【XAUUSD】

Although there is no conclusion on the cessation of the war in the second negotiations between Russia and Ukraine, it can still be considered a good start with the establishment of the humanitarian corridor.

In addition to the factors of war, when the Fed chairman reported to the Senate, he believed that the Conflict between Ukraine and Russia would make prices higher. They have said that they plan to raise interest rates by 1 yard in March.

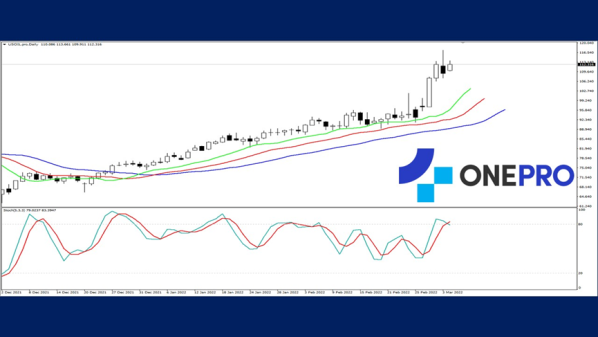

Gold's technical line has Alligator showing a golden cross while KD also shows a golden cross. the price has not been significantly suppressed and continues to consolidate at the high level. The follow-up would mainly be whether the war intensifies or whether the Fed's measures will stabilize economic factors.

XAUUSD – D1

Resistance 1: 1950.00 / Resistance 2: 1980.00 / Resistance 3: 2000.00

Support point 1: 1920.00 / support point 2: 1900.00 / support point 3: 1880.00

【USOIL】

Although Russia's crude oil is sold at a discount, many crude oil buyers still dare not buy. The price of crude oil has soared to a new high point in 14 years.

There are news reports that Iran has the opportunity to reach a new nuclear agreement this month. This can bring relief to the original supply to a certain extent and oil prices could be revised back from the high point.

The recent fluctuations in the price of crude oil have been huge. It rushed to $117.5 per barrel, and then pulling back to $107 per barrel. Investors that use leverage trading may have to remember to watch their leverage or they may experience the pleasure of reaping huge profits or even huge losses. The technical line type is bullish but because of the huge fluctuations, investors are recommended to wait for the pull backs. The repercussions of brainless chases are too great as it is easy to make unexpected losses.

USOIL – D1

Resistance 1: 112.500 / Resistance 2: 115.500 / Resistance 3: 117.800

Support 1: 111.200 / Support 2: 108.500 / Support 3: 106.800

【Dow Jones Index USA30】

The Dow Jones index opened higher but moved lower. This is related to the Fed chairman's remarks in the Senate to continue to raise interest rates. The net change of Dow was changed from 200 to 100 and ended the trading day by 0.29% down.

At this stage, most investors in the United States expect interest rates to rise by about 1 yard. Therefore, the Dow Jones index will have been in a downward trend of in these months.

The datas have been worse and that indicates that the speed of interest rate hikes may be faster. The Fed currently only has two tools to use which is to raise interest rates and shrink the balance sheet.

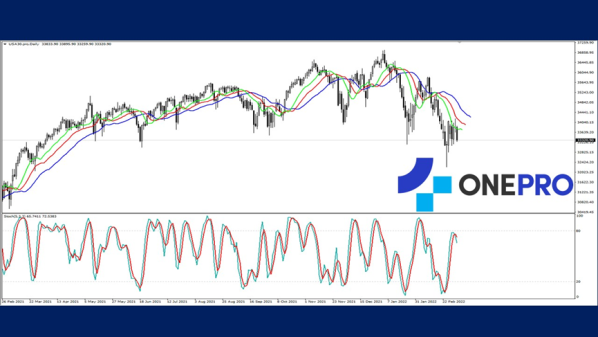

From the technical line, the Dow Jones Index Alligator and KD have begun to show a dead crosses. With the Fed's interest rate decision 3/16 coming closer, the uncertainties of the interest rate hike are getting lower. Many investors have begun to gradually adjust their investment positions. At the moment, it is more conservative to invest in US stocks.

USA30 –D1

Resistance point 1: 34200 / Resistance point 2: 34800 / Resistance point 3: 35500

Support point 1: 33200 / support point 2: 32800 / support point 3: 32200

【EURUSD】

Recently due to the war factors and the impact of the Fed's expected interest rate hikes, the dollar index has been favoured by investors. The rise of the dollar index also means that other non-US currencies have fallen. In the European Union that has bore the brunt of the war, the euro has recently broken the low. This is coupled with the recent deterioration of inflation, the price of crude oil and raw materials. The subsequent movement of the euro looks to be unpromising.

From the technical line point of view, the euro trend is really weak. Not only is the Alligator a death cross, KD is also falling into the low-end blunting area. This indicates that investors in the euro short side are more active.

EURUSD – D1

Resistance point 1: 1.10800 / Resistance point 2: 1.11200 / Resistance point 3: 1.11800

Support 1: 1.10000 / Support 2: 1.09500 / Support 3: 1.08000

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply