【XAUUSD】

The moment Russia showed signs of an attack, gold prices immediately rushed upwards. It first broke through the highest price in January 2021, followed by breaking through the highest price in September 2020. Just yesterday, the price of gold came to $1976 per ounce. The era of turmoil has come and it was inevitable that gold would be considered a safe-haven currency.

This looks to be extended to the level of world wars in different countries and not just between Russia and Ukraine.

Some of the market's short orders were forced to stop losses and this also resulted in a sudden surge in prices. This was accompanied by some large buyers rushing in at prices that were on the high. This caused the price to have a long upper shadow line.

On the technical line, because of the breakout of the swing highs, it indicates bulls. The breakout of the highs will definitely lead to a golden cross of the moving average. However, there was a long upper shadow line that represents the upper selling pressure. This drove the KD to a death cross. Investors could take note that the overall trend is still going up and it should take longer for a pull back.

XAUUSD – D1

Resistance 1: 1920.00 / Resistance 2: 1972.00 / Resistance 3: 2015.00

Support 1: 1905.00 / Support 2: 1902.50 / Support 3: 1895.80

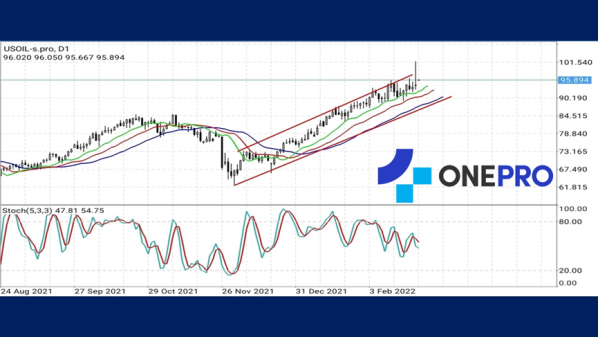

【USOIL】

Europe has cut off the pipeline access with Russia. The wave of Russian sanctions is mainly against Russia's crude oil exports. This drove the crude oil prices to $101.5 per barrel and directly breaking through the 100 mark.

The United States is gradually taking on the heavy responsibility of crude oil supply and is expected to release more war reserves to solve the problem of crude oil shortage at this stage. However, the demand for crude oil is still getting higher after the epidemic and it will take a while for oil prices to be solved in a short period of time.

The price of crude oil rose to break through the 100 mark yesterday but then fell back to about 96.5 per barrel. This shows that there is still selling pressure above. The upward trend of crude oil still exists but with the problem of crude oil supply not completely solved, it is difficult for crude oil to have a lower price.

USOIL – D1

Resistance 1: 96.800 / Resistance 2: 98.000 / Resistance 3: 101.540

Support 1: 95.800 / Support 2: 94.500 / Support 3: 91.200

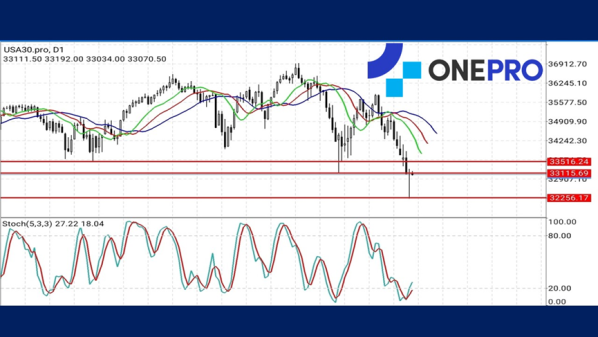

【Dow Jones Index USA30】

U.S. stocks fell all the way after Russia launched a full-scale attack. Dow fell below the low of 33115 set a month ago. Their lowest point came to 32256 and that was close to 850 points.

However, from the second sanctions imposed by US President Biden on Russia where there was a restriction in Russia's ability to do business in dollars, euros, pounds, and Japanese yen, the entire Dow Jones index market had a big V turn!

In their recent decline, although the market has fallen all the way, there were a large number of buy orders at this strong support.

From the technical line, the bottom flip makes KD a golden cross. This indicates that there is lots of buying at the bottom. However, the opening of Alligator is quite large and it is a little difficult to reverse the trend directly.

USA30 –D1

Resistance 1: 33200 / Resistance 2: 33800 / Resistance 3: 34200

Support 1: 32800 / Support 2: 32500 / Support 3: 32256

【EURUSD】

After the Russian attack, the price of the euro finally fell below the consolidation range. A large part of the decline was because of the appreciation of the dollar. However, this situation of falling below the low of the range did not last long. It returned to consolidation mode within the consolidation range.

EURUSD KD line shows a very clear low-end divergence which indicates that the buying force near the low is quite large.

EURUSD – D1

Resistance 1: 1.12500 / Resistance 2: 1.13880 / Resistance 3: 1.14850

Support 1: 1.11800 / Support 2: 1.11150 / Support 3: 1.11050

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply