oil position traders right now is not the price but the fluctuation. Some of the market volatility and regulations have made crude oil rise and fall sharply.

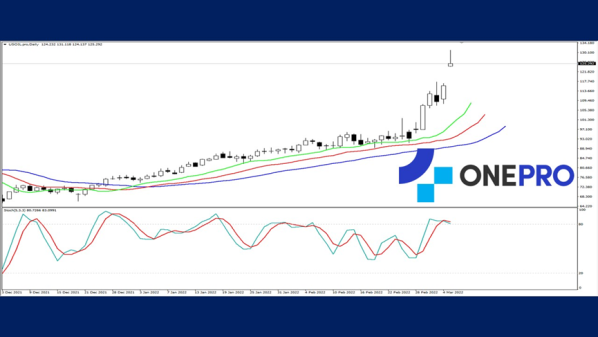

Crude oil directly jumped high on Monday morning to directly hit a recent high of $131 per barrel, but then pulled a long shadow line correction back to about $125. The current stage of crude oil price fluctuations is an exaggeration. Investors should manage their risks when investing to avoid accidents. Current Alligator shows a golden cross and KD a high-end figure. The crude oil purchases remain high.

USOIL – D1

Resistance 1: 126.500 / Resistance 2: 128.500 / Resistance 3: 131.800

Support 1: 123.200 / Support 2: 120.500 / Support 3: 117.800

【Dow Jones Index USA30】

Basically, the appreciation of the currency does not necessarily benefit the stock market. The U.S. Dow Jones index has experienced this even when the non-farm employment data and unemployment rate data performance are very good. However, the better the data, the more investors are worried that the Fed will have a positive interest rate hike. The rise in interest rates will represents the increase in borrowing interest rates, so the market will have a lot of funds pumped out. This psychological expectation will then make the US stock market to fall in advance.

At present, the Dow Jones' performance shows a lot of uncertainties in the market with war, inflation, interest rates.

The daily Dow Jones Index KD still shows a death cross and Alligator also shows a death cross. The Dow Jones Index is still plagued by the risk of the market. Investors are much more conservative. Well, at least not until the Fed decides on interest rates.

USA30 –D1

Resistance 1: 33800 / Resistance 2: 34200 / Resistance 3: 34500

Support 1: 33000 / support 2: 32500 / support 3: 32200

【EURUSD】

The US dollar with the excellent performance of non-farm, showed a strong side. The release of non-farm data is 678,000 higher than the data expected and this is coupled with the unemployment rate of 3.8% which is also the best data in the recent year. March 15-16 is the Fed interest rate decision meeting and the probability of a basic interest rate increase is nearly 99.9%. When coupled with the recent war information, the dollar received strong buying support.

The appreciation of the dollar means that other non-U.S. currencies are sniped. The euro has been falling against the dollar for some time as their recent economic data in Europe shows that inflation has worsened and the war occurring in Europe. The euro is facing a lot of selling pressure.

The euro in the daily technical line shows an Alligator death cross and the KD low-end figure. This indicates that the recent selling pressure has very heavy. The EURUSD has been falling below the recent new low. The next support price below is far away so euro traders should pay attention to the risk tolerance and take advantage of the trend.

EURUSD – D1

Resistance 1: 1.11200 / Resistance 2: 1.11800 / Resistance 3: 1.12200

Support 1: 1.10500 / support 2: 1.10200 / support 3: 1.09800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply