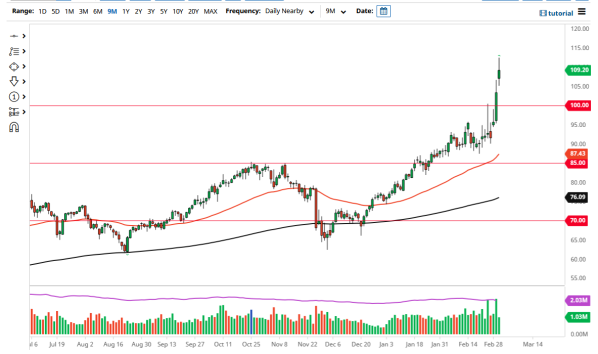

The West Texas Intermediate Crude Oil market has gapped higher to kick off the trading session on Wednesday and then shot straight towards the $112.50 level. This move was rather alarming, as crude oil has been completely off the rails for a while. Now that we have broken through the $100 level rather handily over the last couple of sessions, it does make sense that we need to pull back.

This is even more obvious due to the fact that the daily candlestick is going to be a bit of a shooting star, and some people would even also consider this to be a bit of an “island reversal.” If we were to turn around and break down below the gap, that could send this market looking towards the $100 level, possibly even down to the $97.50 level. We are obviously in an uptrend, and it is difficult to imagine a scenario where that would change considering what is going on around the world.

When we do pull back, it is likely that the market will continue to see a lot of buyers trying to get involved in this market because we have seen so much in the way of demand picking up as the economies around the world continue to see the reopening trade come into the picture. Furthermore, we also have the war in Ukraine that has people worried about Russian supply. In fact, it is worth noting that the Russian oil markets have been effectively frozen as so many companies will not deal with them now.

If we were to break above the top of the candlestick on Wednesday, the market would become even more parabolic, and it would be even more dangerous. I think that a lot of people will come back into the picture and try to take advantage of “cheap oil”, as this market almost certainly has much further to go due to a whole host of issues, not the least of which would be the lack of supply. If Russian oil is completely taken out of the market, then that supply issue will be even worse. The 50-day EMA is all the way down at the $87.43 level, so a correction is desperately needed.

Leave a Reply